Question: Please answer all the questions for Case 4 Olive Company produces two products. In September, the joint costs of processing were $825,000. Production and sales

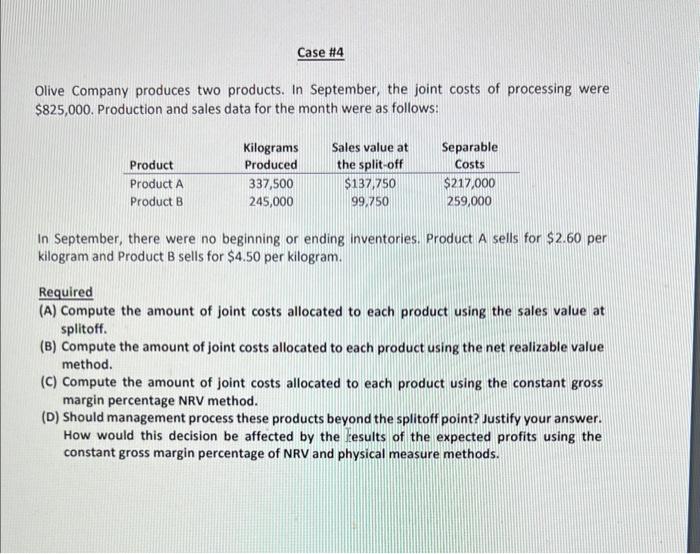

Olive Company produces two products. In September, the joint costs of processing were $825,000. Production and sales data for the month were as follows: In September, there were no beginning or ending inventories. Product A sells for $2.60 per kilogram and Product B sells for $4.50 per kilogram. Required (A) Compute the amount of joint costs allocated to each product using the sales value at splitoff. (B) Compute the amount of joint costs allocated to each product using the net realizable value method. (C) Compute the amount of joint costs allocated to each product using the constant gross margin percentage NRV method. (D) Should management process these products beyond the splitoff point? Justify your answer. How would this decision be affected by the results of the expected profits using the constant gross margin percentage of NRV and physical measure methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts