Question: please answer all three question asap, will upvote thanks Defects of the Payback Period method when compared to NPV is that the Payback Period does

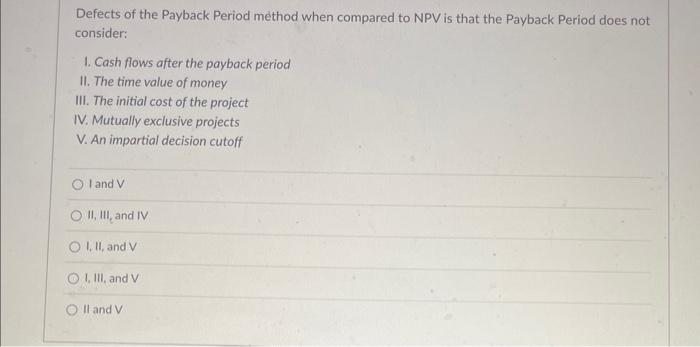

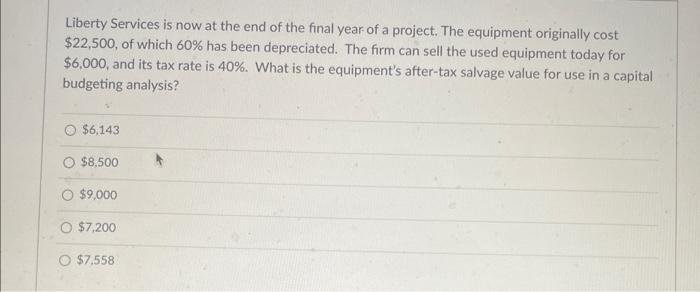

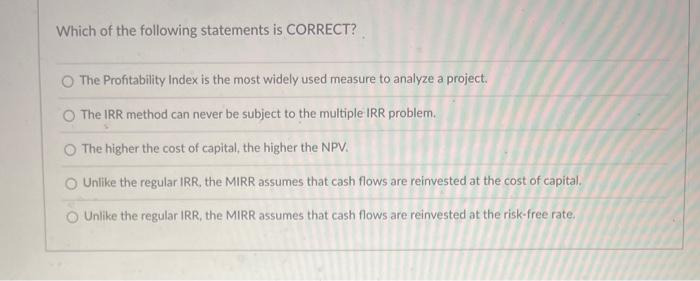

Defects of the Payback Period method when compared to NPV is that the Payback Period does not consider: 1. Cash flows after the payback period II. The time value of money III. The initial cost of the project IV. Mutually exclusive projects V. An impartial decision cutoff l and V II. III, and IV I. II, and V I. III, and V II and V Liberty Services is now at the end of the final year of a project. The equipment originally cost $22,500, of which 60% has been depreciated. The firm can sell the used equipment today for $6.000, and its tax rate is 40%. What is the equipment's after-tax salvage value for use in a capital budgeting analysis? $6,143 $8,500 $9,000 $7,200 $7,558 Which of the following statements is CORRECT? The Profitability Index is the most widely used measure to analyze a project. The IRR method can never be subject to the multiple IRR problem. The higher the cost of capital, the higher the NPV. Unlike the regular IRR, the MIRR assumes that cash flows are reinvested at the cost of capital. Unlike the regular IRR, the MIRR assumes that cash flows are reinvested at the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts