Question: Please Answer all the Questions & round any numbers upto 4 digit after decimal. Thank you! Estimate a stock's beta based on the following return

Please Answer all the Questions & round any numbers upto 4 digit after decimal. Thank you!

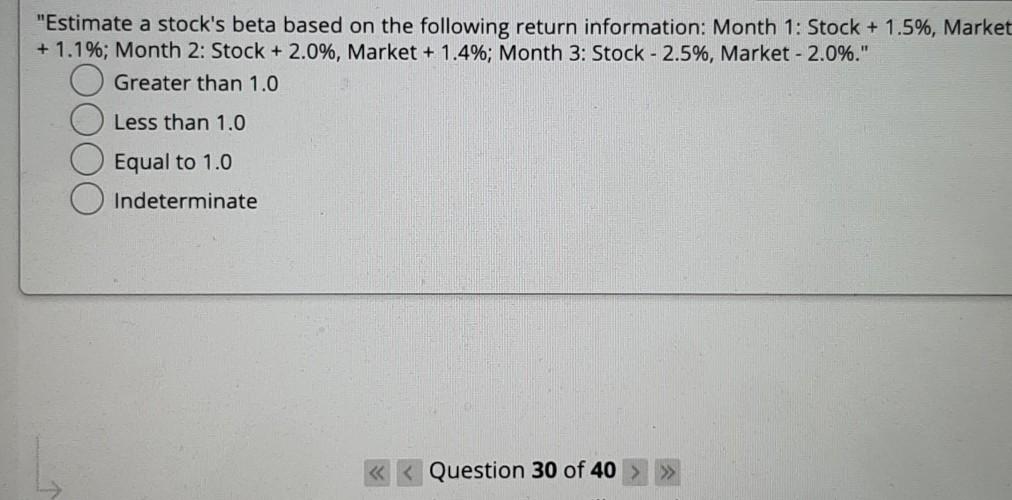

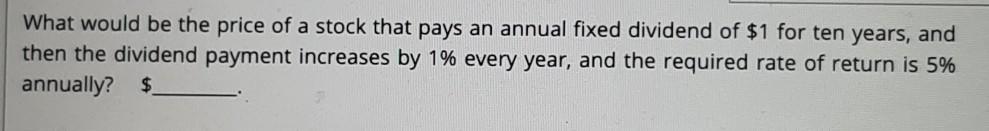

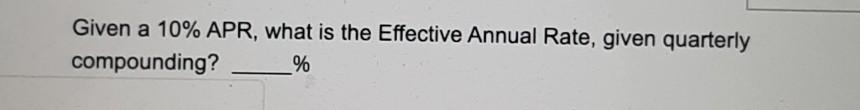

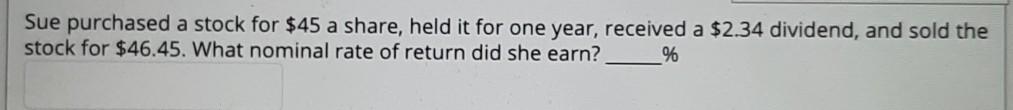

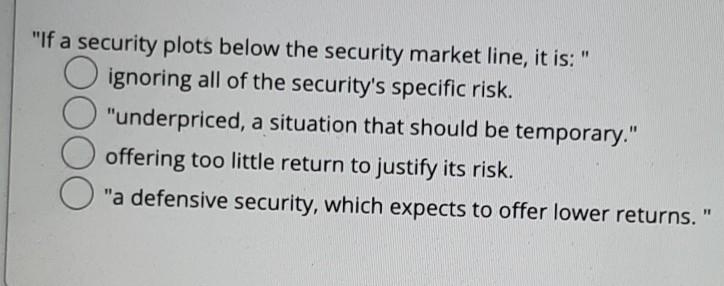

"Estimate a stock's beta based on the following return information: Month 1: Stock + 1.5%, Market + 1.1%; Month 2: Stock + 2.0%, Market + 1.4%; Month 3: Stock - 2.5%, Market - 2.0%." Greater than 1.0 Less than 1.0 Equal to 1.0 Indeterminate Question 30 of 40 What would be the price of a stock that pays an annual fixed dividend of $1 for ten years, and then the dividend payment increases by 1% every year, and the required rate of return is 5% annually? $. Given a 10% APR, what is the Effective Annual Rate, given quarterly compounding? % Sue purchased a stock for $45 a share, held it for one year, received a $2.34 dividend, and sold the stock for $46.45. What nominal rate of return did she earn? % "If a security plots below the security market line, it is: " O ignoring all of the security's specific risk. "underpriced, a situation that should be temporary." offering too little return to justify its risk. "a defensive security, which expects to offer lower returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts