Question: please answer all the questions in detail. don't forget question#3! thank you. hapter 6 Learning Objectives 2, 3 P6-40B Accounting for inventory using the perpetual

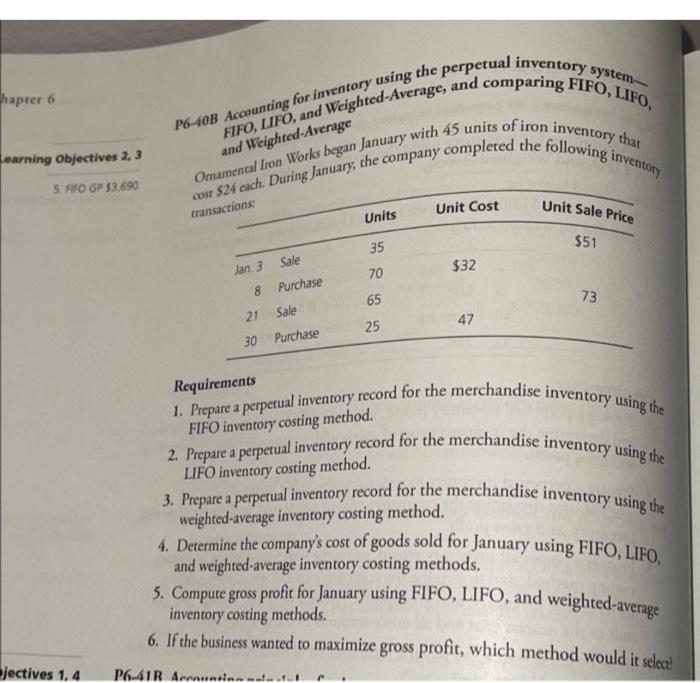

hapter 6 Learning Objectives 2, 3 P6-40B Accounting for inventory using the perpetual inventory system FIFO, LIFO, and Weighted-Average, and comparing FIFO, LIFO, Omamental Iron Works began January with 45 units of iron inventory that cost $24 each. During January, the company completed the following inventory and Weighted-Average 5. RFO GP 53,690 transactions Unit Cost Unit Sale Price Units 35 $51 $32 70 65 73 Jan 3 Sale 8 Purchase 21 Sale 30 Purchase 47 25 Requirements FIFO inventory costing method. LIFO inventory costing method. 1. Prepare a perpetual inventory record for the merchandise inventory using the 2. Prepare a perpetual inventory record for the merchandise inventory using the 3. Prepare a perpetual inventory record for the merchandise inventory using the weighted-average inventory costing method. 4. Determine the company's cost of goods sold for January using FIFO, LIFO. and weighted average inventory costing methods. 5. Compute gross profit for January using FIFO, LIFO, and weighted average inventory costing methods. 6. If the business wanted to maximize gross profit, which method would it select jectives 1.4 P6.41R Annuncio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts