Question: Please answer all the questions step by step, with explaining all the symbols, and how to approach this type of question rather than answers only.

Please answer all the questions step by step, with explaining all the symbols, and how to approach this type of question rather than answers only. Thanks!

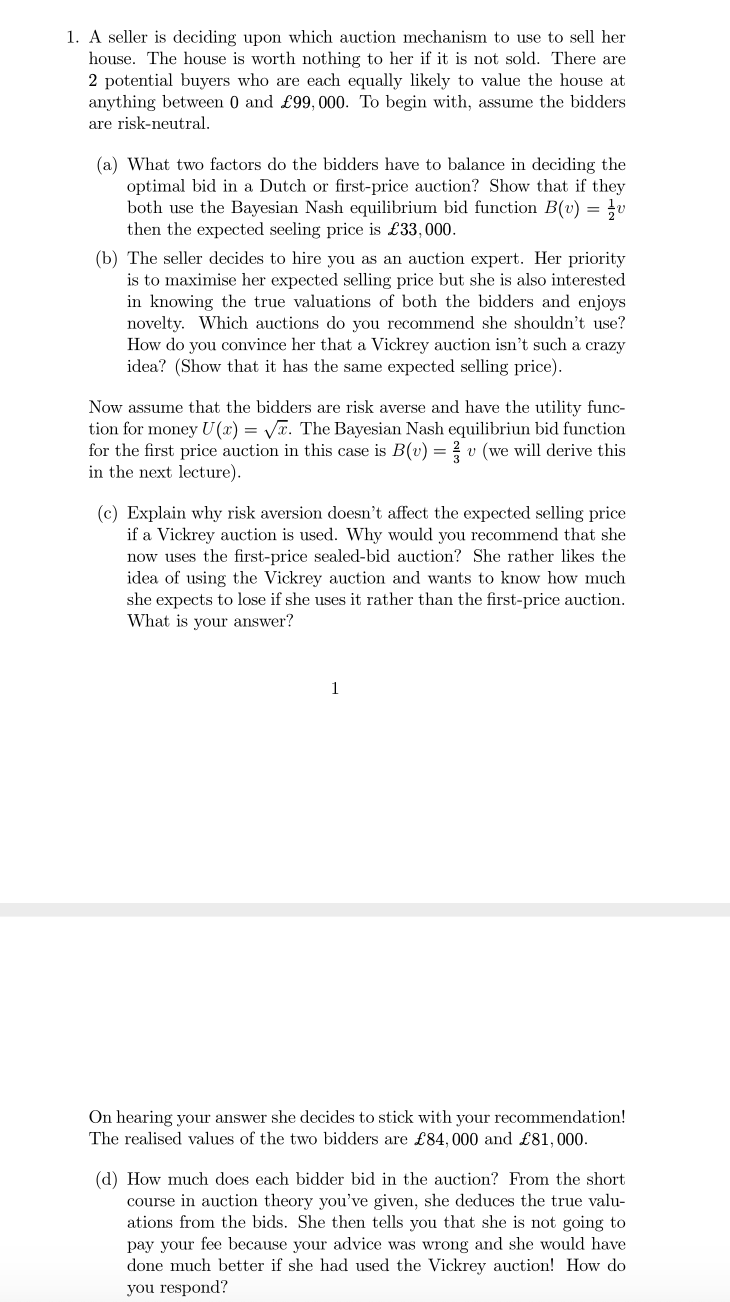

1. A seller is deciding upon which auction mechanism to use to sell her house. The house is worth nothing to her if it is not sold. There are 2 potential buyers who are each equally likely to value the house at anything between 0 and 99,000. To begin with, assume the bidders are risk-neutral. (a) What two factors do the bidders have to balance in deciding the optimal bid in a Dutch or first-price auction? Show that if they both use the Bayesian Nash equilibrium bid function B(v)=21v then the expected seeling price is 33,000. (b) The seller decides to hire you as an auction expert. Her priority is to maximise her expected selling price but she is also interested in knowing the true valuations of both the bidders and enjoys novelty. Which auctions do you recommend she shouldn't use? How do you convince her that a Vickrey auction isn't such a crazy idea? (Show that it has the same expected selling price). Now assume that the bidders are risk averse and have the utility function for money U(x)=x. The Bayesian Nash equilibriun bid function for the first price auction in this case is B(v)=32v (we will derive this in the next lecture). (c) Explain why risk aversion doesn't affect the expected selling price if a Vickrey auction is used. Why would you recommend that she now uses the first-price sealed-bid auction? She rather likes the idea of using the Vickrey auction and wants to know how much she expects to lose if she uses it rather than the first-price auction. What is your answer? On hearing your answer she decides to stick with your recommendation! The realised values of the two bidders are 84,000 and 81,000. (d) How much does each bidder bid in the auction? From the short course in auction theory you've given, she deduces the true valuations from the bids. She then tells you that she is not going to pay your fee because your advice was wrong and she would have done much better if she had used the Vickrey auction! How do you respond? 1. A seller is deciding upon which auction mechanism to use to sell her house. The house is worth nothing to her if it is not sold. There are 2 potential buyers who are each equally likely to value the house at anything between 0 and 99,000. To begin with, assume the bidders are risk-neutral. (a) What two factors do the bidders have to balance in deciding the optimal bid in a Dutch or first-price auction? Show that if they both use the Bayesian Nash equilibrium bid function B(v)=21v then the expected seeling price is 33,000. (b) The seller decides to hire you as an auction expert. Her priority is to maximise her expected selling price but she is also interested in knowing the true valuations of both the bidders and enjoys novelty. Which auctions do you recommend she shouldn't use? How do you convince her that a Vickrey auction isn't such a crazy idea? (Show that it has the same expected selling price). Now assume that the bidders are risk averse and have the utility function for money U(x)=x. The Bayesian Nash equilibriun bid function for the first price auction in this case is B(v)=32v (we will derive this in the next lecture). (c) Explain why risk aversion doesn't affect the expected selling price if a Vickrey auction is used. Why would you recommend that she now uses the first-price sealed-bid auction? She rather likes the idea of using the Vickrey auction and wants to know how much she expects to lose if she uses it rather than the first-price auction. What is your answer? On hearing your answer she decides to stick with your recommendation! The realised values of the two bidders are 84,000 and 81,000. (d) How much does each bidder bid in the auction? From the short course in auction theory you've given, she deduces the true valuations from the bids. She then tells you that she is not going to pay your fee because your advice was wrong and she would have done much better if she had used the Vickrey auction! How do you respond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts