Question: Please answer all the questions using formulate and showing all your workings, no excel as I wouldnt understand what you did thank you 2 (opt...

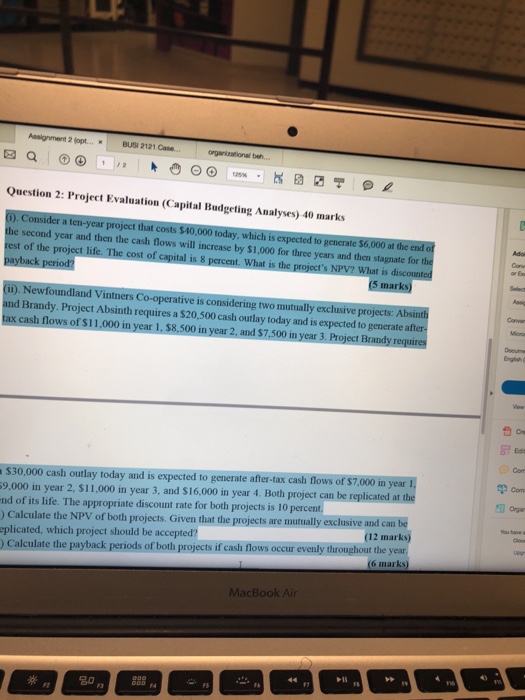

2 (opt... BUSI 2121 Case Question 2: Project Evaluation (Capital Budgeting Analyses) 40 marks 0). Consider a ten-year project that costs $40,000 today, which is expected to generate $6,000 at the end of the second year and then the cash flows will increase by $1,000 for three years and then stagnate for the of the project life. The cost of capital is8 What is di Newfoundland Vintners Co-operative is considering two mutually exclusive projects: Absinth and Brandy. Project Absinth requires a $20,500 cash outlay today and is expected to generate aft Deume Com $30,000 cash outlay today and is expected to generate after-tax cash flows of $7,000 in 9,.000 in year 2, $11,000 in year 3, and $16,000 in year 4. Both project can be repl nd of its life. The appropriate discount rate for both projects is 10 percent )Calcul eplicated, which project should be accepted Calculate the payback periods of both projects if cash flows occur evenly throughout the y late the NPV of both projects. Given that the projects ar e mutually exclusive and can be (12 marks) MacBook Air 10 80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts