Question: please answer all the questions. please show all work 21. You are gathering data on a 60 unit apartment building, using the attached form and

please answer all the questions. please show all work

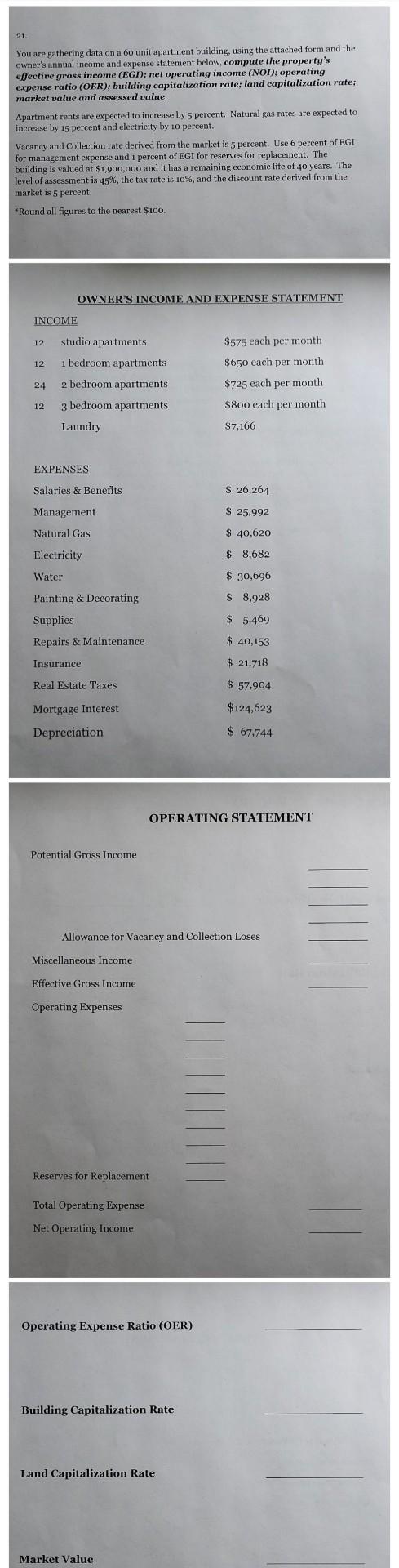

21. You are gathering data on a 60 unit apartment building, using the attached form and the owner's annual income and expense statement below, compute the property's effective gross income (EGT); net operating income (NOI): operating expense ratio (OER); building capitalization rate: land capitalization rate: market value and assessed value. Apartment rents are expected to increase by 5 percent. Natural gas rates are expected to increase by 15 percent and electricity by 10 percent. Vacancy and Collection rate derived from the market is 5 percent. Use 6 percent of EGI for management expense and 1 percent of EGI for reserves for replacement. The building is valued at $1,900,000 and it has a remaining economic life of 40 years. The level of assessment is 45%, the tax rate is 10%, and the discount rate derived from the market is 5 percent. *Round all figures to the nearest $100. OWNER'S INCOME AND EXPENSE STATEMENT INCOME 12 studio apartments 1 bedroom apartments 12 $575 each per month $650 each per month $725 each per month S8oo each per month 24 2 bedroom apartments 12 3 bedroom apartments Laundry $7,166 EXPENSES Salaries & Benefits $ 26,264 Management $ 25,992 Natural Gas $ 40,620 Electricity $ 8.682 Water $ 30,696 Painting & Decorating S 8,928 $ 5.469 Supplies Repairs & Maintenance $ 40,153 Insurance $ 21,718 Real Estate Taxes $ 57,904 $124,623 Mortgage Interest Depreciation $ 67,744 OPERATING STATEMENT Potential Gross Income Allowance for Vacancy and Collection Loses Miscellaneous Income Effective Gross Income Operating Expenses Reserves for Replacement Total Operating Expense Net Operating Income Operating Expense Ratio (OER) Building Capitalization Rate Land Capitalization Rate Market Value 21. You are gathering data on a 60 unit apartment building, using the attached form and the owner's annual income and expense statement below, compute the property's effective gross income (EGT); net operating income (NOI): operating expense ratio (OER); building capitalization rate: land capitalization rate: market value and assessed value. Apartment rents are expected to increase by 5 percent. Natural gas rates are expected to increase by 15 percent and electricity by 10 percent. Vacancy and Collection rate derived from the market is 5 percent. Use 6 percent of EGI for management expense and 1 percent of EGI for reserves for replacement. The building is valued at $1,900,000 and it has a remaining economic life of 40 years. The level of assessment is 45%, the tax rate is 10%, and the discount rate derived from the market is 5 percent. *Round all figures to the nearest $100. OWNER'S INCOME AND EXPENSE STATEMENT INCOME 12 studio apartments 1 bedroom apartments 12 $575 each per month $650 each per month $725 each per month S8oo each per month 24 2 bedroom apartments 12 3 bedroom apartments Laundry $7,166 EXPENSES Salaries & Benefits $ 26,264 Management $ 25,992 Natural Gas $ 40,620 Electricity $ 8.682 Water $ 30,696 Painting & Decorating S 8,928 $ 5.469 Supplies Repairs & Maintenance $ 40,153 Insurance $ 21,718 Real Estate Taxes $ 57,904 $124,623 Mortgage Interest Depreciation $ 67,744 OPERATING STATEMENT Potential Gross Income Allowance for Vacancy and Collection Loses Miscellaneous Income Effective Gross Income Operating Expenses Reserves for Replacement Total Operating Expense Net Operating Income Operating Expense Ratio (OER) Building Capitalization Rate Land Capitalization Rate Market Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts