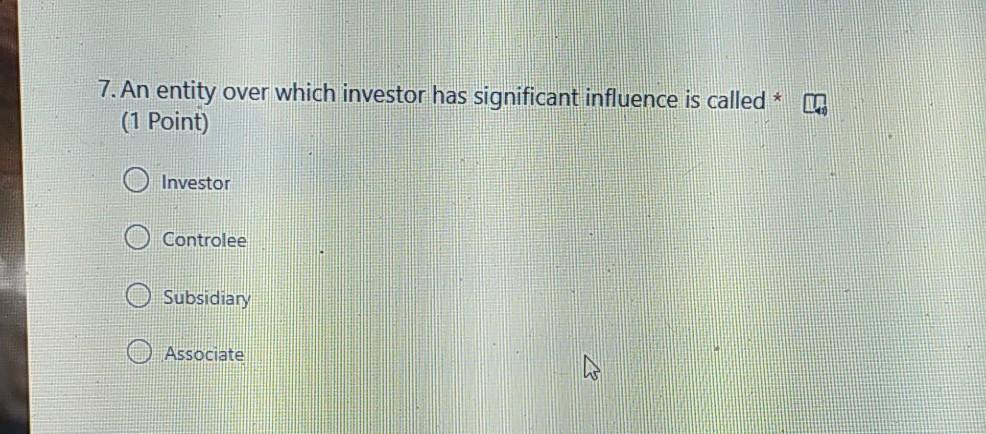

Question: please answer all the questions immediately thankyou 7. An entity over which investor has significant influence is called a (1 Point) Investor Controlee Subsidiary Associate

please answer all the questions immediately thankyou

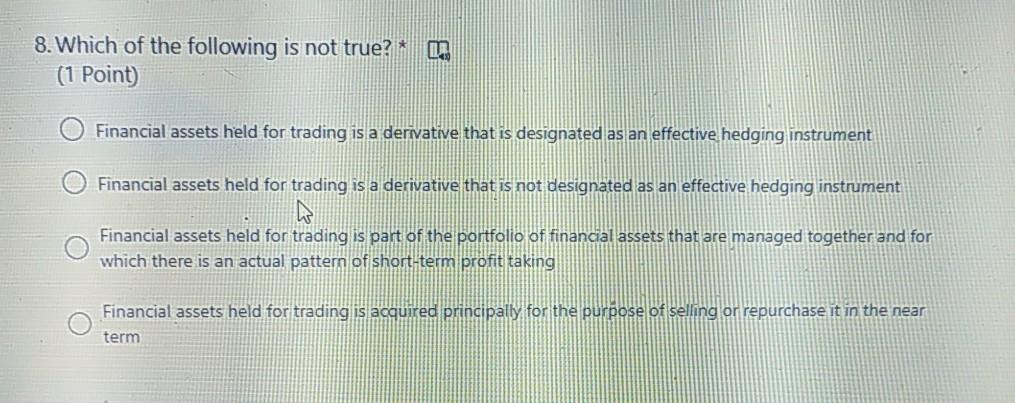

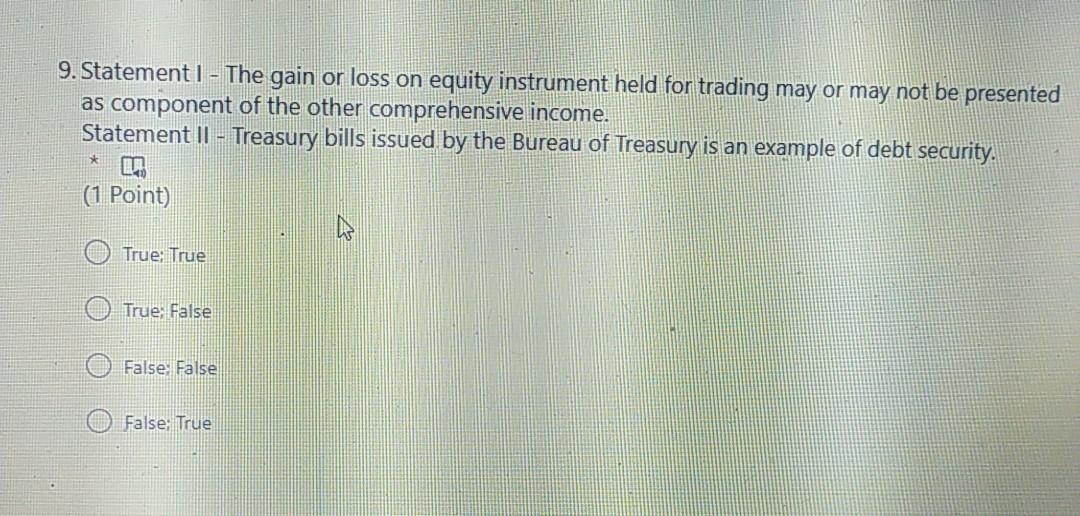

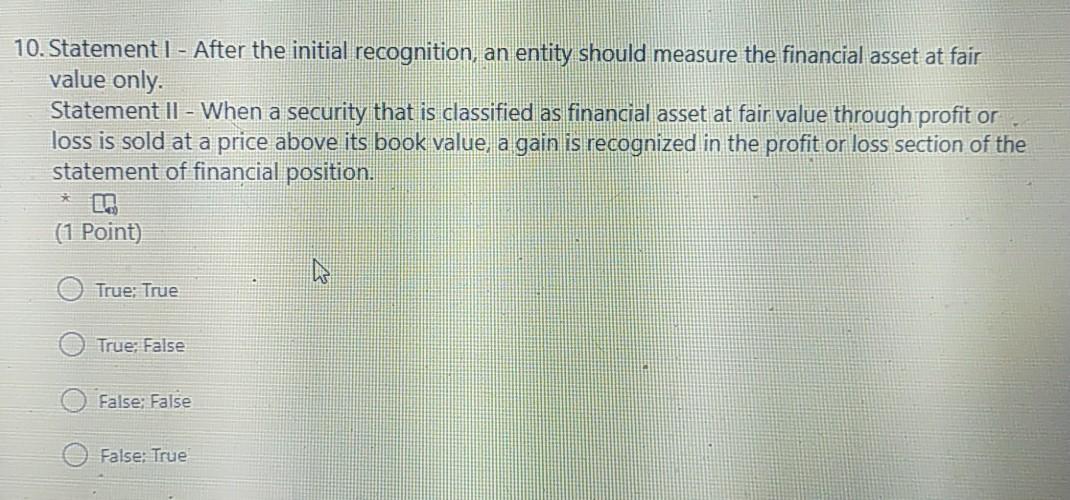

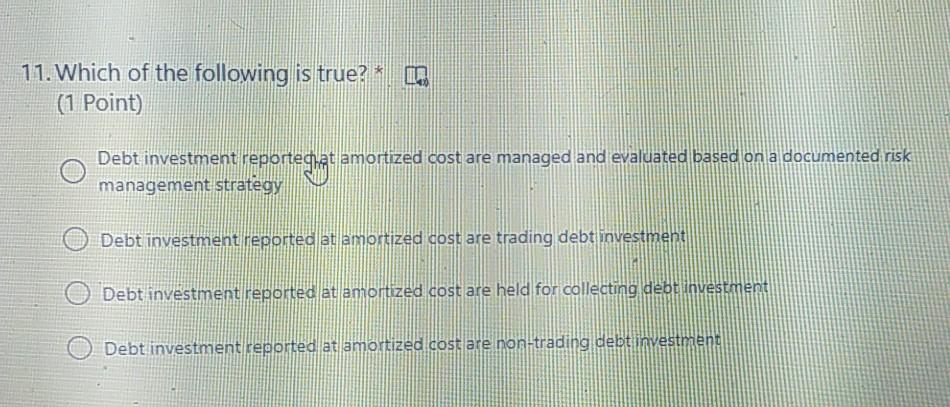

7. An entity over which investor has significant influence is called a (1 Point) Investor Controlee Subsidiary Associate 8. Which of the following is not true?* (1 Point) Financial assets held for trading is a derivative that is designated as an effective hedging instrument Financial assets held for trading is a derivative that is not designated as an effective hedging instrument Financial assets held for trading is part of the portfolio of financial assets that are managed together and for which there is an actual pattern of short-term profit taking Financial assets held for trading is acquired principally for the purpose of selling or repurchase it in the near term 9. Statement 1 - The gain or loss on equity instrument held for trading may or may not be presented as component of the other comprehensive income. Statement || - Treasury bills issued by the Bureau of Treasury is an example of debt security. (1 Point) True: True True False False False False; True 10. Statement | - After the initial recognition, an entity should measure the financial asset at fair value only. Statement 11 - When a security that is classified as financial asset at fair value through profit or loss is sold at a price above its book value, a gain is recognized in the profit or loss section of the statement of financial position. (1 Point) True: True True: False False: False False: True 11. Which of the following is true? cm (1 Point) Debt investment reportedat amortized cost are managed and evaluated based on a documented risk management strategy Debt investment reported at amortized cost are trading debt investment Debt investment reported at amortized cost are held for collecting debt investment Debt investment reported at amortized cost are non-trading debt investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts