Question: PLEASE ANSWER ALL THE QUESTIONS CORRECTLY Problem 17-07 The Focus fund is a mutual fund that holds long-term positions in a small number of nondividend-paying

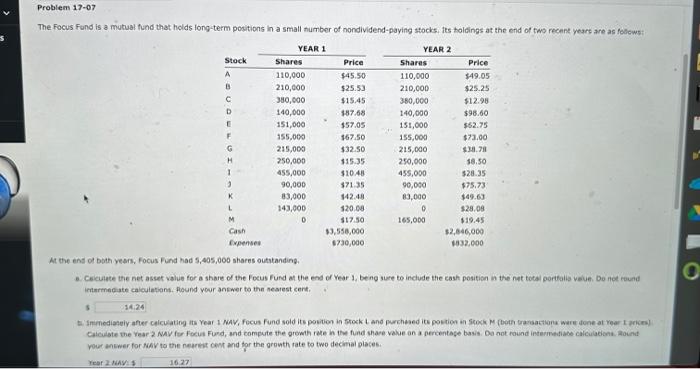

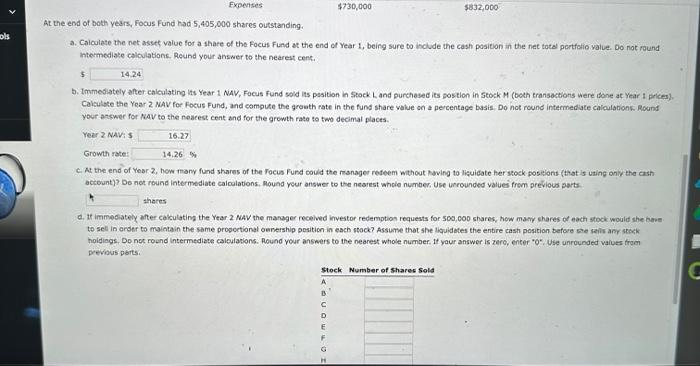

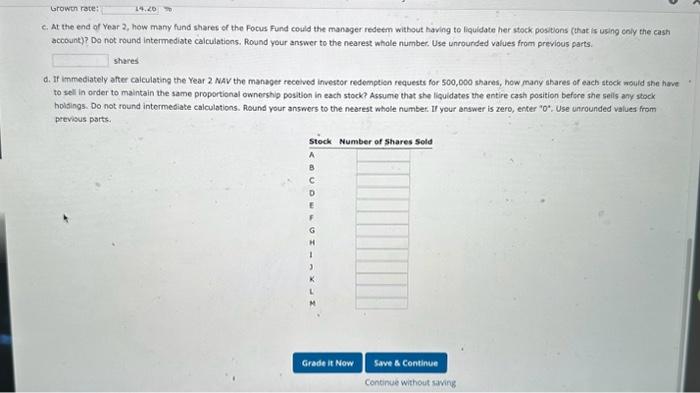

Problem 17-07 The Focus fund is a mutual fund that holds long-term positions in a small number of nondividend-paying stocks, its boldings at the end of fwo recant years are as fobcwsi At the ens of both yers, Focus Fund had 5,405,000 shares outitanding. 3. Csicuate the net asset value for a share of the fouus fund at the end of Vear 1. beng sure to include the cash positisn in the nat total oorfalis value. Do noe rand ientarmegate caiculetions. found vour ankwer to the nearest cent. 3 your answer for fab to the nearwit oent and for the gronth rate to two decinal olaces. he end of both years, Focus Fund had 5,405,000 shares outstanding. a. Caiculate the net asset value for a share of the Focus Fund at the end of Year 1 , being sure to include the cash position in the net total portfoio value. Do not round intermediake calculations. Reund your answer to the nearest cent. b. Immediately after calculating Its Year 1 NAV, Focus Fund sold its pesition h Stock L and purchased ies postion in Stock M (both transoctions were bone at Year i prices). Calsulate the Year 2 NAV for Focus Fund, and compute the grosth rate in the fund share value on a percentage basis. Do hot round intermediate caloulationk. Round your acswer for Nav to the neatest cent and for the growth rato to two decimal places. Yeer 2 Natis Growth rate: c. At the end of Yesr 2, how mony fund shares of the Focus Fund could the manager redeem without having to lisuidate her stock posilions (that is using oniv the cash actount)? Do net round intermediate calculations. Mound your answer to the nearest whole number. Use unrounded values from previous parts theres d. If immeciately after calculating the Year 2 Nav the manager received investor redemption requests for 500,000 shares, how maniy shares of each stock would she have to sel in order to maintain the same propcrtional ownership position in each stock? Assume that she liguldotes the entire cash position betore she selis arer stosk hoidings, Do not round intermediate calculations. Aound your answers to the nearest whole number. If yaur answer is zero, enter "o*. Use unrounded values fraem pervious ports. c. At the end of Vear 2, how many fund shares of the Focus Fund could the manager redeem without having to liquidate her stock positions (that is using cnly the cash account)? Do not round intermediate calculations. Round your answer to the nearest whole number. Use unrourded values from previous parts. shares d. If inmediately after caiculating the Year 2 NAV the manuger recelved ifvestor redempticn requests for 500,000 shares, how many shares of each steck mould she have to sell in order to maintain the same proportional ownershig position in each stock? Assume that she liguldates the entire cash position before she seils any stock holsings. Do not round intermediabe calculotions. Round your answers to the nearest whole number, If your answer is zero, epter "O*, Use unrounded values from previsus parts. Problem 17-07 The Focus fund is a mutual fund that holds long-term positions in a small number of nondividend-paying stocks, its boldings at the end of fwo recant years are as fobcwsi At the ens of both yers, Focus Fund had 5,405,000 shares outitanding. 3. Csicuate the net asset value for a share of the fouus fund at the end of Vear 1. beng sure to include the cash positisn in the nat total oorfalis value. Do noe rand ientarmegate caiculetions. found vour ankwer to the nearest cent. 3 your answer for fab to the nearwit oent and for the gronth rate to two decinal olaces. he end of both years, Focus Fund had 5,405,000 shares outstanding. a. Caiculate the net asset value for a share of the Focus Fund at the end of Year 1 , being sure to include the cash position in the net total portfoio value. Do not round intermediake calculations. Reund your answer to the nearest cent. b. Immediately after calculating Its Year 1 NAV, Focus Fund sold its pesition h Stock L and purchased ies postion in Stock M (both transoctions were bone at Year i prices). Calsulate the Year 2 NAV for Focus Fund, and compute the grosth rate in the fund share value on a percentage basis. Do hot round intermediate caloulationk. Round your acswer for Nav to the neatest cent and for the growth rato to two decimal places. Yeer 2 Natis Growth rate: c. At the end of Yesr 2, how mony fund shares of the Focus Fund could the manager redeem without having to lisuidate her stock posilions (that is using oniv the cash actount)? Do net round intermediate calculations. Mound your answer to the nearest whole number. Use unrounded values from previous parts theres d. If immeciately after calculating the Year 2 Nav the manager received investor redemption requests for 500,000 shares, how maniy shares of each stock would she have to sel in order to maintain the same propcrtional ownership position in each stock? Assume that she liguldotes the entire cash position betore she selis arer stosk hoidings, Do not round intermediate calculations. Aound your answers to the nearest whole number. If yaur answer is zero, enter "o*. Use unrounded values fraem pervious ports. c. At the end of Vear 2, how many fund shares of the Focus Fund could the manager redeem without having to liquidate her stock positions (that is using cnly the cash account)? Do not round intermediate calculations. Round your answer to the nearest whole number. Use unrourded values from previous parts. shares d. If inmediately after caiculating the Year 2 NAV the manuger recelved ifvestor redempticn requests for 500,000 shares, how many shares of each steck mould she have to sell in order to maintain the same proportional ownershig position in each stock? Assume that she liguldates the entire cash position before she seils any stock holsings. Do not round intermediabe calculotions. Round your answers to the nearest whole number, If your answer is zero, epter "O*, Use unrounded values from previsus parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts