Question: please answer all three if possible! DU LOIG VO Question 6 1 pts You purchase a bond with an invoice price of $939. The bond

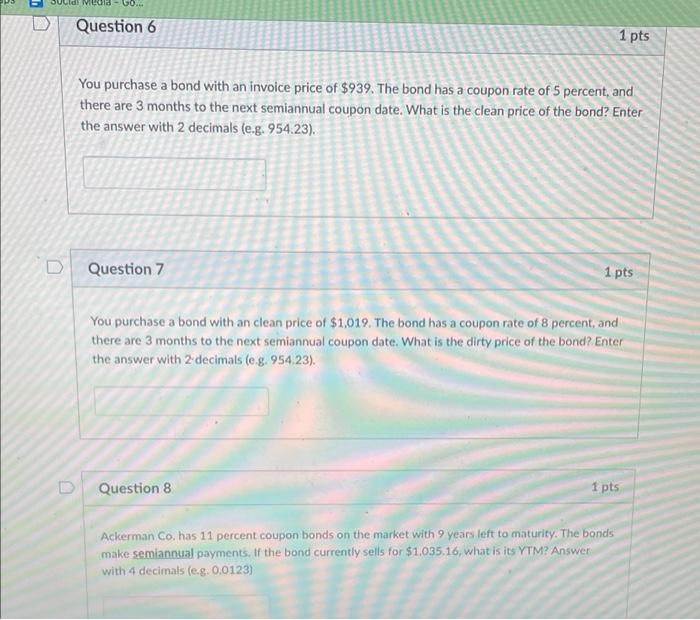

DU LOIG VO Question 6 1 pts You purchase a bond with an invoice price of $939. The bond has a coupon rate of 5 percent, and there are 3 months to the next semiannual coupon date. What is the clean price of the bond? Enter the answer with 2 decimals (e.g. 954.23). D Question 7 1 pts You purchase a bond with an clean price of $1,019. The bond has a coupon rate of 8 percent, and there are 3 months to the next semiannual coupon date. What is the dirty price of the bond? Enter the answer with 2 decimals le g. 954.23). Question 8 1 pts Ackerman Co. has 11 percent coupon bonds on the market with 9 years left to maturity. The bonds make semiannual payments. If the bond currently sells for $1,035,16, what is its YTM? Answer with 4 decimals (e.g. 0,0123)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts