Question: Please answer all the questions given with the excel formula used. Thanks 18 2. Klein has a profit margin of 5%, a total assets turnover

Please answer all the questions given with the excel formula used. Thanks

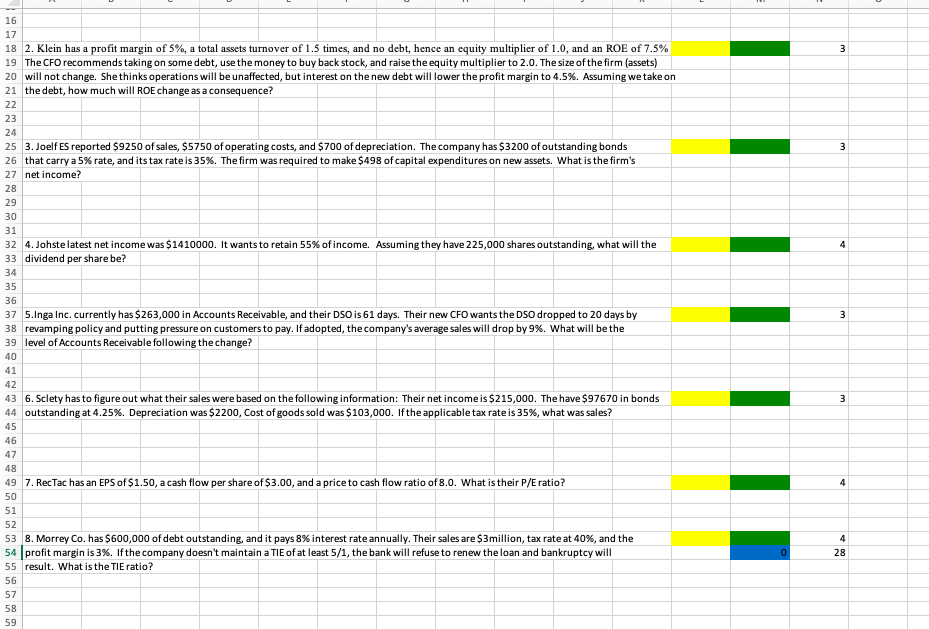

18 2. Klein has a profit margin of 5%, a total assets turnover of 1.5 times, and no debt, hence an equity multiplier of 1.0, and an ROE of 7.5% 19 The CFO recommends taking on some debt, use the money to buy back stock, and raise the equity multiplier to 2.0. The size of the firm (assets) 20 will not change. She thinks operations will be unaffected, but interest on the new debt will lower the profit margin to 4.5%. Assuming we take on 21 the debt, how much will ROE change as a consequence? 25 3. Joelf Es reported $9250 of sales, $5750 of operating costs, and $700 of depreciation. The company has $3200 of outstanding bonds 26 that carry a 5% rate, and its tax rate is 35%. The firm was required to make $498 of capital expenditures on new assets. What is the firm's 27 net income? 28 29 32 4. Johste latest net income was $1410000. It wants to retain 55% of income. Assuming they have 225,000 shares outstanding, what will the 33 dividend per share be? 34 37 5.Inga Inc. currently has $263,000 in Accounts Receivable, and their DSO is 61 days. Their new CFO wants the DSO dropped to 20 days by 38 revamping policy and putting pressure on customers to pay. If adopted, the company's average sales will drop by 9%. What will be the 39 level of Accounts Receivable following the change? 42 43 6. Sclety has to figure out what their sales were based on the following information: Their net income is $215,000. The have $97670 in bonds 44 outstanding at 4.25%. Depreciation was $2200, Cost of goods sold was $103,000. If the applicable tax rate is 35%, what was sales? 46 49 7. Rec Tac has an EPS of $1.50, a cash flow per share of $3.00, and a price to cash flow ratio of 8.0. What is their P/E ratio? 53 8. Morrey Co. has $600,000 of debt outstanding, and it pays 8% interest rate annually. Their sales are $3million, tax rate at 40%, and the 54 profit margin is 3%. If the company doesn't maintain a TIE of at least 5/1, the bank will refuse to renew the loan and bankruptcy will 55 result. What is the TIE ratio? 028 18 2. Klein has a profit margin of 5%, a total assets turnover of 1.5 times, and no debt, hence an equity multiplier of 1.0, and an ROE of 7.5% 19 The CFO recommends taking on some debt, use the money to buy back stock, and raise the equity multiplier to 2.0. The size of the firm (assets) 20 will not change. She thinks operations will be unaffected, but interest on the new debt will lower the profit margin to 4.5%. Assuming we take on 21 the debt, how much will ROE change as a consequence? 25 3. Joelf Es reported $9250 of sales, $5750 of operating costs, and $700 of depreciation. The company has $3200 of outstanding bonds 26 that carry a 5% rate, and its tax rate is 35%. The firm was required to make $498 of capital expenditures on new assets. What is the firm's 27 net income? 28 29 32 4. Johste latest net income was $1410000. It wants to retain 55% of income. Assuming they have 225,000 shares outstanding, what will the 33 dividend per share be? 34 37 5.Inga Inc. currently has $263,000 in Accounts Receivable, and their DSO is 61 days. Their new CFO wants the DSO dropped to 20 days by 38 revamping policy and putting pressure on customers to pay. If adopted, the company's average sales will drop by 9%. What will be the 39 level of Accounts Receivable following the change? 42 43 6. Sclety has to figure out what their sales were based on the following information: Their net income is $215,000. The have $97670 in bonds 44 outstanding at 4.25%. Depreciation was $2200, Cost of goods sold was $103,000. If the applicable tax rate is 35%, what was sales? 46 49 7. Rec Tac has an EPS of $1.50, a cash flow per share of $3.00, and a price to cash flow ratio of 8.0. What is their P/E ratio? 53 8. Morrey Co. has $600,000 of debt outstanding, and it pays 8% interest rate annually. Their sales are $3million, tax rate at 40%, and the 54 profit margin is 3%. If the company doesn't maintain a TIE of at least 5/1, the bank will refuse to renew the loan and bankruptcy will 55 result. What is the TIE ratio? 028

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts