Question: please answer all these questions, i dont have many left. Question 16 (1 point) Duo Company has beginning inventory balances of $100,000 for raw materials

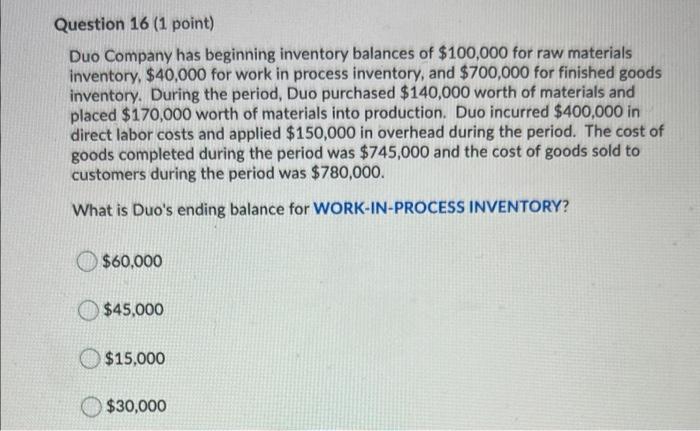

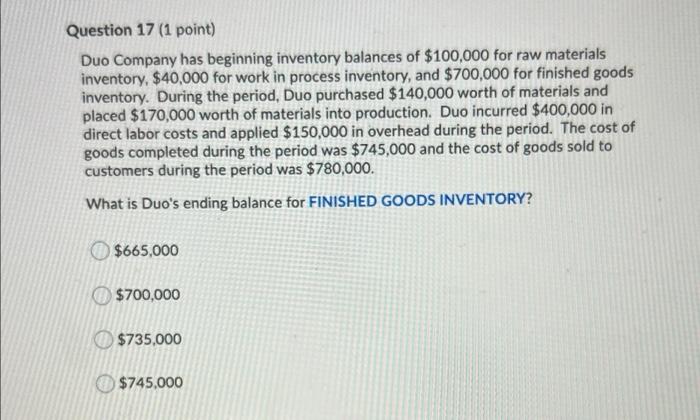

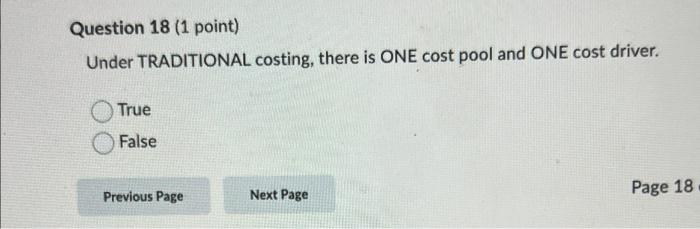

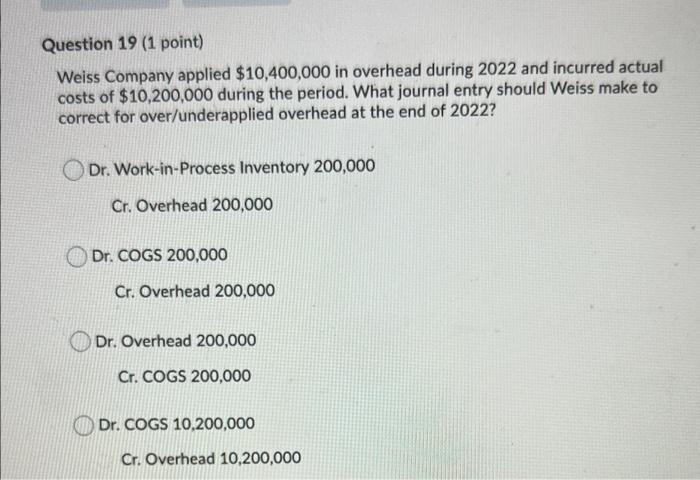

Question 16 (1 point) Duo Company has beginning inventory balances of $100,000 for raw materials inventory $40,000 for work in process inventory, and $700,000 for finished goods inventory. During the period, Duo purchased $140,000 worth of materials and placed $170,000 worth of materials into production. Duo incurred $400,000 in direct labor costs and applied $150,000 in overhead during the period. The cost of goods completed during the period was $745,000 and the cost of goods sold to customers during the period was $780,000. What is Duo's ending balance for WORK-IN-PROCESS INVENTORY? $60,000 $45,000 $15,000 $30,000 Question 17 (1 point) Duo Company has beginning inventory balances of $100,000 for raw materials inventory, $40,000 for work in process inventory, and $700,000 for finished goods inventory. During the period, Duo purchased $140,000 worth of materials and placed $170,000 worth of materials into production. Duo incurred $400,000 in direct labor costs and applied $150,000 in overhead during the period. The cost of goods completed during the period was $745,000 and the cost of goods sold to customers during the period was $780,000. What is Duo's ending balance for FINISHED GOODS INVENTORY? $665,000 $700,000 $735,000 $745,000 Question 18 (1 point) Under TRADITIONAL costing, there is ONE cost pool and ONE cost driver. True False Previous Page Next Page Page 18 Question 19 (1 point) Weiss Company applied $10,400,000 in overhead during 2022 and incurred actual costs of $10,200,000 during the period. What journal entry should Weiss make to correct for over/underapplied overhead at the end of 2022? Dr. Work-in-Process Inventory 200,000 Cr. Overhead 200,000 Dr. COGS 200,000 Cr. Overhead 200,000 Dr. Overhead 200,000 Cr. COGS 200,000 Dr. COGS 10,200,000 Cr. Overhead 10,200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts