Question: Please answer all three part. Wade paid $7000 for a car that needed substantial repairs. He spend $2400 on parts for it and worked on

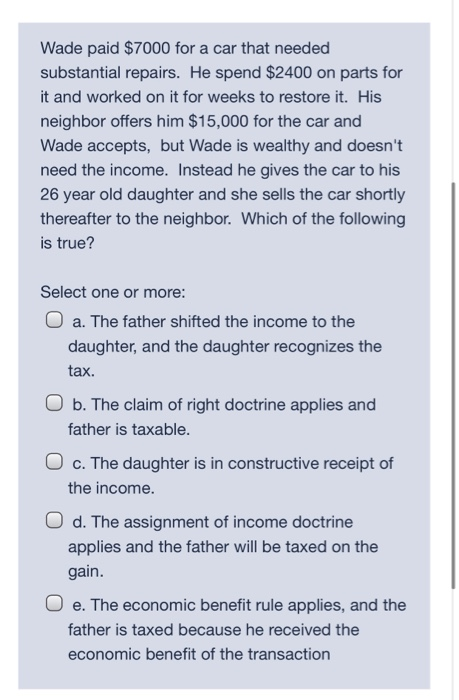

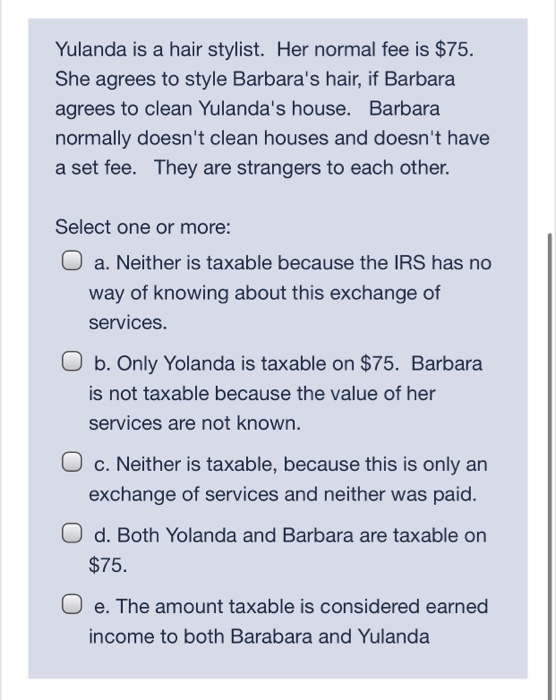

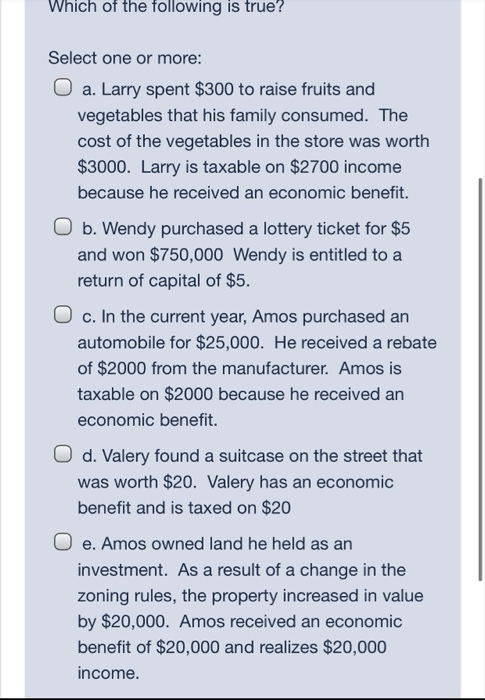

Wade paid $7000 for a car that needed substantial repairs. He spend $2400 on parts for it and worked on it for weeks to restore it. His neighbor offers him $15,000 for the car and Wade accepts, but Wade is wealthy and doesn't need the income. Instead he gives the car to his 26 year old daughter and she sells the car shortly thereafter to the neighbor. Which of the following is true? Select one or more: O a. The father shifted the income to the daughter, and the daughter recognizes the tax. O b. The claim of right doctrine applies and father is taxable. O c. The daughter is in constructive receipt of the income. d. The assignment of income doctrine applies and the father will be taxed on the gain. O e. The economic benefit rule applies, and the father is taxed because he received the economic benefit of the transaction Yulanda is a hair stylist. Her normal fee is $75. She agrees to style Barbara's hair, if Barbara agrees to clean Yulanda's house. Barbara normally doesn't clean houses and doesn't have a set fee. They are strangers to each other. Select one or more: a. Neither is taxable because the IRS has no way of knowing about this exchange of services. b. Only Yolanda is taxable on $75. Barbara is not taxable because the value of her services are not known. O c. Neither is taxable, because this is only an exchange of services and neither was paid. d. Both Yolanda and Barbara are taxable on $75. e. The amount taxable is considered earned income to both Barabara and Yulanda Which of the following is true? Select one or more: O a. Larry spent $300 to raise fruits and vegetables that his family consumed. The cost of the vegetables in the store was worth $3000. Larry is taxable on $2700 income because he received an economic benefit. O b. Wendy purchased a lottery ticket for $5 and won $750,000 Wendy is entitled to a return of capital of $5. O c. In the current year, Amos purchased an automobile for $25,000. He received a rebate of $2000 from the manufacturer. Amos is taxable on $2000 because he received an economic benefit. O d. Valery found a suitcase on the street that was worth $20. Valery has an economic benefit and is taxed on $20 O e. Amos owned land he held as an investment. As a result of a change in the zoning rules, the property increased in value by $20,000. Amos received an economic benefit of $20,000 and realizes $20,000 income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts