Question: PLEASE ANSWER ALL THIS ASAP!! REALLY NEED HELP PLEASE! THANK YOU:) Question 1 (a) Kenanga Corporation has a $1,000 par value, twenty-year, 6% annual coupon

PLEASE ANSWER ALL THIS ASAP!! REALLY NEED HELP PLEASE! THANK YOU:)

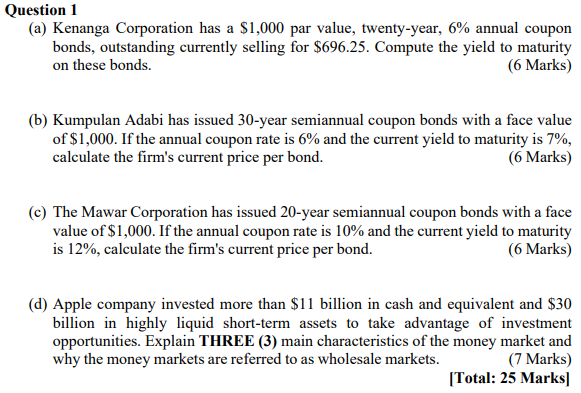

Question 1 (a) Kenanga Corporation has a $1,000 par value, twenty-year, 6% annual coupon bonds, outstanding currently selling for $696.25. Compute the yield to maturity on these bonds. (6 Marks) (b) Kumpulan Adabi has issued 30-year semiannual coupon bonds with a face value of $1,000. If the annual coupon rate is 6% and the current yield to maturity is 7%, calculate the firm's current price per bond. (6 Marks) (c) The Mawar Corporation has issued 20-year semiannual coupon bonds with a face value of $1,000. If the annual coupon rate is 10% and the current yield to maturity is 12%, calculate the firm's current price per bond. (6 Marks) (d) Apple company invested more than $11 billion in cash and equivalent and $30 billion in highly liquid short-term assets to take advantage of investment opportunities. Explain THREE (3) main characteristics of the money market and why the money markets are referred to as wholesale markets. (7 Marks) [Total: 25 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts