Question: Please answer all! Thumbs up! Daily Enterprises is purchasing a $14,000,000 machine. The machine will be depreciated using straight-line depreciation over its 5 year life

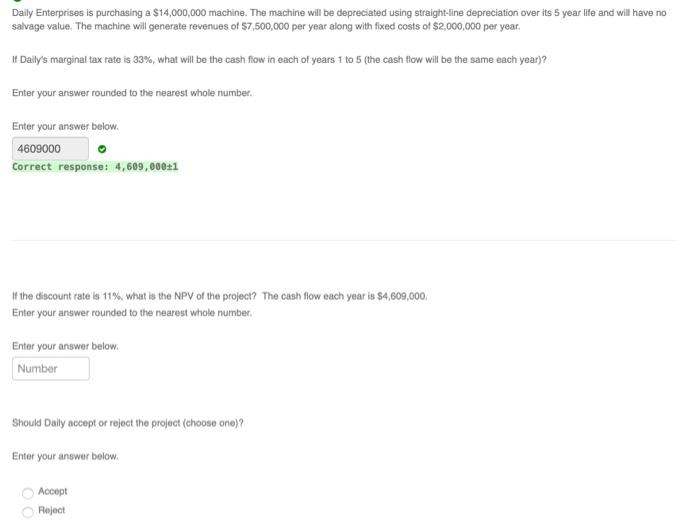

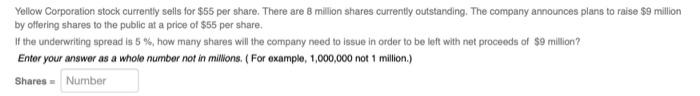

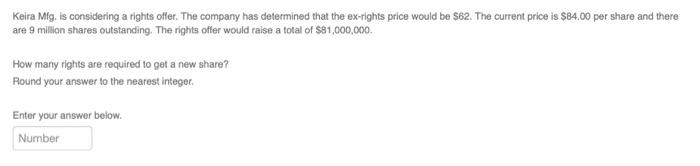

Daily Enterprises is purchasing a $14,000,000 machine. The machine will be depreciated using straight-line depreciation over its 5 year life and will have no salvage value. The machine will generate revenues of $7,500,000 per year along with fixed costs of $2,000,000 per year. If Daily's marginal tax rate is 33%, what will be the cash flow in each of years 1 to 5 (the cash flow will be the same each year)? Enter your answer rounded to the nearest whole number. Enter your answer below. 4609000 Correct response: 4,609,000:1 If the discount rate is 11%, what is the NPV of the project? The cash flow each year is $4,609,000 Enter your answer rounded to the nearest whole number Enter your answer below. Number Should Dally accept or reject the project (choose one)? Enter your answer below. Accept Reject Yellow Corporation stock currently sells for $55 per share. There are 8 million shares currently outstanding. The company announces plans to raise $9 million by offering shares to the publicat a price of $55 per share. If the underwriting spread is 5%, how many shares will the company need to issue in order to be left with net proceeds of $9 million? Enter your answer as a whole number not in millions. (For example, 1,000,000 not 1 million.) Shares - Number Keira Mfg. is considering a rights offer. The company has determined that the ex-rights price would be $62. The current price is $84.00 per share and there are 9 million shares outstanding. The rights offer would raise a total of $81,000,000 How many rights are required to get a new share? Round your answer to the nearest integer. Enter your answer below. Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts