Question: please answer all three questions I really need for a class thank you!!!!!! 3. Use the information in the table below to calculate the utility

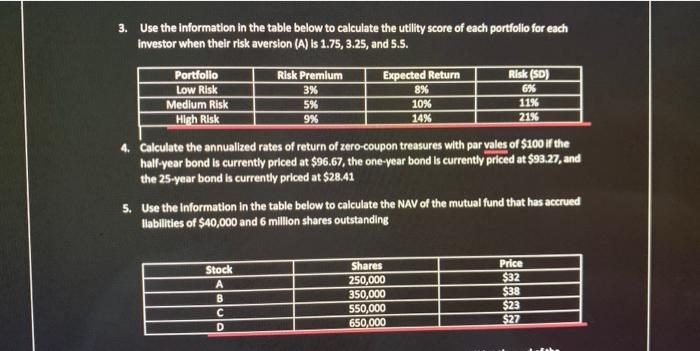

3. Use the information in the table below to calculate the utility score of each portfollo for each investor when their risk aversion (A) is 1.75,3.25, and 5.5. 4. Calculate the annualized rates of return of zero-coupon treasures with par vales of $100 if the half-year bond is currently priced at $96.67, the one-year bond is currently priced at $93.27, and the 25-year bond is currently priced at $28.41 5. Use the Information in the table below to calculate the NAV of the mutual fund that has accrued liabilities of $40,000 and 6 milion shares outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts