Question: Please answer all, they are the same question GL901 - Based on Problem 9-1A LO C2, P1 The January 1, Year 1 trial balance for

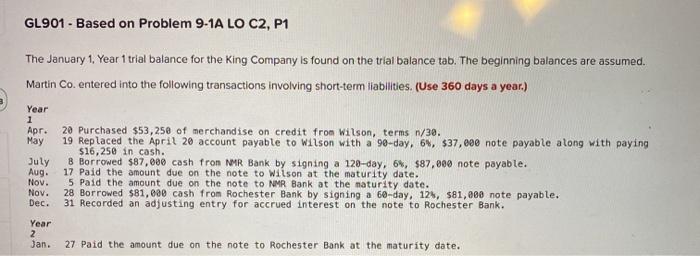

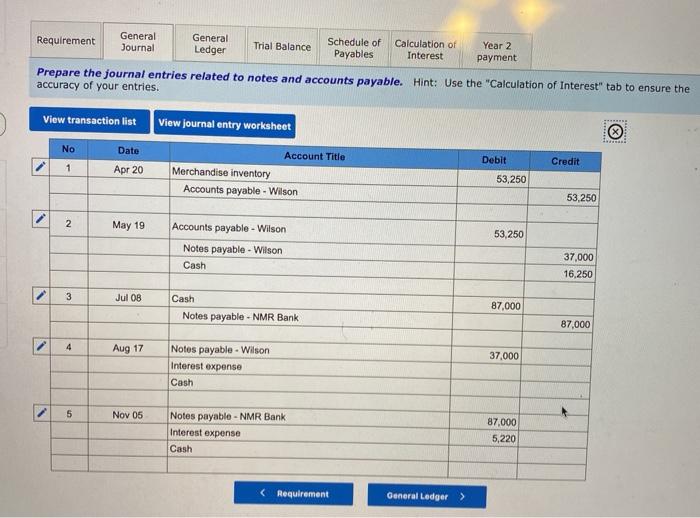

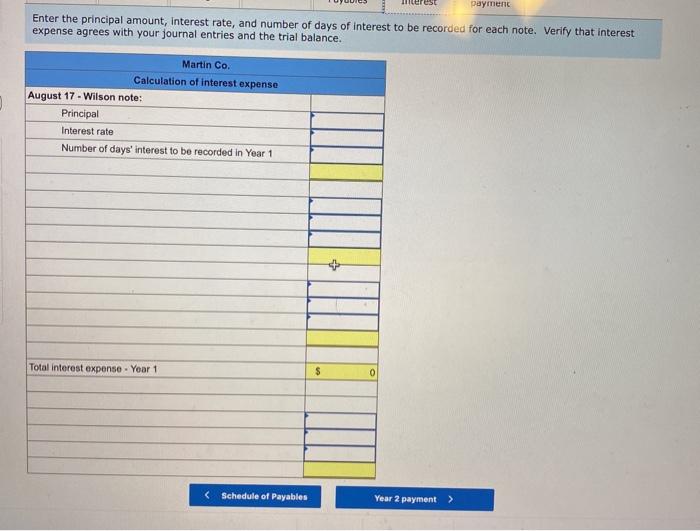

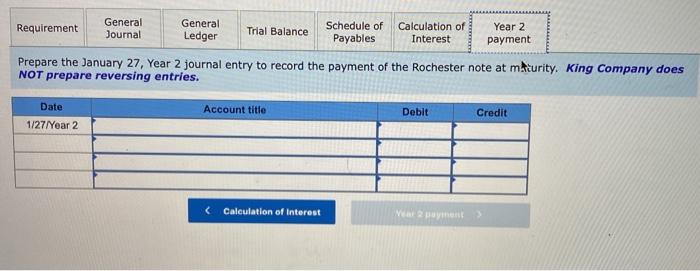

GL901 - Based on Problem 9-1A LO C2, P1 The January 1, Year 1 trial balance for the King Company is found on the trial balance tab. The beginning balances are assumed. Martin Co. entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year 1 Apr. May July Aug. Nov. Nov. 20 Purchased $53,258 of merchandise on credit from Wilson, terms n/30. 19 Replaced the April 20 account payable to Wilson with a 90-day, 69, $37,000 note payable along with paying $16,250 in cash. 8 Borrowed $87,000 cash from NMR Bank by signing a 120-day, 6%, $87,000 note payable. 17 Paid the amount due on the note to Wilson at the maturity date. 5 Paid the amount due on the note to NMR Bank at the maturity date. 28 Borrowed $81,000 cash from Rochester Bank by signing a 60-day, 125, $81,980 note payable. 31 Recorded an adjusting entry for accrued interest on the note to Rochester Bank. Dec. Year 2 Jan. 27 Paid the amount due on the note to Rochester Bank at the maturity date. Requirement General Journal General Ledger Trial Balance Schedule of Payables Calculation of Interest Year 2 payment Prepare the journal entries related to notes and accounts payable. Hint: Use the "Calculation of Interest" tab to ensure the accuracy of your entries. View transaction list View journal entry worksheet No Date Credit 1 Apr 20 Account Title Merchandise inventory Accounts payable - Wilson Debit 53,250 53,250 N May 19 53,250 Accounts payable - Wilson Notes payable - Wilson Cash 37,000 16,250 3 Jul 08 Cash Notes payable - NMR Bank 87,000 87,000 4 Aug 17 37.000 Notes payable. Wilson Interest expense Cash 5 Nov 05 Notes payable - NMR Bank Interest expense Cash 87.000 5,220 merest payment Enter the principal amount, interest rate, and number of days of interest to be recorded for each note. Verify that interest expense agrees with your journal entries and the trial balance. Martin Co. Calculation of interest expense August 17. Wilson note: Principal Interest rate Number of days' interest to be recorded in Year 1 Total interest expense - Yoar 1 $ 0 Requirement General Journal General Ledger Trial Balance Schedule of Payables Calculation of Interest Year 2 payment Prepare the January 27, Year 2 journal entry to record the payment of the Rochester note at mdcurity. King Company does NOT prepare reversing entries. Account title Date 1/27/Year 2 Debit Credit Calculation of interest Na payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts