Question: PLEASE ANSWER ALL THE REQUIREMENTS WITH EXPLANATION FOR THUMBS UP! THANK YOU! 1. A company is planning the financing of a major expansion. It will

PLEASE ANSWER ALL THE REQUIREMENTS WITH EXPLANATION FOR THUMBS UP! THANK YOU!

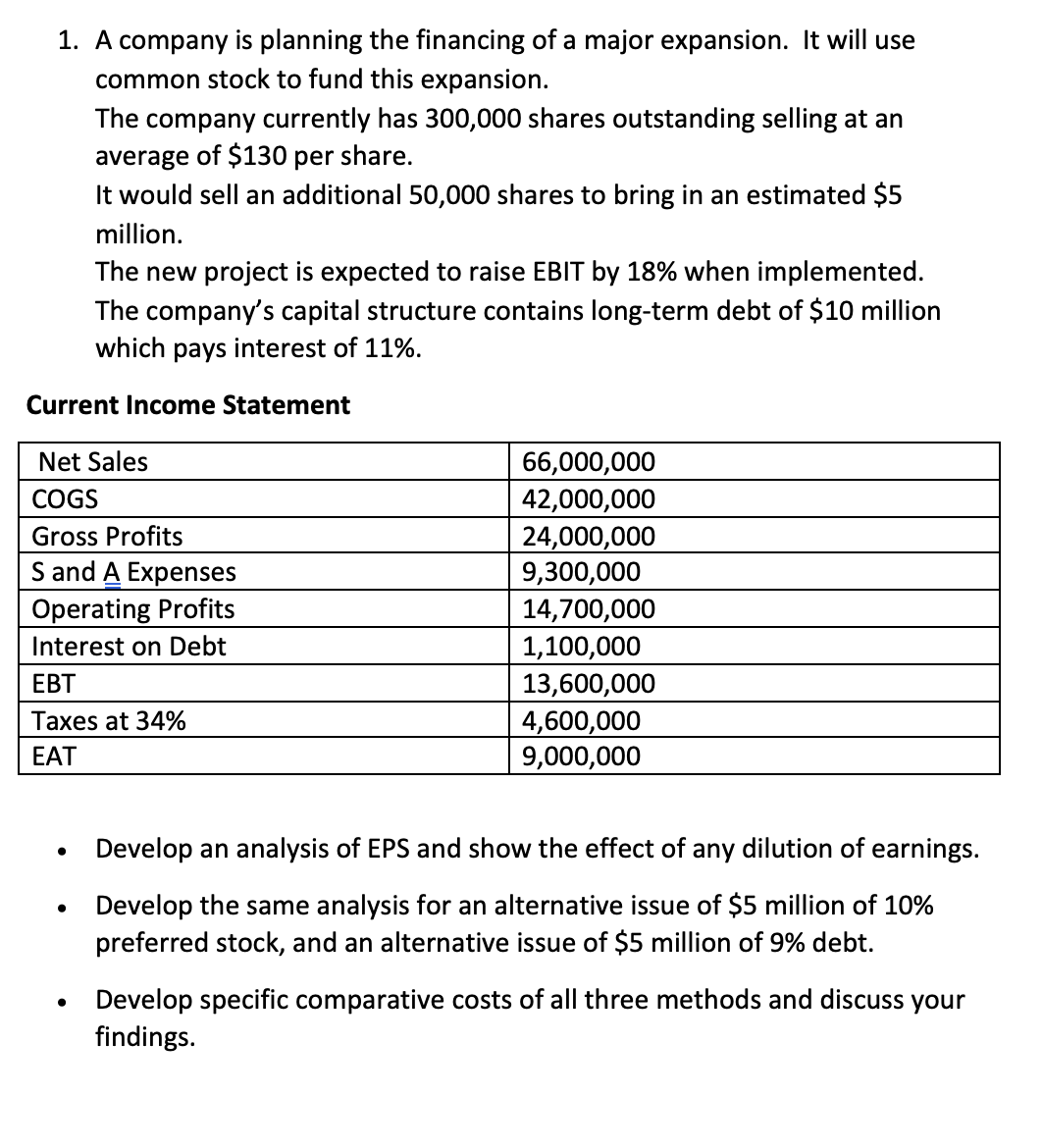

1. A company is planning the financing of a major expansion. It will use common stock to fund this expansion. The company currently has 300,000 shares outstanding selling at an average of $130 per share. It would sell an additional 50,000 shares to bring in an estimated $5 million. The new project is expected to raise EBIT by 18% when implemented. The company's capital structure contains long-term debt of $10 million which pays interest of 11%. Current Income Statement - Develop an analysis of EPS and show the effect of any dilution of earnings. - Develop the same analysis for an alternative issue of $5 million of 10% preferred stock, and an alternative issue of $5 million of 9% debt. - Develop specific comparative costs of all three methods and discuss your findings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts