Question: Please answer all! Thumbs up! The common stock and debt of Windows Phone Corp. are valued at $58 million and $22 million, respectively. Investors currently

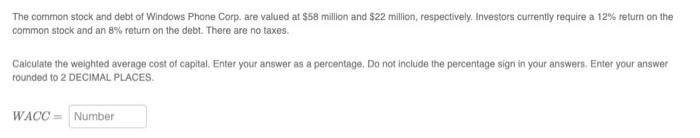

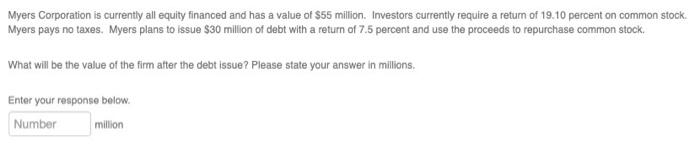

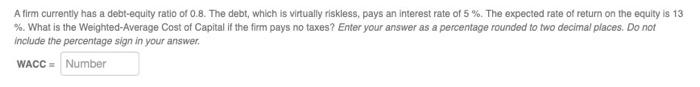

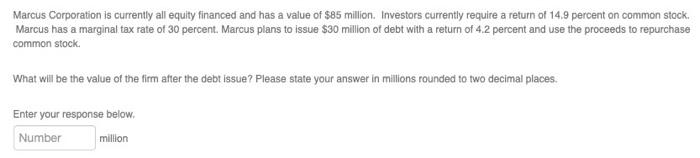

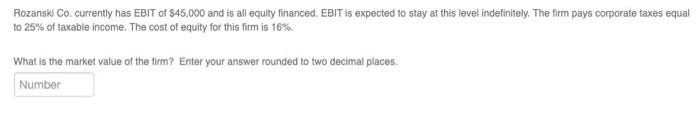

The common stock and debt of Windows Phone Corp. are valued at $58 million and $22 million, respectively. Investors currently require a 12% return on the common stock and an 8% return on the debt. There are no taxes. Calculate the weighted average cost of capital. Enter your answer as a percentage. Do not include the percentage sign in your answers, Enter your answer rounded to 2 DECIMAL PLACES WACC = Number Myers Corporation is currently all equity financed and has a value of $55 million. Investors currently require a retum of 19.10 percent on common stock. Myers pays no taxes. Myers plans to issue $30 million of debt with a return of 7.5 percent and use the proceeds to repurchase common stock. What will be the value of the firm after the debt issue? Please state your answer in millions Enter your response below. Number million A firm currently has a debt-equity ratio of 0.8. The debt, which is virtually riskless, pays an interest rate of 5%. The expected rate of return on the equity is 13 %. What is the Weighted Average Cost of Capital if the firm pays no taxes? Enter your answer as a percentage rounded to two decimal places. Do not include the percentage sign in your answer. WACC - Number Marcus Corporation is currently all equity financed and has a value of $85 million. Investors currently require a return of 14.9 percent on common stock. Marcus has a marginal tax rate of 30 percent. Marcus plans to issue $30 million of debt with a return of 4.2 percent and use the proceeds to repurchase common stock What will be the value of the firm after the debt issue? Please state your answer in millions rounded to two decimal places. Enter your response below. Number million Rozanski Co. currently has EBIT of S45,000 and is all equity financed. EBIT is expected to stay at this level indefinitely. The firm pays corporate taxes equal to 25% of taxable income. The cost of equity for this firm is 16%. What is the market value of the firm? Enter your answer rounded to two decimal places. Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts