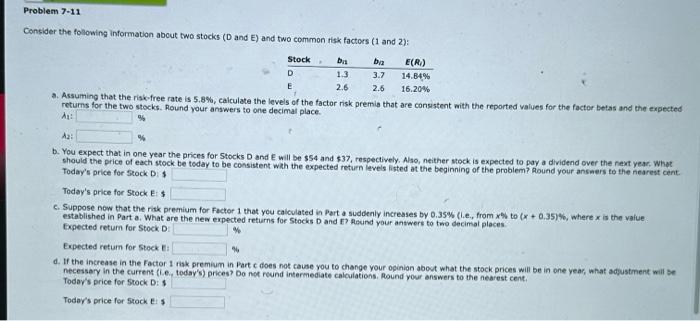

Question: PLEASE ANSWER ALL THE QUESTIONS Consider the folowing information abcut two stocics (D and E ) and two common fisk factors ( 1 and 2

Consider the folowing information abcut two stocics (D and E ) and two common fisk factors ( 1 and 2 ): a. Assuming that the risk-free rate is 5.8%, caiculate the levels of the factor risk premis that are consistent with the reported values for the factor betas and the expected retums for the two stocks. Round your answers to one decimal place. 4: wh A 2 : b. You expect that in one year the prices for Stocks D and E will be $54 and $37, respectively. Also, neither stock is expected to pay a dividend over the rext year, What thould the price of each stock be tedau th he consistent wath the expected return levels listed at the beginning of the problem? Round your ansmers to the nearest cent. Today's price for 500k D. 1 Today's price for 5 tock E: $ c. Suppose now that the ritk premium for factor 1 that you calculated in Part a suddenily increases by 0.35\% (l.e., from x% to (x+0.35)%, where x is the value established in Part a. What are the new exnected returns for Stocks D and E. Hlound your answers to tho decimat pleces. Expected retum for Stock D: Expected retum for Stock E: o d. If the increase in the Factor 1 risk premium in Part c does not cause you to change your opinion about what the stock prices will be in one year, what adjustment will se necessery in the current (i.e. todav's) arices? Do not reund intermediate calculations. Pound your answers to the nearest cent. Toder's price for 5 tock D: 1 Todar's price for 5tock E: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts