Question: Please answer all three 9, Scranton Shipyards has $11.0 million in total invested operating capital, and its WACC is 10%. Scranton has the following income

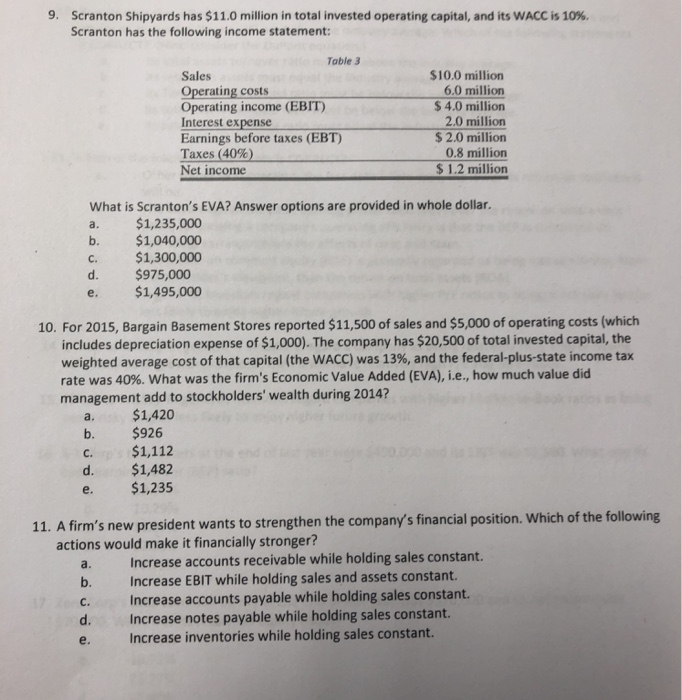

9, Scranton Shipyards has $11.0 million in total invested operating capital, and its WACC is 10%. Scranton has the following income statement: Table 3 Sales Operating costs Operating income (EBIT) Interest expense Earnings before taxes (EBT) Taxes (40%) Net income $10.0 million 6.0 million $4.0 million 2.0 million $ 2.0 million 0.8 million $ 1.2 million What is Scranton's EVA? Answer options are provided in whole dollar. a. $1,235,000 b. $1,040,000 C. $1,300,000 d. $975,000 e. $1,495,000 10. For 2015, Bargain Basement Stores reported $11,500 of sales and $5,000 of operating costs (which includes depreciation expense of $1,000). The company has $20,500 of total invested capital, the weighted average cost of that capital (the WACC) was 13%, and the federal-plus-state income tax rate was 40%, what was the firm's Economic Value Added (EVA), i.e., how much value did management add to stockholders' wealth during 2014? a. $1,420 b. $926 c. $1,112 d. $1,482 e. $1,235 11. A firm's new president wants to strengthen the company's financial position. Which of the following actions would make it financially stronger? Increase accounts receivable while holding sales constant. a. b. Increase EBIT while holding sales and assets constant. c. Increase accounts payable while holding sales constant. d. Increase notes payable while holding sales constant. e. Increase inventories while holding sales constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts