Question: please answer all, they're all one question ill give a thumbs up :) Mini-Cusc: points Read carefully the below text and reverse following questions: The

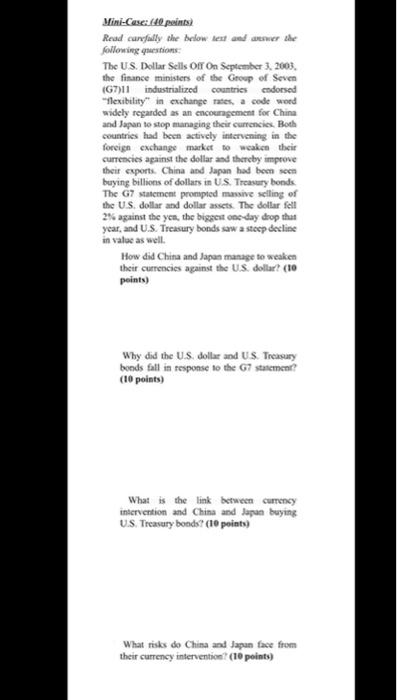

Mini-Cusc: points Read carefully the below text and reverse following questions: The US. Dollar Sells Off on September 3, 2003, the finance ministers of the Group of Seven (G7)11 industrialized countries endorsed "flexibility in exchange rates, a code word widely regarded as an encouragement for China and Japan to stop managing their currencie Both countries had been actively intervening in the foreign exchange market to weaken their currencies against the dollar and thereby improve their exports. China and Japan had been seen buying billions of dollars in US Treasury bonds The G7 statement prompted massive selling of the US dollar and dollar assets. The dollar fell 2% against the yen, the biggest one day drop that year, and U.S. Treasury bonds saw a steep decline in value as well. How did China and Japan manage to weaken their currencies against the US dollar! (to points) Why did the US dollar and US Treasury bends fall in response to the G7 statement? (10 points) What is the link between currency intervention and China and Japan buying U.S. Treasury bonds? (10 points) What risks do China and Japan face from their currency intervention? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts