Question: PLEASE ANSWER ALL THE QUESTIONS CORRECTLY 15. The replacement chain approach - Evaluating projects with unequal lives Evaluating projects with unequal lives Blue E.k Manufacturing

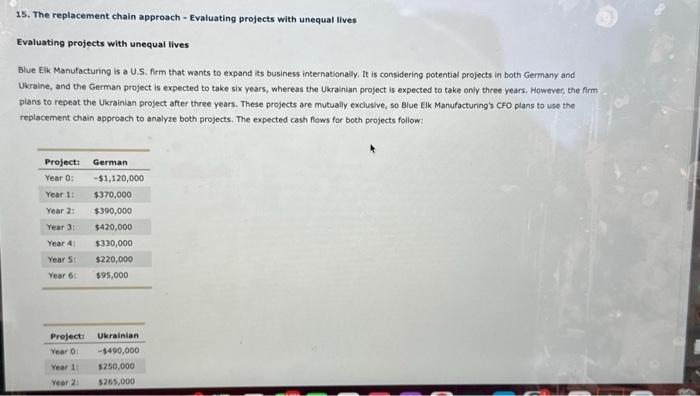

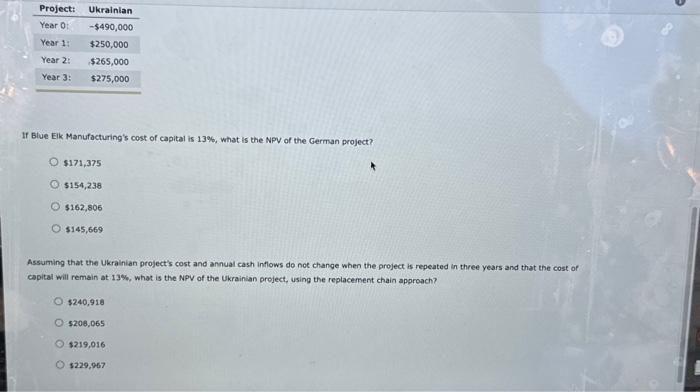

15. The replacement chain approach - Evaluating projects with unequal lives Evaluating projects with unequal lives Blue E.k Manufacturing is a U.S. firm that wants to expand its business internationally. It is considering potential projects in both Germany and Ukraine, and the German project is expected to take six years, whereas the Ukrainian project is expected to take only three years. However, the firm plans to repeat the Ukrainian project after three years. These projects are mutually exclusive, so Blue Elk Manufacturing's CFO plans to use the replacement chain approsch to analyze both projects. The expected cash fiows for both projects follow: If Blue Elk Manufacturing's cost of capital is 13%, what is the NPV of the German project? $171,375 $154,238 $162,806 $145,669 Assuming that the Ukrainian project's cost and annual cash inflows do not change when the project is repeated in three years and that the cost of capital will remain at 13%, what is the NPV of the Ukrainian project, using the replacement chain approach? $240,910 $206,065 $219,016 $229,967

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts