Question: please answer all the questions. thank you Ryan is single and 50 year old. He contributed $30,000 to Roth IRA 6 years ago. The balance

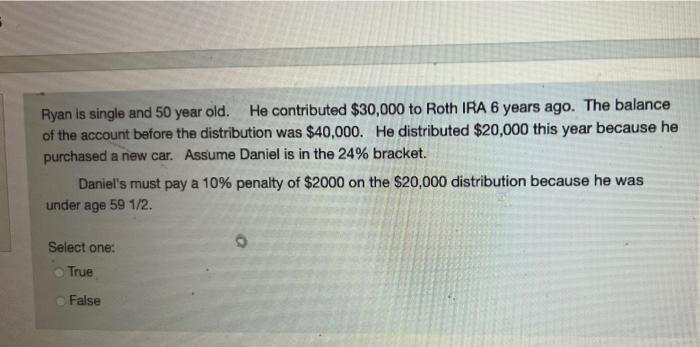

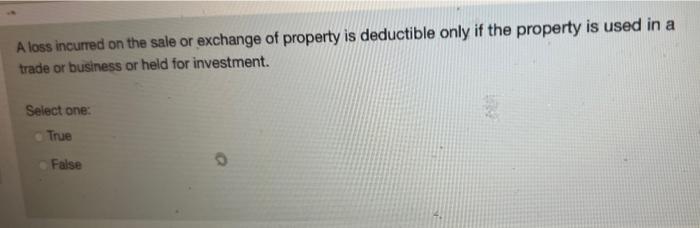

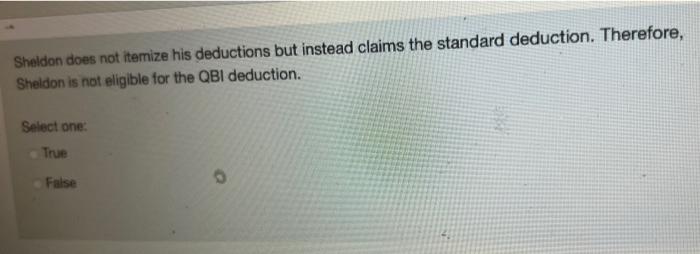

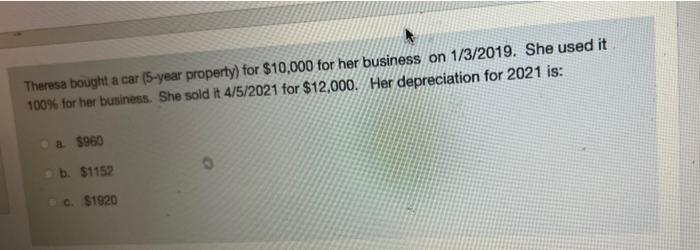

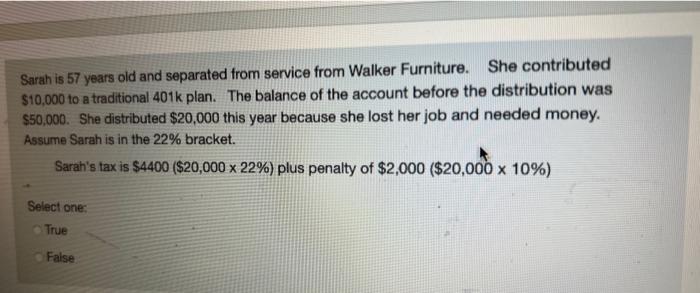

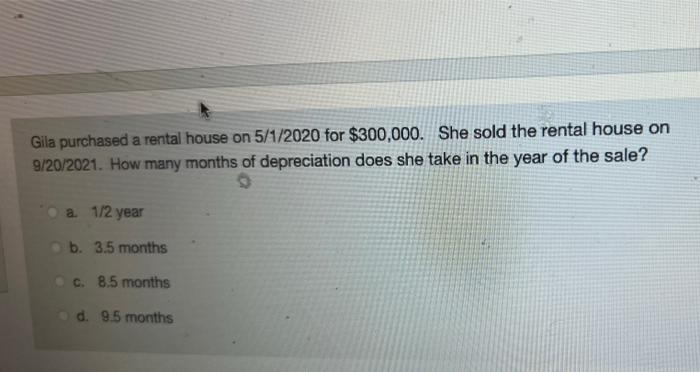

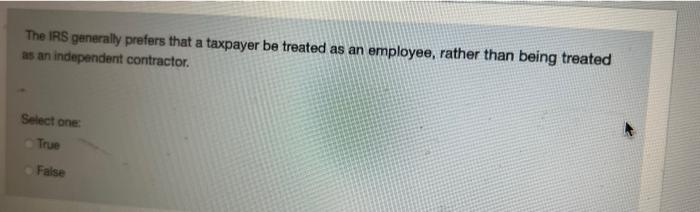

Ryan is single and 50 year old. He contributed $30,000 to Roth IRA 6 years ago. The balance of the account before the distribution was $40,000. He distributed $20,000 this year because he purchased a new car. Assume Daniel is in the 24% bracket. Daniel's must pay a 10% penalty of $2000 on the $20,000 distribution because he was under age 59 1/2. Select one: True False A loss incurred on the sale or exchange of property is deductible only if the property is used in a trade or business or held for investment. Select one: True False Sheldon does not itemize his deductions but instead claims the standard deduction. Therefore, Sheldon is not eligible for the QBI deduction. Select one: True False Theresa bought a car (5-year property) for $10,000 for her business on 1/3/2019. She used it 100% for her business. She sold it 4/5/2021 for $12,000. Her depreciation for 2021 is: a $960 b. $1152 c. $1920 Sarah is 57 years old and separated from service from Walker Furniture. She contributed $10,000 to a traditional 401k plan. The balance of the account before the distribution was $50,000. She distributed $20,000 this year because she lost her job and needed money Assume Sarah is in the 22% bracket. Sarah's tax is $4400 ($20,000 x 22%) plus penalty of $2,000 ($20,000 10%) Select one: True False Gila purchased a rental house on 5/1/2020 for $300,000. She sold the rental house on 9/20/2021. How many months of depreciation does she take in the year of the sale? a 1/2 year b. 3.5 months c. 8.5 months d. 9.5 months The IRS generally prefers that a taxpayer be treated as an employee, rather than being treated as an independent contractor. Select one True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts