Question: Please Answer all three questions Practice Questions 1. A portfolio manager creates the following portfolio: a) What is the expected return of the portfolio? b)

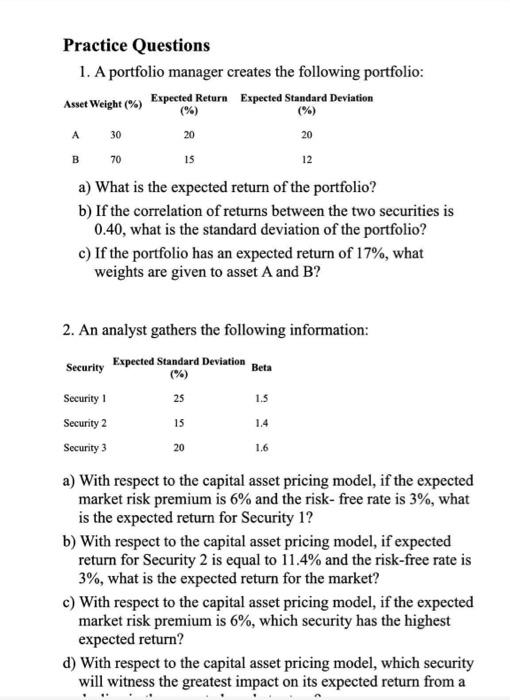

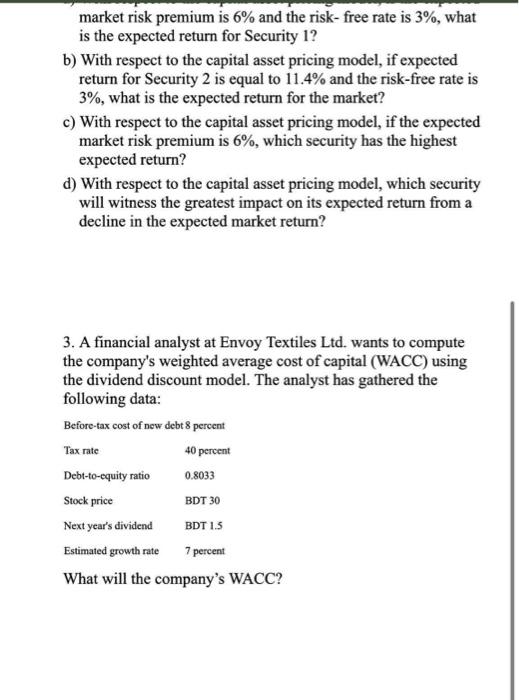

Practice Questions 1. A portfolio manager creates the following portfolio: a) What is the expected return of the portfolio? b) If the correlation of returns between the two securities is 0.40, what is the standard deviation of the portfolio? c) If the portfolio has an expected return of 17%, what weights are given to asset A and B ? 2. An analyst gathers the following information: a) With respect to the capital asset pricing model, if the expected market risk premium is 6% and the risk- free rate is 3%, what is the expected return for Security 1 ? b) With respect to the capital asset pricing model, if expected return for Security 2 is equal to 11.4% and the risk-free rate is 3%, what is the expected return for the market? c) With respect to the capital asset pricing model, if the expected market risk premium is 6%, which security has the highest expected return? d) With respect to the capital asset pricing model, which security will witness the greatest impact on its expected return from a market risk premium is 6% and the risk- free rate is 3%, what is the expected return for Security 1? b) With respect to the capital asset pricing model, if expected return for Security 2 is equal to 11.4% and the risk-free rate is 3%, what is the expected return for the market? c) With respect to the capital asset pricing model, if the expected market risk premium is 6%, which security has the highest expected return? d) With respect to the capital asset pricing model, which security will witness the greatest impact on its expected return from a decline in the expected market return? 3. A financial analyst at Envoy Textiles Ltd. wants to compute the company's weighted average cost of capital (WACC) using the dividend discount model. The analyst has gathered the following data: What will the company's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts