Question: please answer all the questions Consider a bond paying a coupon rate of 8.50% per year semiannually when the market interest rate is only 3.4

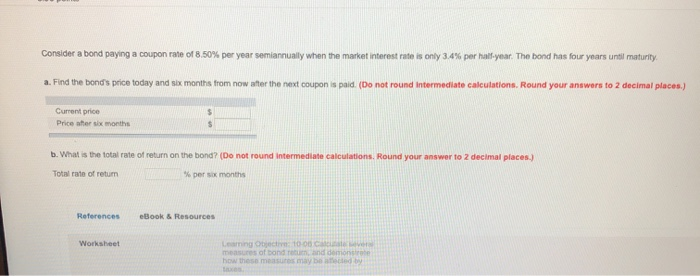

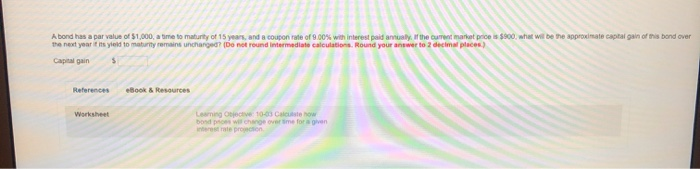

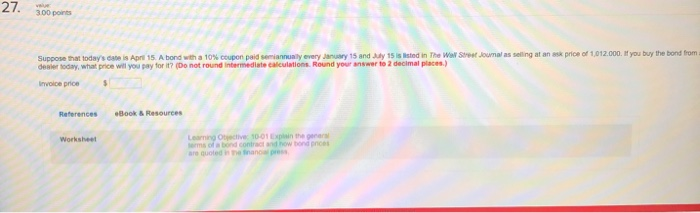

Consider a bond paying a coupon rate of 8.50% per year semiannually when the market interest rate is only 3.4 % per half-year. The bond has four years until maturity a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Curent price Price ater six months b. What is the total rate of return on the bond? (Do not round intermediate calculations, Round your answer to 2 decimal places.) Total rate of retun % per six months References eBook & Resources Leaning Objective 10.00 Catunste e measures of bond retuen, and demonsirete how these measures may be atferted by taxes Worksheet intat A bond has a par value of $1,000, a time to maturity of 15 years, and a coupon rate of 9.00 % with interest paid annualy, If the cument market price is $900, what wil be the approximate captal gain of this bond over the next year it its yleld to maturity remains unchanged? (De not round intermedlate calculations. Round your answer to 2 decimal places) Capital gain References eBook & Resources Leaning Objective 10-03 Calcuste how bond proes wil change over Sme for a given interest rate proecton Worksheet 27. vue 300 points Suppose that today's date is April 15. A bond with a 10 % coupon paid semiannualy every January 15 and July 15 is isted in The Wal Street Joumal as selling at an ask price of 1,012.000. If you buy the bond from dealer today, what price wil you pay for it? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Invoice price References eBook & Resources Learning Otective 10-01 Explsin the genaral serms of a bond contract and how bond pnces are quoted in the financal press Worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts