Question: Please answer all three, thank you. please include the Letter answer 3.33 pts Question 19 At the beginning of the year, First Gear Corporation (a

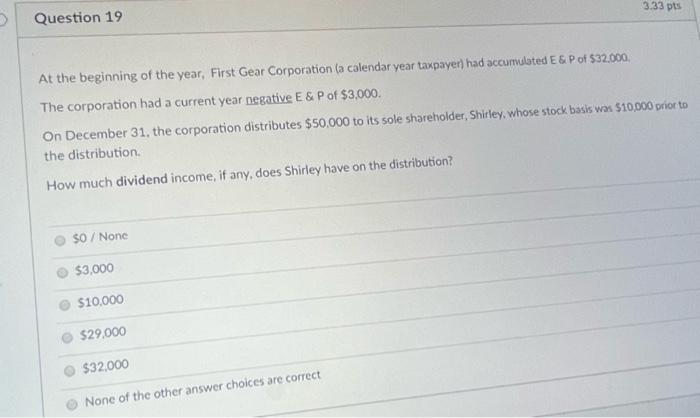

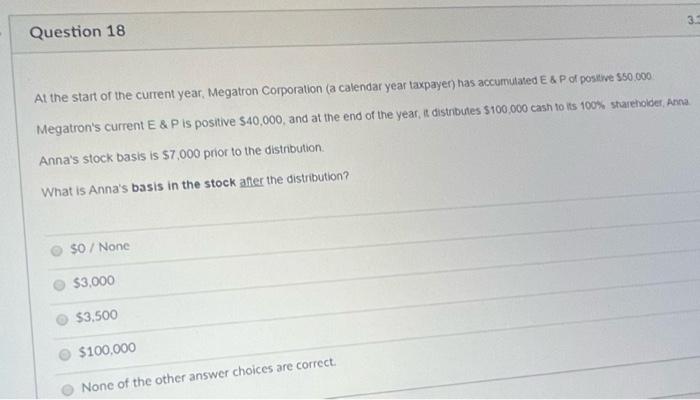

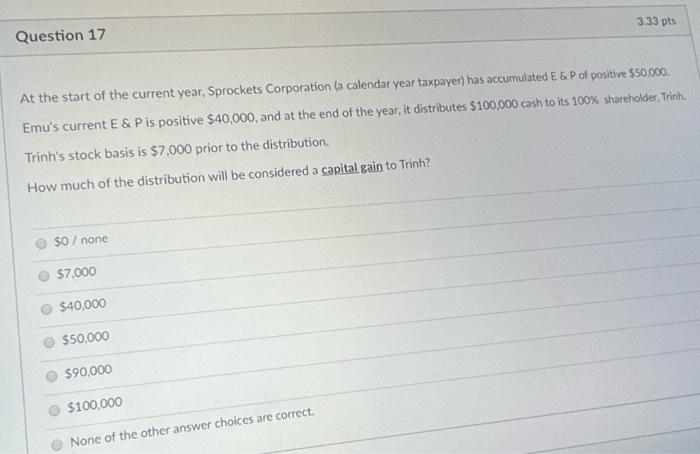

3.33 pts Question 19 At the beginning of the year, First Gear Corporation (a calendar year taxpayer) had accumulated E & P of $32,000 The corporation had a current year negative E & P of $3,000 On December 31, the corporation distributes $50,000 to its sole shareholder, Shirley, whose stock basis was $10,000 prior to the distribution How much dividend income, if any, does Shirley have on the distribution? SO / None $3,000 $10,000 $29,000 $32,000 None of the other answer choices are correct 3. Question 18 At the start of the current year, Megatron Corporation (a calendar year taxpayer) has accumulated E&P of positive 550.000 Megatron's current E&P is positive $40,000, and at the end of the year, it distributes 100.000 cash to its 100% shareholder, Anna Anna's stock basis is $7,000 prior to the distribution What is Anna's basis in the stock after the distribution? $0 / None $3,000 $3.500 $100,000 None of the other answer choices are correct 3.33 pts Question 17 At the start of the current year, Sprockets Corporation la calendar year taxpayer) has accumulated E & P of positive $50,000 Emu's current E & Pis positive $40,000, and at the end of the year, it distributes $100,000 cash to its 100% shareholder, Trinh Trinh's stock basis is $7,000 prior to the distribution. How much of the distribution will be considered a capital gain to Trinh? $0 / none $7.000 $40,000 $50,000 $90,000 $100,000 None of the other answer choices are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts