Question: Please answer all the questions. I will rate. Summit Builders has a market debt-equity ratio of 0.75 and a corporate tax rate of 21%, and

Please answer all the questions. I will rate.

Please answer all the questions. I will rate.

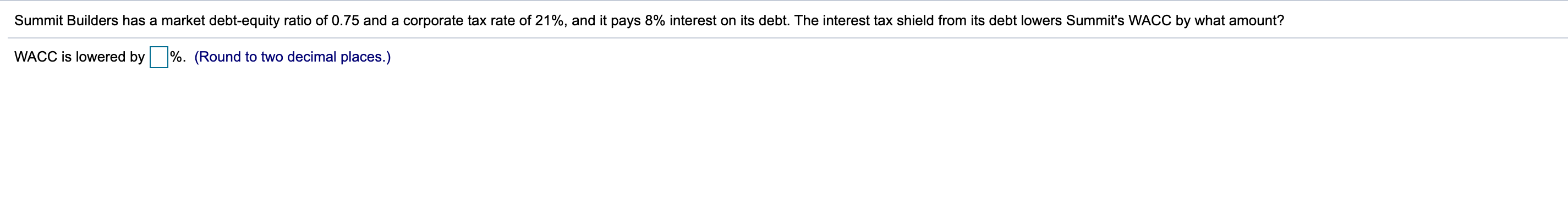

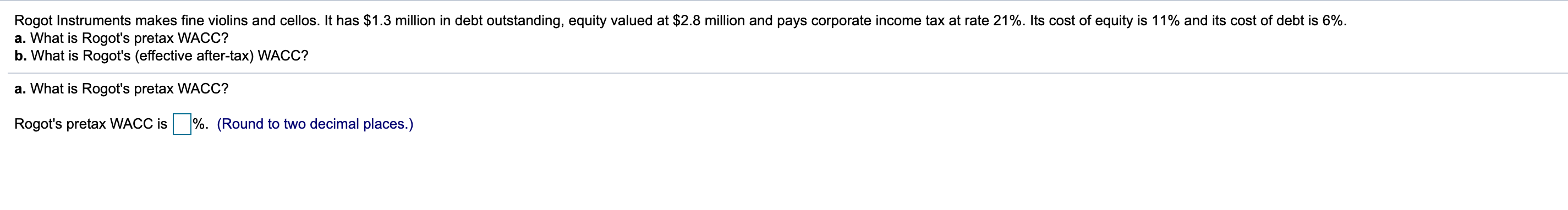

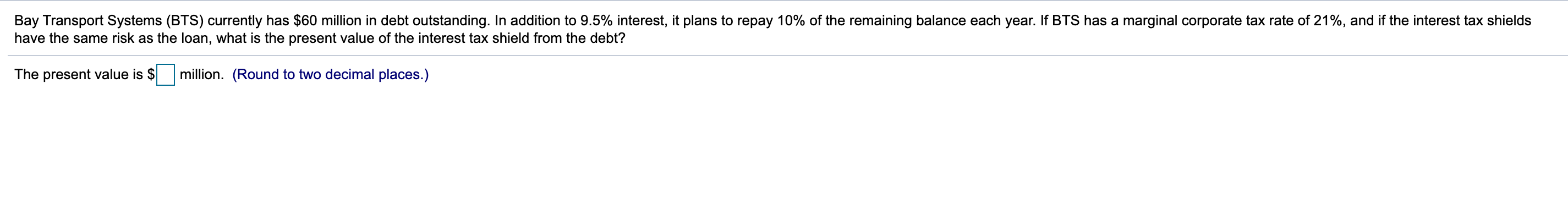

Summit Builders has a market debt-equity ratio of 0.75 and a corporate tax rate of 21%, and it pays 8% interest on its debt. The interest tax shield from its debt lowers Summit's WACC by what amount? WACC is lowered by %. (Round to two decimal places.) Rogot Instruments makes fine violins and cellos. It has $1.3 million in debt outstanding, equity valued at $2.8 million and pays corporate income tax at rate 21%. Its cost of equity is 11% and its cost of debt is 6%. a. What is Rogot's pretax WACC? b. What is Rogot's (effective after-tax) WACC? a. What is Rogot's pretax WACC? Rogot's pretax WACC is %. (Round to two decimal places.) Bay Transport Systems (BTS) currently has $60 million in debt outstanding. In addition to 9.5% interest, it plans to repay 10% of the remaining balance each year. If BTS has a marginal corporate tax rate of 21%, and if the interest tax shields have the same risk as the loan, what is the present value of the interest tax shield from the debt? The present value is $ million. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts