Question: please answer all the questions immediately thankyou 33. Under PAS 20. Grants are (1 Point) Recognized in profit or loss on a systematic basis over

please answer all the questions immediately thankyou

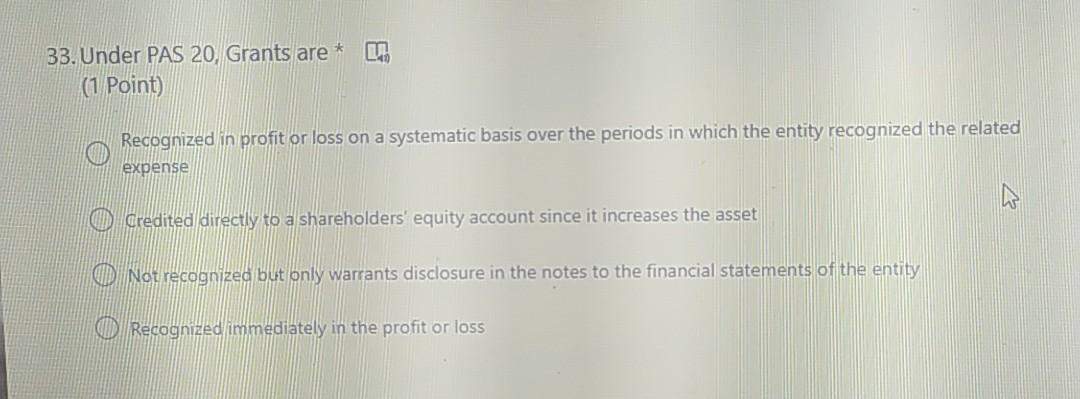

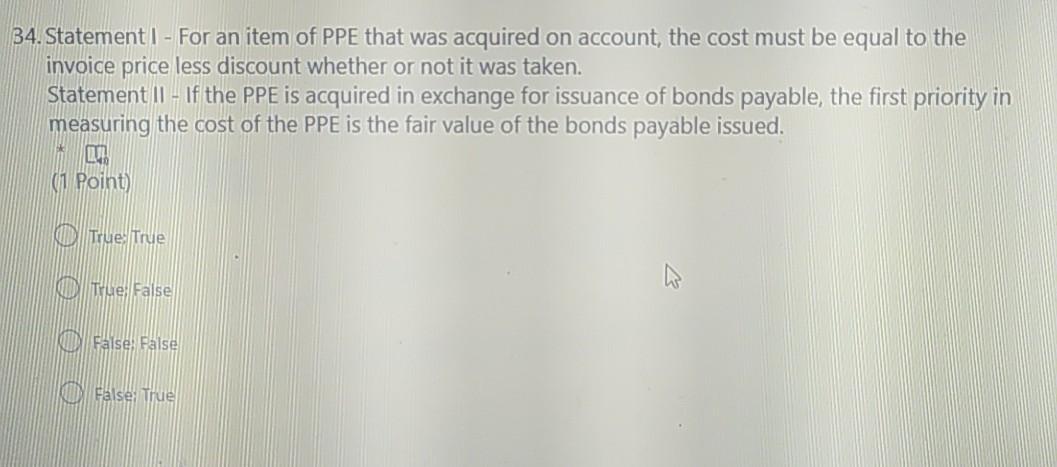

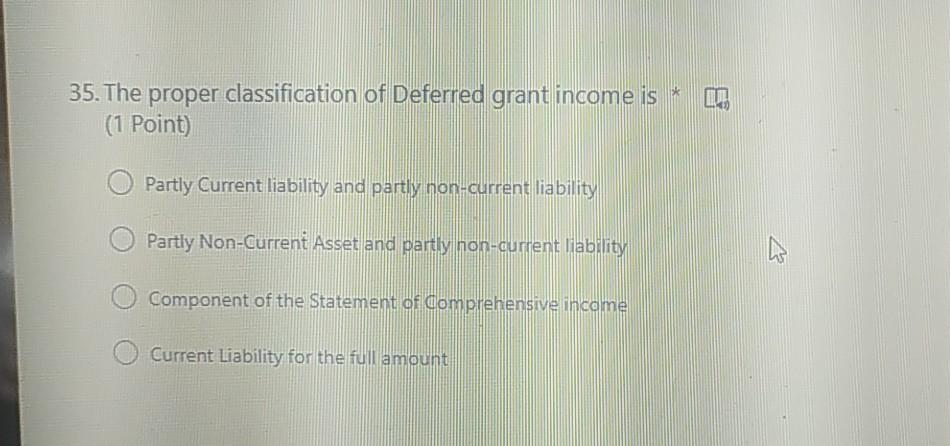

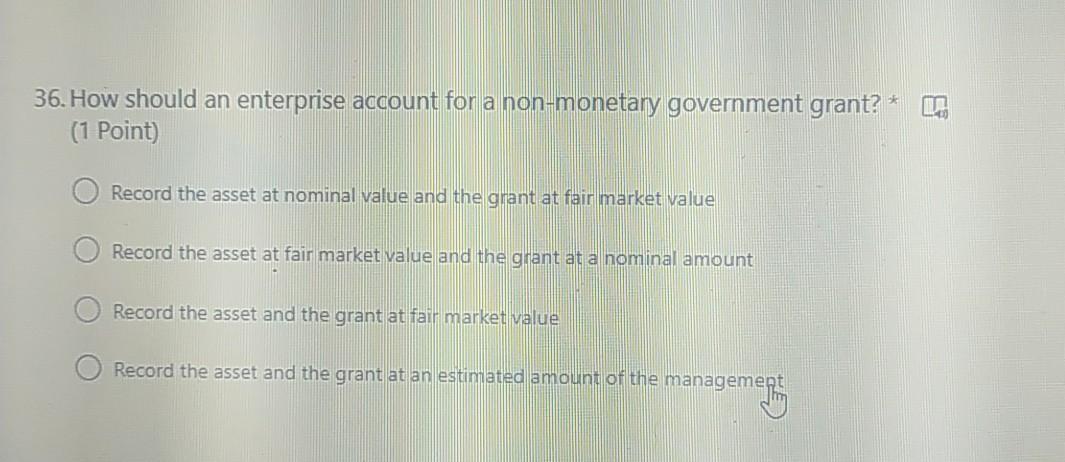

33. Under PAS 20. Grants are (1 Point) Recognized in profit or loss on a systematic basis over the periods in which the entity recognized the related expense Credited directly to a shareholders' equity account since it increases the asset Not recognized but only warrants disclosure in the notes to the financial statements of the entity 0 Recognized immediately in the profit or loss 34.Statement | - For an item of PPE that was acquired on account, the cost must be equal to the invoice price less discount whether or not it was taken. Statement 11 - If the PPE is acquired in exchange for issuance of bonds payable, the first priority in measuring the cost of the PPE is the fair value of the bonds payable issued. (1 Point True True KUD True False False: False False True DUE 35. The proper classification of Deferred grant income is (1 Point) Partly Current liability and partly non-current liability Partly Non-Current Asset and partly non-current liability Component of the Statement of domprehensive income Current Liability for the full amount 36. How should an enterprise account for a non-monetary government grant?* 0. (1 Point) Record the asset at nominal value and the grant at fair market value Record the asset at fair market value and the grant at a nominal amount Record the asset and the grant at fair market value Record the asset and the grant at an estimated amount of the management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts