Question: Please answer all the questions. Please copy and paste the following link to see the documents. file:///Usersaseersteve/Downloads/2018%20form%201040(1)%20(2).pdf file:///Usersaseersteve/Downloads/f1040s1--dft%20(1).pdf See Rodney Hall's Form 1040 copied below

Please answer all the questions.

Please copy and paste the following link to see the documents.

file:///Usersaseersteve/Downloads/2018%20form%201040(1)%20(2).pdf

file:///Usersaseersteve/Downloads/f1040s1--dft%20(1).pdf

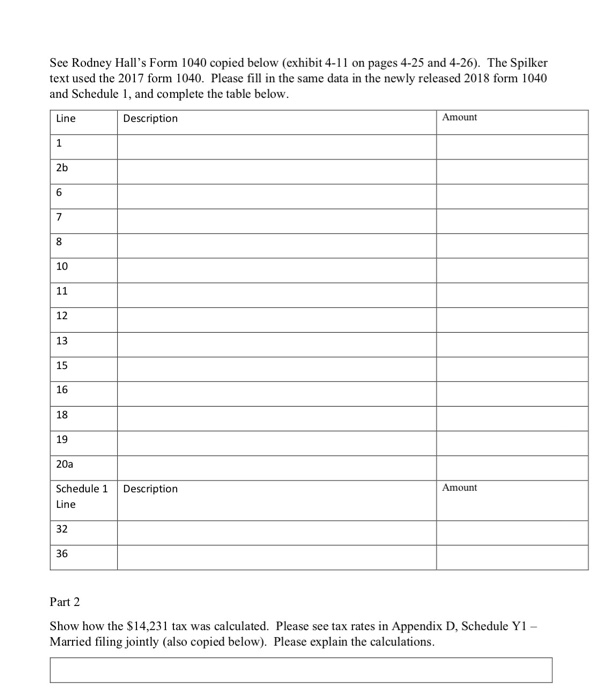

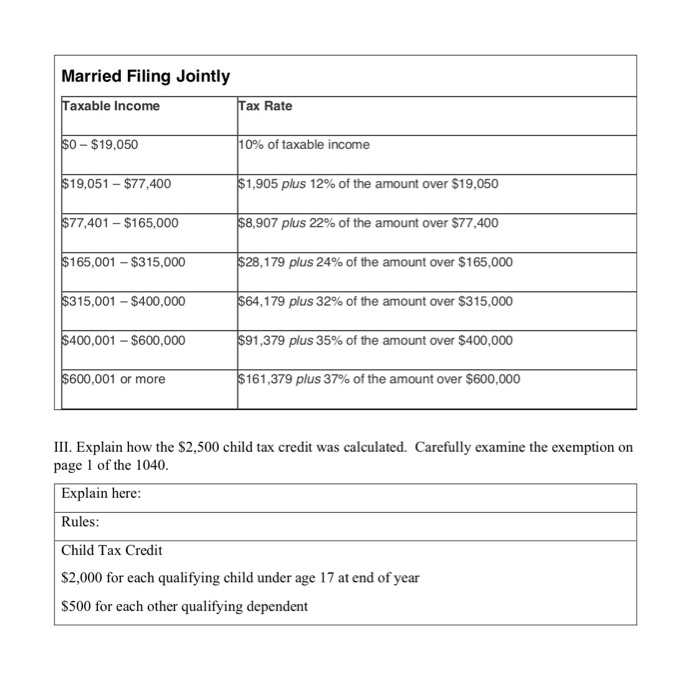

See Rodney Hall's Form 1040 copied below (exhibit 4-11 on pages 4-25 and 4-26). The Spilker text used the 2017 form 1040. Please fill in the same data in the newly released 2018 form 1040 and Schedule 1, and complete the table below. Line Description Amount 2b 10 12 13 15 16 18 19 20a Schedule 1 Description Line 32 36 Part 2 Show how the $14,231 tax was calculated. Please see tax rates in Appendix D, Schedule Y1- Married filing jointly (also copied below). Please explain the calculations Married Filing Jointly axable Income ax Rate -$19,050 0% of taxable income 19,051 $77,400 77,401 - $165,000 165,001 $315,000 315,001- $400,000 1,905 plus 12% of the amount over $19,050 8,907 plus 22% of the amount over $77,400 28,179 plus 24% of the amount over $165,000 64,179 plus 32% of the amount over $315,000 91,379 plus 35% of the amount over $400,000 161,379 plus 37% of the amount over $600,000 400,001 $600,000 600,001 or more III. Explain how the $2,500 child tax credit was calculated. Carefully examine the exemption on page of the 1040 Explain here Rules Child Tax Credit $2,000 for each qualifying child under age 17 at end of year $500 for each other qualifying dependernt See Rodney Hall's Form 1040 copied below (exhibit 4-11 on pages 4-25 and 4-26). The Spilker text used the 2017 form 1040. Please fill in the same data in the newly released 2018 form 1040 and Schedule 1, and complete the table below. Line Description Amount 2b 10 12 13 15 16 18 19 20a Schedule 1 Description Line 32 36 Part 2 Show how the $14,231 tax was calculated. Please see tax rates in Appendix D, Schedule Y1- Married filing jointly (also copied below). Please explain the calculations Married Filing Jointly axable Income ax Rate -$19,050 0% of taxable income 19,051 $77,400 77,401 - $165,000 165,001 $315,000 315,001- $400,000 1,905 plus 12% of the amount over $19,050 8,907 plus 22% of the amount over $77,400 28,179 plus 24% of the amount over $165,000 64,179 plus 32% of the amount over $315,000 91,379 plus 35% of the amount over $400,000 161,379 plus 37% of the amount over $600,000 400,001 $600,000 600,001 or more III. Explain how the $2,500 child tax credit was calculated. Carefully examine the exemption on page of the 1040 Explain here Rules Child Tax Credit $2,000 for each qualifying child under age 17 at end of year $500 for each other qualifying dependernt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts