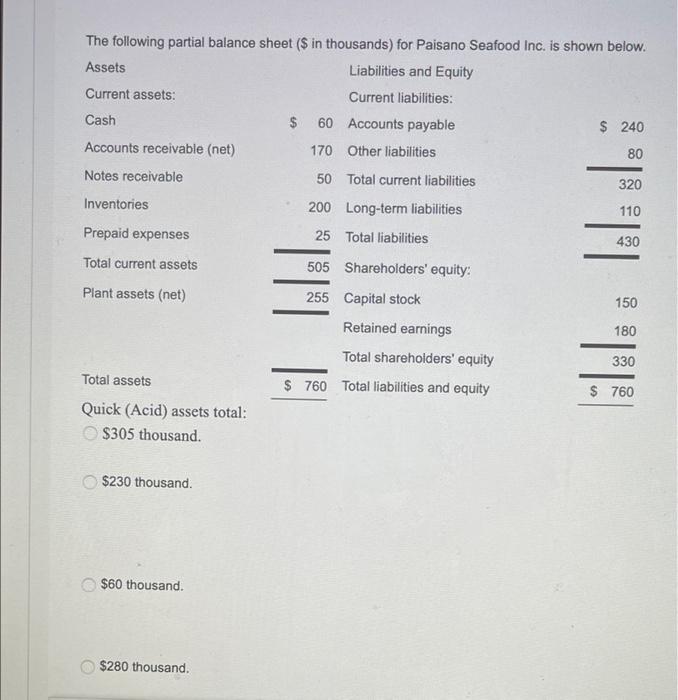

Question: please answer all three The following partial balance sheet ($ in thousands) for Paisano Seafood Inc. is shown below. Assets Liabilities and Equity Current assets:

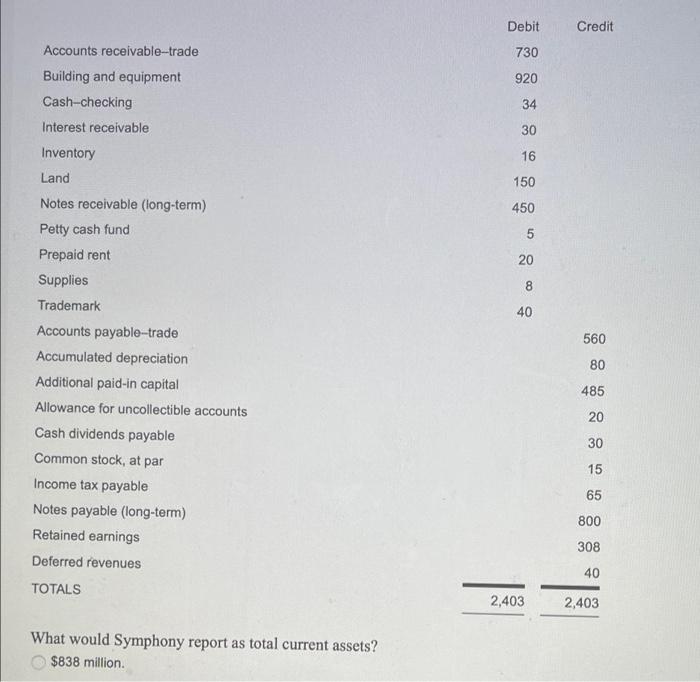

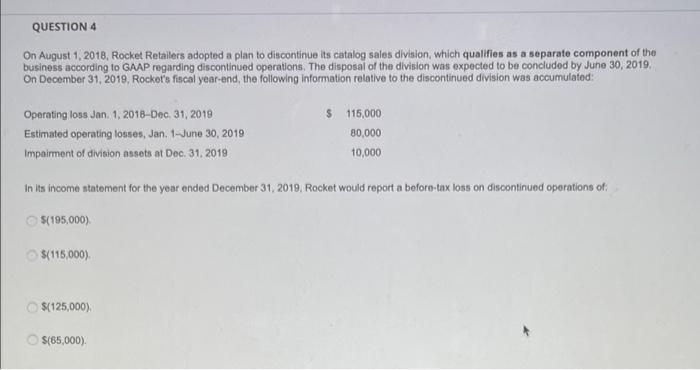

The following partial balance sheet ($ in thousands) for Paisano Seafood Inc. is shown below. Assets Liabilities and Equity Current assets: Current liabilities: Cash $ 60 Accounts payable $ 240 Accounts receivable (net) 170 Other liabilities 80 Notes receivable 50 Total current liabilities 320 Inventories 200 Long-term liabilities 110 Prepaid expenses 25 Total liabilities 430 Total current assets 505 Shareholders' equity: Plant assets (net) 150 255 Capital stock Retained earnings Total shareholders' equity 180 330 Total assets $ 760 Total liabilities and equity $ 760 Quick (Acid) assets total: $305 thousand. $230 thousand $60 thousand. $280 thousand. Debit Credit 730 920 34 30 16 Accounts receivable-trade Building and equipment Cash-checking Interest receivable Inventory Land Notes receivable (long-term) Petty cash fund Prepaid rent Supplies Trademark 150 450 5 20 8 40 560 80 485 20 30 Accounts payable-trade Accumulated depreciation Additional paid-in capital Allowance for uncollectible accounts Cash dividends payable Common stock, at par Income tax payable Notes payable (long-term) Retained earnings Deferred revenues TOTALS 15 65 800 308 40 2,403 2,403 What would Symphony report as total current assets? $838 million. QUESTION 4 On August 1, 2018, Rocket Retailers adopted a plan to discontinue its catalog sales division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by June 30, 2019, On December 31, 2019, Rocket's fiscal year-end, the following information relative to the discontinued division was accumulated: Operating loss Jan 1, 2018-Dec 31, 2019 Estimated operating losses, Jan. 1-June 30, 2019 Impairment of division assets at Dec 31, 2019 $ 115,000 80,000 10,000 In its income statement for the year ended December 31, 2019, Rocket would report a before-tux loss on discontinued operations of $(195,000) $(115,000) $(125,000) $(65,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts