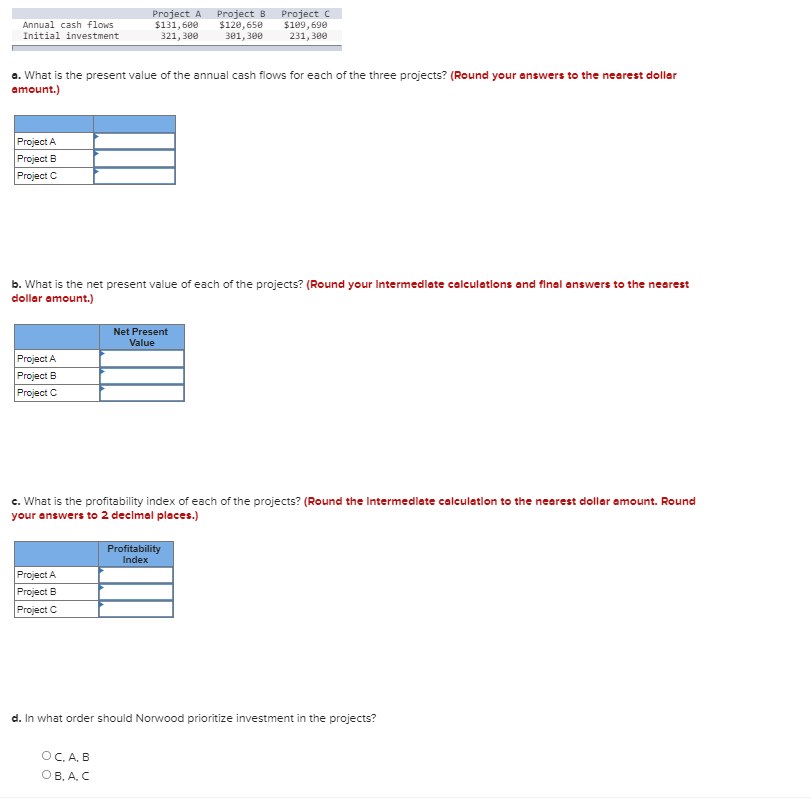

Question: Please answer all three! Thank you Annual cash flows Initial investment Project A $131,680 321,380 Project B $120,650 301,300 Project C $189,690 231,300 a. What

Please answer all three! Thank you

Please answer all three! Thank you

Annual cash flows Initial investment Project A $131,680 321,380 Project B $120,650 301,300 Project C $189,690 231,300 a. What is the present value of the annual cash flows for each of the three projects? (Round your answers to the nearest dollar amount.) Project A Project B Project b. What is the net present value of each of the projects? (Round your Intermediate calculations and final answers to the nearest dollar amount.) Net Present Value Project A Project B Project c. What is the profitability index of each of the projects? (Round the Intermedlate calculation to the nearest dollar amount. Round your answers to 2 decimal places.) Profitability Index Project A Project B Project d. In what order should Norwood prioritize investment in the projects? , , , . Annual cash flows Initial investment Project A $131,680 321,380 Project B $120,650 301,300 Project C $189,690 231,300 a. What is the present value of the annual cash flows for each of the three projects? (Round your answers to the nearest dollar amount.) Project A Project B Project b. What is the net present value of each of the projects? (Round your Intermediate calculations and final answers to the nearest dollar amount.) Net Present Value Project A Project B Project c. What is the profitability index of each of the projects? (Round the Intermedlate calculation to the nearest dollar amount. Round your answers to 2 decimal places.) Profitability Index Project A Project B Project d. In what order should Norwood prioritize investment in the projects? , , , .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts