Question: please answer all the questions immediately thankyou 4 How much is the total additional paid in capital presented in the shareholder's equity section as of

please answer all the questions immediately thankyou

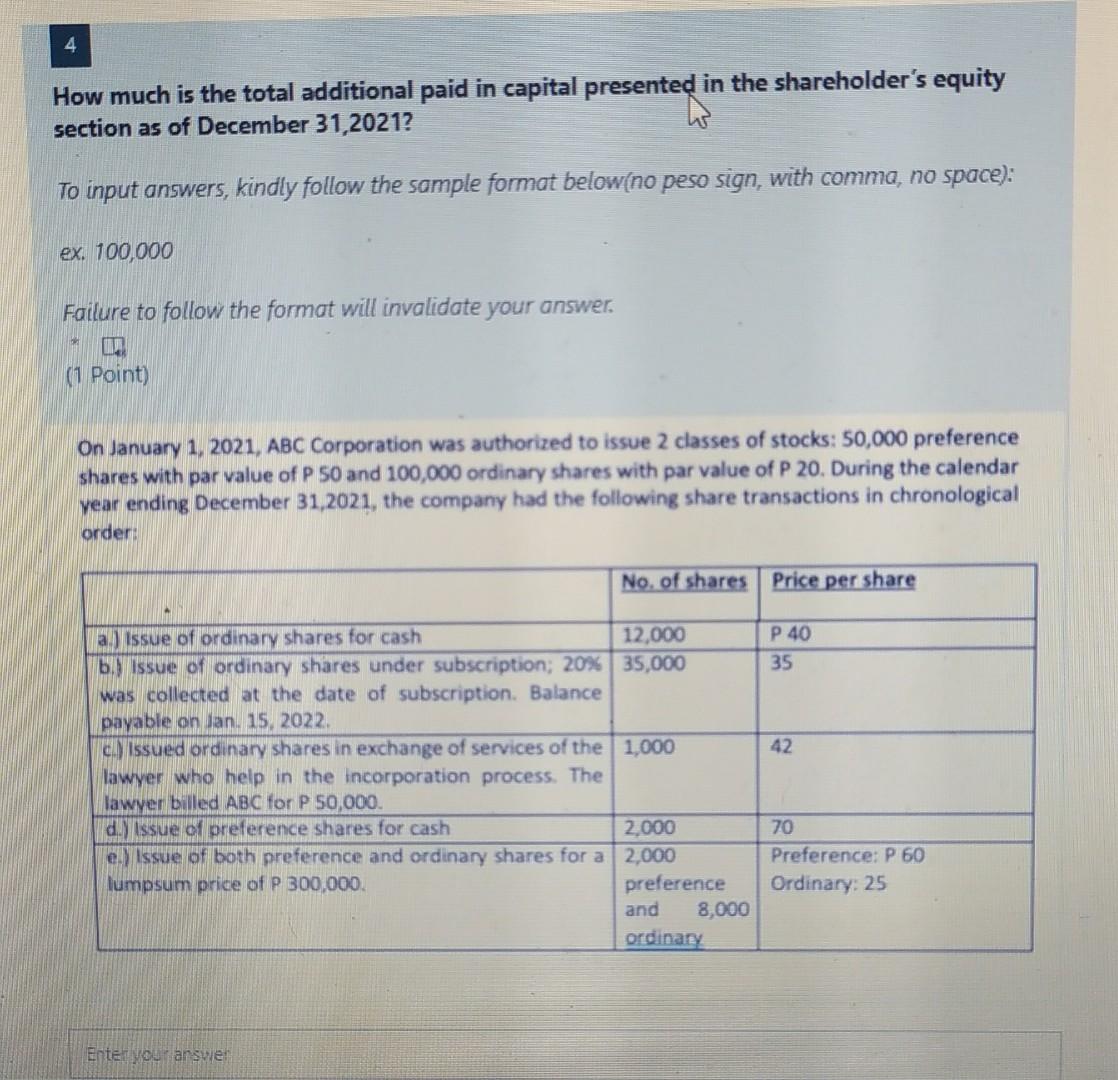

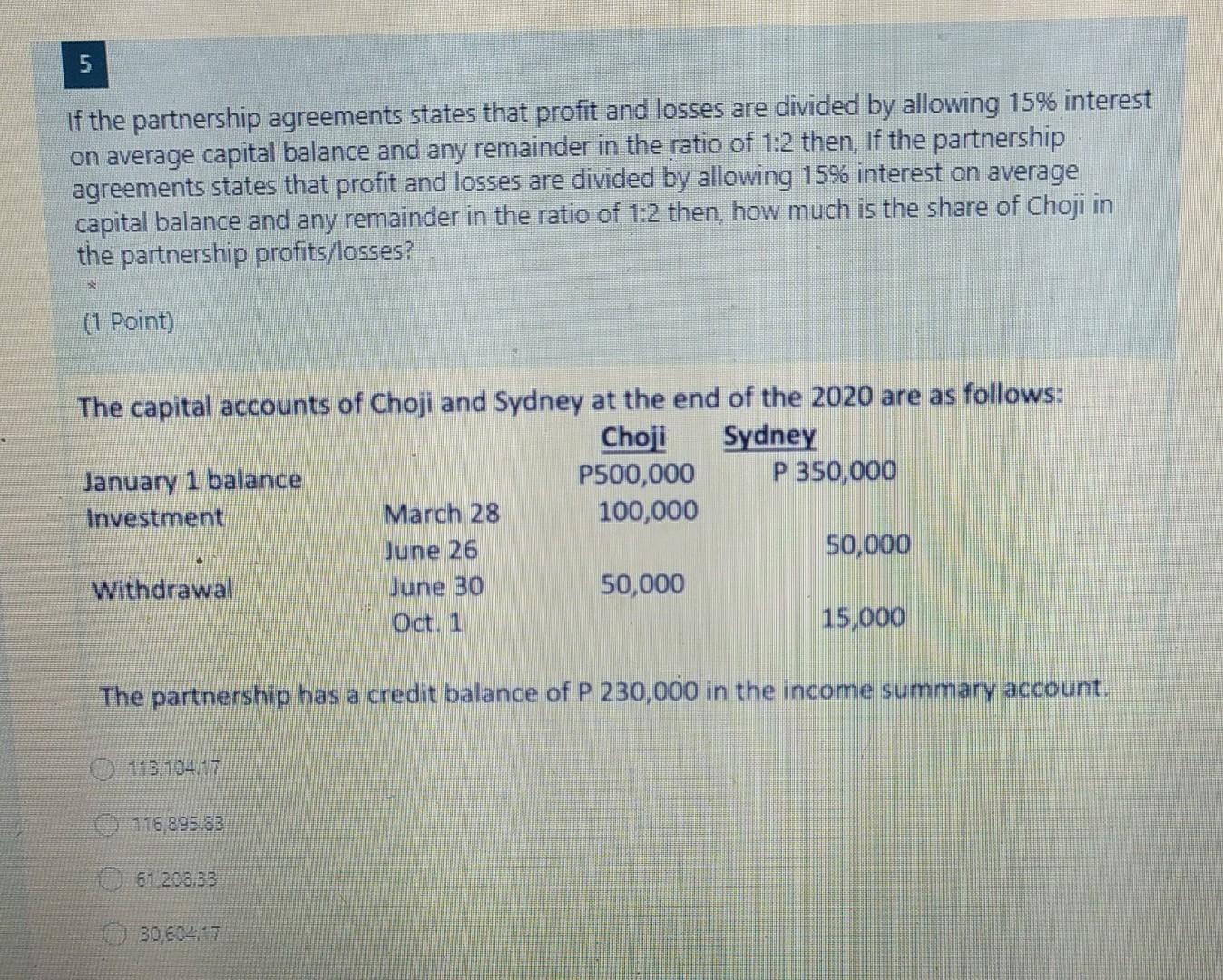

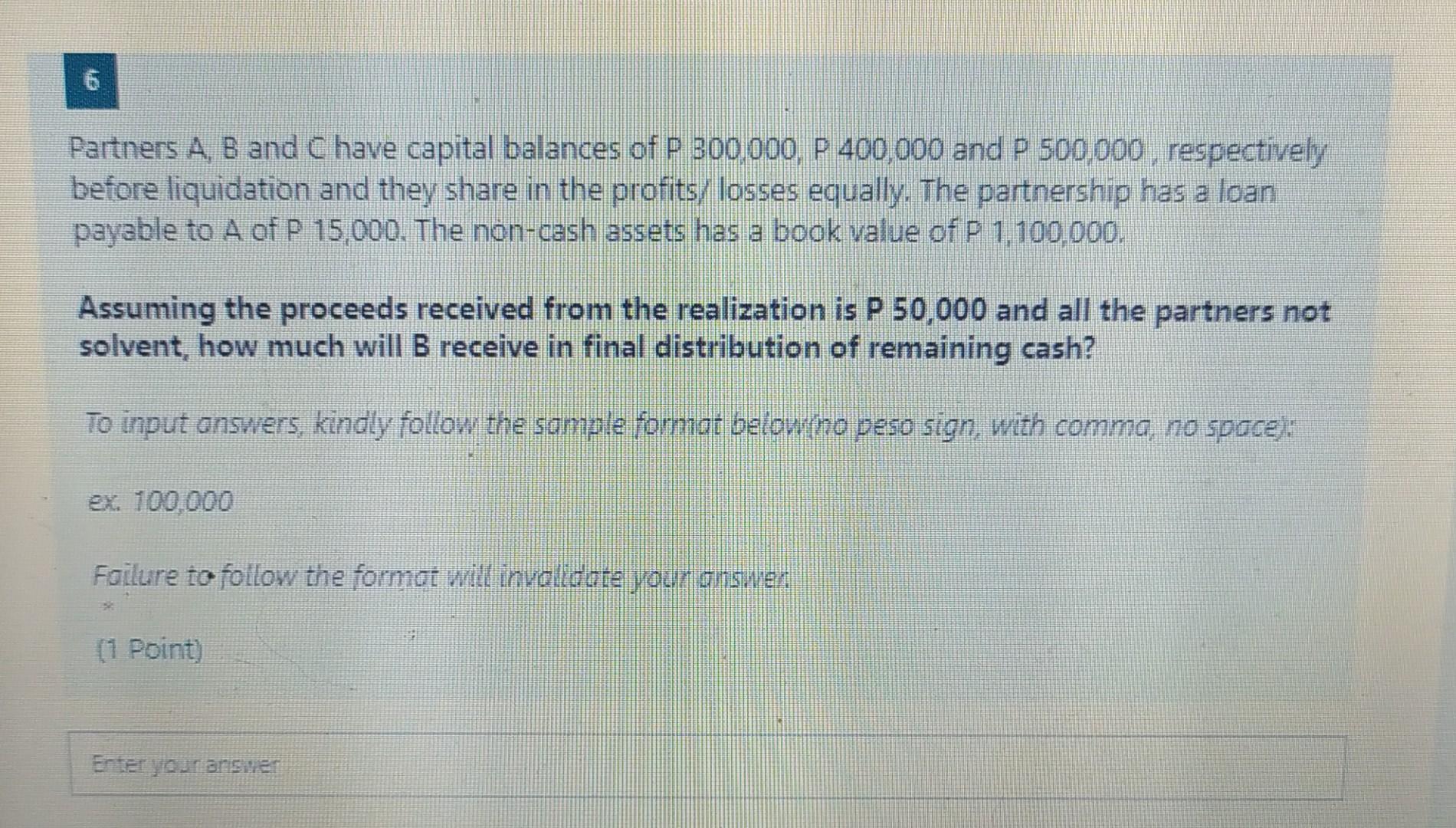

4 How much is the total additional paid in capital presented in the shareholder's equity section as of December 31,2021? To input answers, kindly follow the sample format below(no peso sign, with comma, no space): ex. 100,000 Failure to follow the format will invalidate your answer. (1 Point) On January 1, 2021, ABC Corporation was authorized to issue 2 classes of stocks: 50,000 preference shares with par value of P 50 and 100,000 ordinary shares with par value of P 20. During the calendar year ending December 31,2021, the company had the following share transactions in chronological order: No. of shares Price per share P40 35 42 a.) issue of ordinary shares for cash 12,000 bissue of ordinary shares under subscription; 20% 35,000 was collected at the date of subscription. Balance payable on Jan 15, 2022. e issued ordinary shares in exchange of services of the 1,000 lawyer who help in the incorporation process. The lawyer billed ABC for P 50,000. dyissue of preference shares for cash 2.000 e.issue of both preference and ordinary shares for a 2,000 lumpsum price of P 300,000. preference and 8,000 ordinary 70 Preference: P 60 Ordinary: 25 Enter your answer 5 If the partnership agreements states that profit and losses are divided by allowing 15% interest on average capital balance and any remainder in the ratio of 1:2 then, If the partnership agreements states that profit and losses are divided by allowing 15% interest on average capital balance and any remainder in the ratio of 1:2 then how much is the share of Choji in the partnership profits/losses? (1 Point) The capital accounts of Choji and Sydney at the end of the 2020 are as follows: Choji Sydney January 1 balance P500,000 P 350,000 Investment March 28 100,000 June 26 50,000 Withdrawal June 30 50,000 Oct. 1 15,000 The partnership has a credit balance of P 230,000 in the income summary account, O 113,10417 O 116,895.83 61 208133 306027 6 Partners A, B and C have capital balances of P 300.000, P 400,000 and p 500.000, respectively before liquidation and they share in the profits/ losses equally. The partnership has a loan payable to A of P 15,000. The non-cash assets has a book value of P 1,100,000. Assuming the proceeds received from the realization is P 50,000 and all the partners not solvent, how much will B receive in final distribution of remaining cash? To input answers, kindly follow the sample format below (no peso sign, with comma, no spacej: ex. 100.000 Failure to follow the format will invalidate your answer (1 Point Enter your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts