Question: Please answer all the questions. I will score your answer very good. Thank you! 20. Investors seeking to shelter funds in short-term treasury securities can

Please answer all the questions. I will score your answer very good. Thank you!

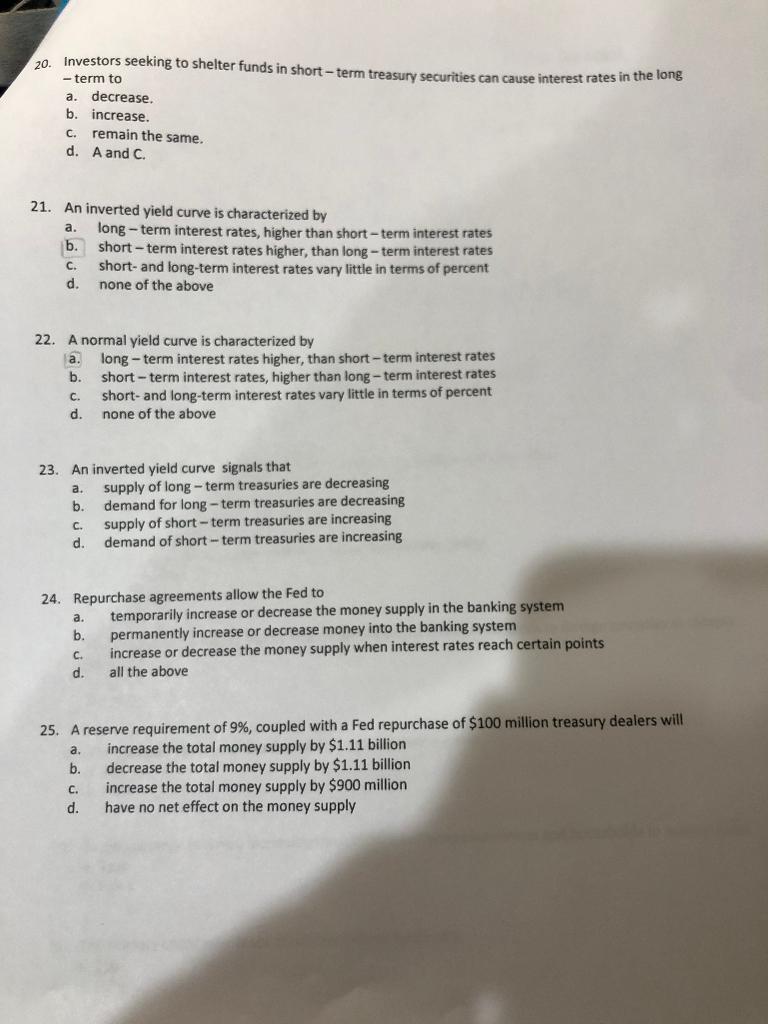

20. Investors seeking to shelter funds in short-term treasury securities can cause interest rates in the long - term to a. decrease. b. increase. c. remain the same. d. A and C. 21. An inverted yield curve is characterized by a. long - term interest rates, higher than short-term interest rates b. short - term interest rates higher, than long - term interest rates c. short-and long-term interest rates vary little in terms of percent d. none of the above 22. A normal yield curve is characterized by a. long - term interest rates higher, than short-term interest rates b. short-term interest rates, higher than long - term interest rates c. short-and long-term interest rates vary little in terms of percent d. none of the above 23. An inverted yield curve signals that a. supply of long - term treasuries are decreasing b. demand for long - term treasuries are decreasing c. supply of short - term treasuries are increasing d. demand of short - term treasuries are increasing 24. Repurchase agreements allow the Fed to a. temporarily increase or decrease the money supply in the banking system b. permanently increase or decrease money into the banking system c. increase or decrease the money supply when interest rates reach certain points d. all the above 25. A reserve requirement of 9%, coupled with a Fed repurchase of $100 million treasury dealers will a. increase the total money supply by $1.11 billion b. decrease the total money supply by $1.11 billion c. increase the total money supply by $900 million d. have no net effect on the money supply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts