Question: PLEASE ANSWER ALL THE QUESTIONS NOT JUST ONLY ONE PLEASE WHO SO EVER ANSWER ALL OF THE 5 QUESTIONS PLEASE Question number 1). For each

PLEASE ANSWER ALL THE QUESTIONS NOT JUST ONLY ONE PLEASE WHO SO EVER ANSWER ALL OF THE 5 QUESTIONS PLEASE

Question number 1). For each cost in case exhibit 3 indicate whether the cost os indirect cost or direct cost ? Q#2). Currently the company uses a traditional overhead allocation system where over head both manufacturing and non manufacturing overhead is allocated based on number of units.

a.) What propotion of the total over head cost of $73,500 will be allocated to basic gym bag and custom gym bags?

Calculate the overhead rates per unit for manufacturing and non manufacturing overhead?

b.) use these rates to allocate manufacturing and non manufacturing overhead cost to each unit. complete the information in the table below... Basic custom Direct material 30.00 35.00 Direct labor 15.00 20.00 Manufacturing overhead ? ? Total manufacturing cost ? ? Sales commission 10.00 12.00 Non manufacturing overhead ? ? Total manufacturing cost ? ? Total Cost ? ?

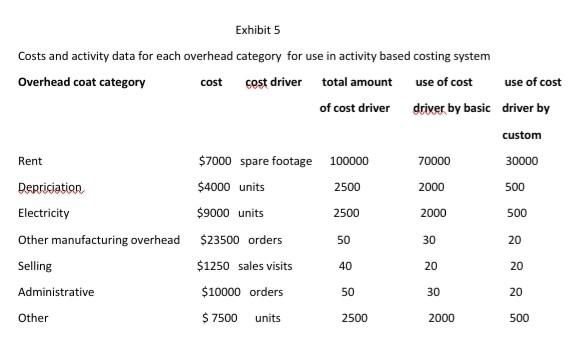

Q#3) Jones and west are conducting an analysis to see if an activity based costing system will lead to different estimates of the cost of basic and custom gym bags. Case exhibit 5 provides cost for each over head. Category and data on activites assumed to drive each of these costs. Using that cost and a activity data allocate overhead cost to basic and custom products using an activity based costing approach. Complete the table below..

Basic Custom Direct material 30.00 35.00 Direct labor 15.00 20.00 Manufacturing over Rent ? ? Depreciation ? ? Electricity ? ? Other manufacturing overhead ? ? Total ? Total manufacturing cost ? ? Sales 3.125 11.50 Administrative ? ? total ? ? other ? ? Total manufacturing cost ? ? Total cost ? ?

Q#4) Why is there such a difference in the cost per unit between the traditional and activity based costing systems?

Q#5 Based on the product costs data from the activity based costing system, what activities do you recommend that jones and west consider next?

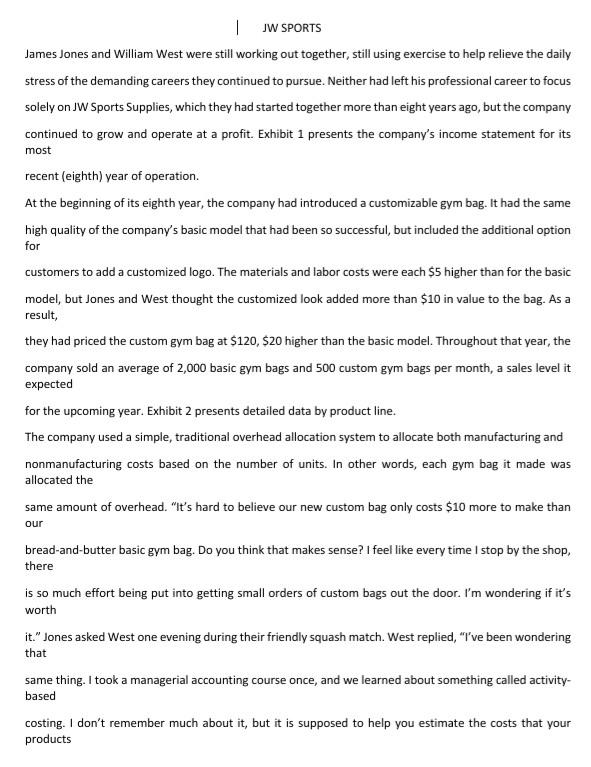

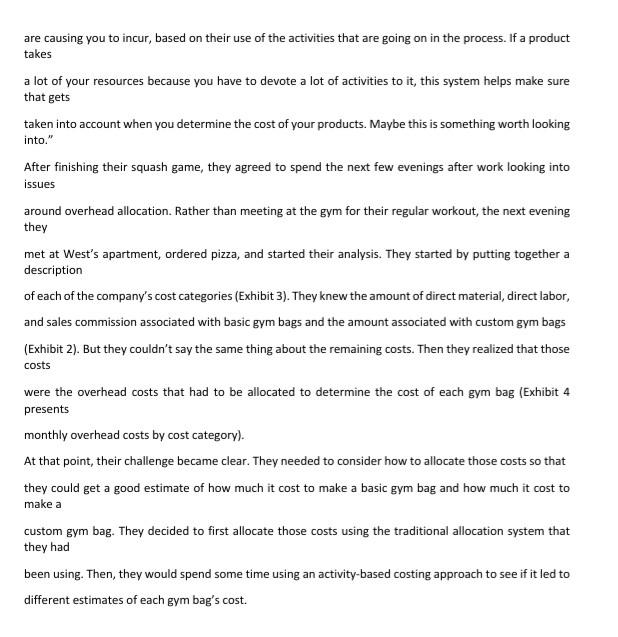

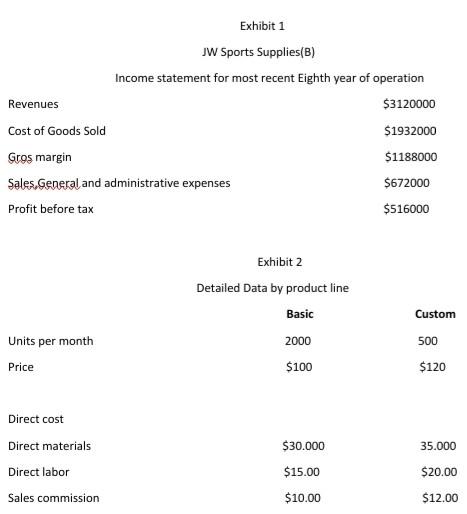

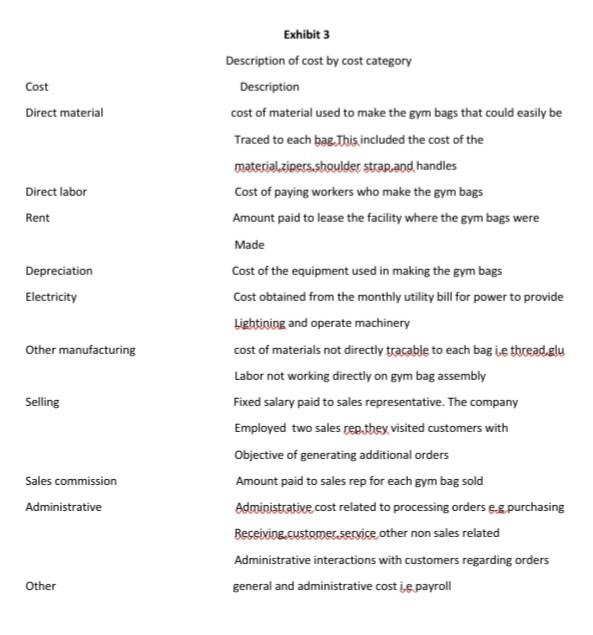

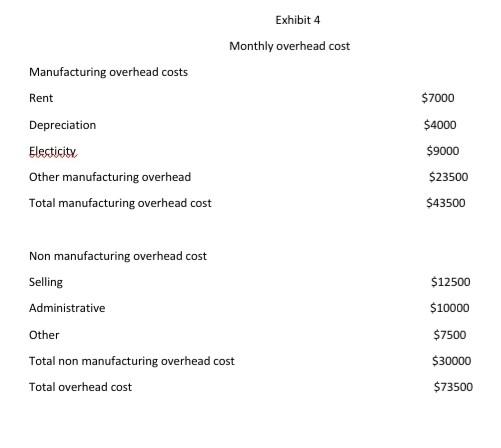

| JW SPORTS James Jones and William West were still working out together, still using exercise to help relieve the daily stress of the demanding careers they continued to pursue. Neither had left his professional career to focus solely on JW Sports Supplies, which they had started together more than eight years ago, but the company continued to grow and operate at a profit. Exhibit 1 presents the company's income statement for its most recent (eighth) year of operation. At the beginning of its eighth year, the company had introduced a customizable gym bag. It had the same high quality of the company's basic model that had been so successful, but included the additional option for customers to add a customized logo. The materials and labor costs were each $5 higher than for the basic model, but Jones and West thought the customized look added more than $10 in value to the bag. As a result, they had priced the custom gym bag at $120, $20 higher than the basic model. Throughout that year, the company sold an average of 2,000 basic gym bags and 500 custom gym bags per month, a sales level it expected for the upcoming year. Exhibit 2 presents detailed data by product line. The company used a simple, traditional overhead allocation system to allocate both manufacturing and nonmanufacturing costs based on the number of units. In other words, each gym bag it made was allocated the same amount of overhead. "it's hard to believe our new custom bag only costs $10 more to make than Our bread-and-butter basic gym bag. Do you think that makes sense? I feel like every time I stop by the shop, there is so much effort being put into getting small orders of custom bags out the door. I'm wondering if it's worth it. Jones asked West one evening during their friendly squash match. West replied, "I've been wondering that same thing. I took a managerial accounting course once, and we learned about something called activity- based costing. I don't remember much about it, but it is supposed to help you estimate the costs that your products are causing you to incur, based on their use of the activities that are going on in the process. If a product takes a lot of your resources because you have to devote a lot of activities to it, this system helps make sure that gets taken into account when you determine the cost of your products. Maybe this is something worth looking into." After finishing their squash game, they agreed to spend the next few evenings after work looking into issues around overhead allocation. Rather than meeting at the gym for their regular workout, the next evening they met at West's apartment, ordered pizza, and started their analysis. They started by putting together a description of each of the company's cost categories (Exhibit 3). They knew the amount of direct material, direct labor, and sales commission associated with basic gym bags and the amount associated with custom gym bags (Exhibit 2). But they couldn't say the same thing about the remaining costs. Then they realized that those costs were the overhead costs that had to be allocated to determine the cost of each gym bag (Exhibit 4 presents monthly overhead costs by cost category). At that point, their challenge became clear. They needed to consider how to allocate those costs so that they could get a good estimate of how much it cost to make a basic gym bag and how much it cost to make a custom gym bag. They decided to first allocate those costs using the traditional allocation system that they had been using. Then, they would spend some time using an activity-based costing approach to see if it led to different estimates of each gym bag's cost. Exhibit 1 JW Sports Supplies(8) Income statement for most recent Eighth year of operation Revenues $3120000 Cost of Goods Sold $1932000 Gros margin $1188000 Sales. General and administrative expenses $672000 Profit before tax $516000 Exhibit 2 Detailed Data by product line Basic 2000 $100 Custom 500 Units per month Price $120 Direct cost $30.000 35.000 Direct materials Direct labor Sales commission $15.00 $20.00 $12.00 $10.00 Cost Direct material Direct labor Rent Depreciation Electricity Exhibit 3 Description of cost by cost category Description cost of material used to make the gym bags that could easily be Traced to each bag. This included the cost of the materialziness.shoulder strap and handles Cost of paying workers who make the gym bags Amount paid to lease the facility where the gym bags were Made Cost of the equipment used in making the gym bags Cost obtained from the monthly utility bill for power to provide Lightining and operate machinery cost of materials not directly tracable to each bag ie thread.glu Labor not working directly on gym bag assembly Fixed salary paid to sales representative. The company Employed two sales rep.they visited customers with Objective of generating additional orders Amount paid to sales rep for each gym bag sold Administrative cost related to processing orders e. purchasing Receiving customer service other non sales related Administrative interactions with customers regarding orders general and administrative cost i,e payroll Other manufacturing Selling Sales commission Administrative Other Exhibit 4 Monthly overhead cost Manufacturing overhead costs Rent Depreciation Electicity Other manufacturing overhead Total manufacturing overhead cost $7000 $4000 $9000 $23500 $43500 $12500 $10000 Non manufacturing overhead cost Selling Administrative Other Total non manufacturing overhead cost Total overhead cost $7500 $30000 $73500 Exhibit 5 Costs and activity data for each overhead category for use in activity based costing system Overhead coat category cost cost driver total amount use of cost use of cost of cost driver driver by basic driver by custom 30000 70000 2000 500 2000 500 Rent $7000 spare footage 100000 Depriciation $4000 units 2500 Electricity $9000 units 2500 Other manufacturing overhead $23500 orders Selling $1250 sales visits 40 Administrative $10000 orders 50 30 20 20 20 50 30 20 Other $ 7500 units 2500 2000 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts