Question: PLEASE ANSWER ALL THREE Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 8 years to

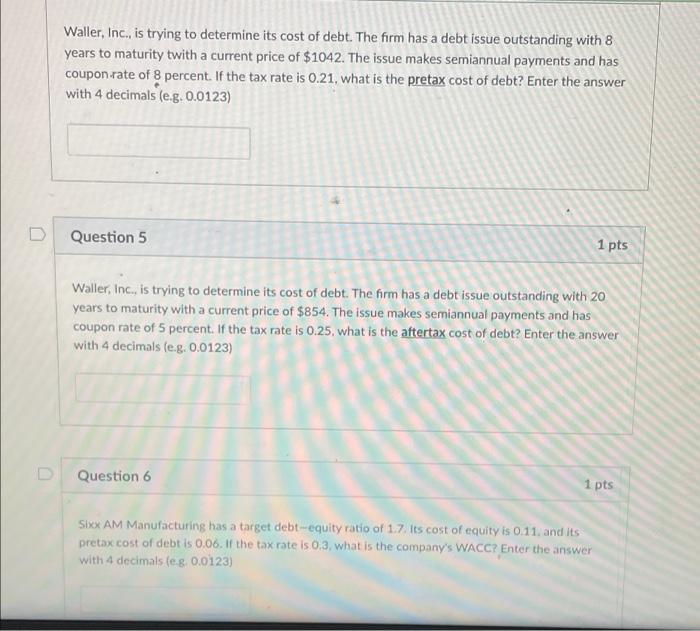

Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 8 years to maturity twith a current price of $1042. The issue makes semiannual payments and has coupon rate of 8 percent. If the tax rate is 0.21, what is the pretax cost of debt? Enter the answer with 4 decimals (e.g. 0.0123) D Question 5 1 pts Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 20 years to maturity with a current price of $854. The issue makes semiannual payments and has coupon rate of 5 percent. If the tax rate is 0.25, what is the aftertax cost of debt? Enter the answer with 4 decimals (e.g. 0.0123) Question 6 1 pts Sixx AM Manufacturing has a target debt-equity ratio of 1.7. Its cost of equity is 0.11 and its pretax cost of debt is 0.06. If the tax rate is 0.3, what is the company's WACC? Enter the answer with 4 decimals les 0.0123)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts