Question: please answer all Use the following information to answer the next several questions. The Norris Company is looking to fund a new project with capital

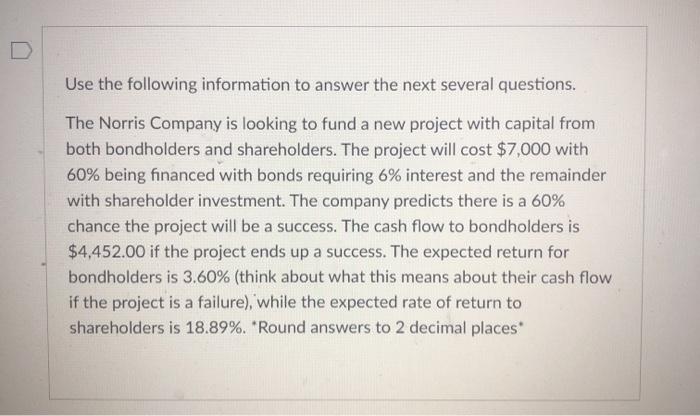

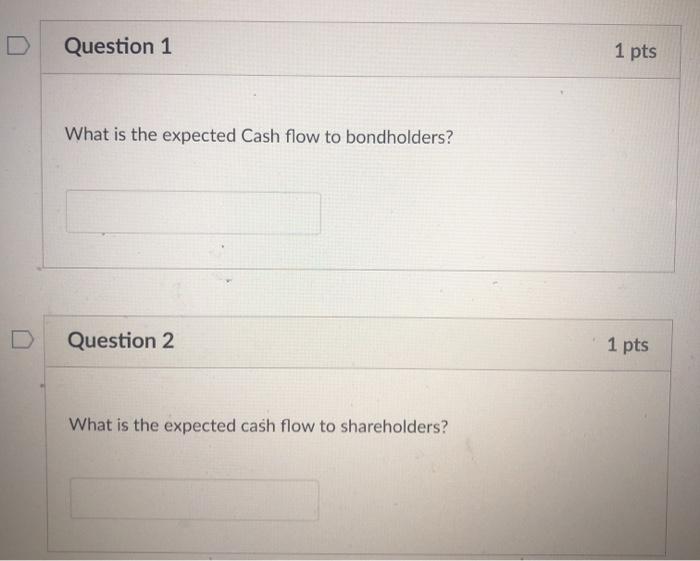

Use the following information to answer the next several questions. The Norris Company is looking to fund a new project with capital from both bondholders and shareholders. The project will cost $7,000 with 60% being financed with bonds requiring 6% interest and the remainder with shareholder investment. The company predicts there is a 60% chance the project will be a success. The cash flow to bondholders is $4,452.00 if the project ends up a success. The expected return for bondholders is 3.60% (think about what this means about their cash flow if the project is a failure), while the expected rate of return to shareholders is 18.89%. "Round answers to 2 decimal places Question 1 1 pts What is the expected Cash flow to bondholders? Question 2 1 pts What is the expected cash flow to shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts