Question: Please answer all three questions. QUESTION 16 Tasty Ltd sells gift boxes of personalised cupcakes. Each gift box sells for 12. The variable costs per

Please answer all three questions.

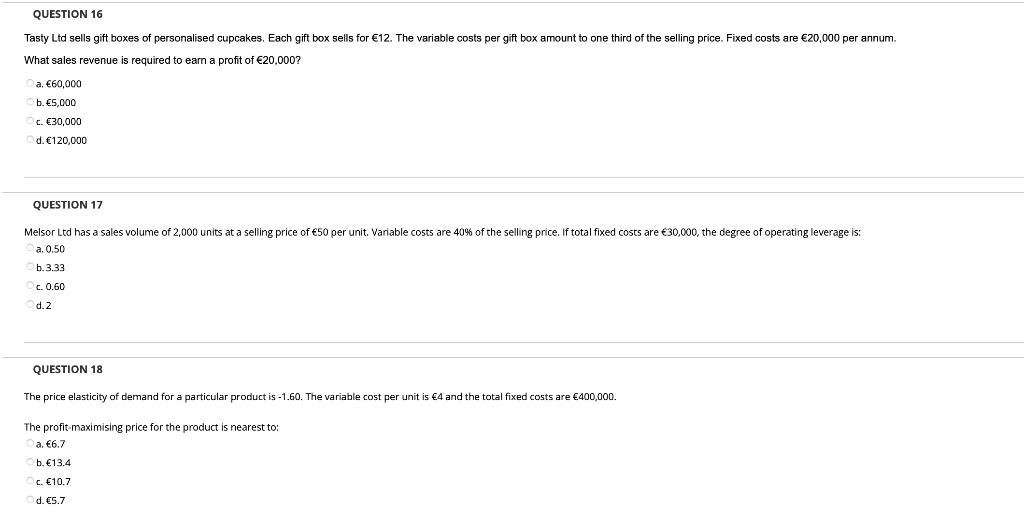

QUESTION 16 Tasty Ltd sells gift boxes of personalised cupcakes. Each gift box sells for 12. The variable costs per gift box amount to one third of the selling price. Fixed costs are 20,000 per annum. What sales revenue is required to earn a profit of 20,000? a. 60,000 b. 5,000 c. 630,000 d. 120.000 QUESTION 17 Melsor Ltd has a sales volume of 2,000 units at a selling price of 50 per unit. Variable costs are 40% of the selling price. If total fixed costs are 30,000, the degree of operating leverage is: a. 0.50 b.3.33 c.0.60 d. 2 QUESTION 18 The price elasticity of demand for a particular product is -1.60. The variable cost per unit is 4 and the total fixed costs are 400,000. nearest to: The profit-maximising price for the product a. 6.7 b. 13,4 c. 10.7 d. 5.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts