Question: please answer all using given formula Section Il Calculation Questions Question 1 [20 marks] Assume that the risk-free rate of interest is 5% and the

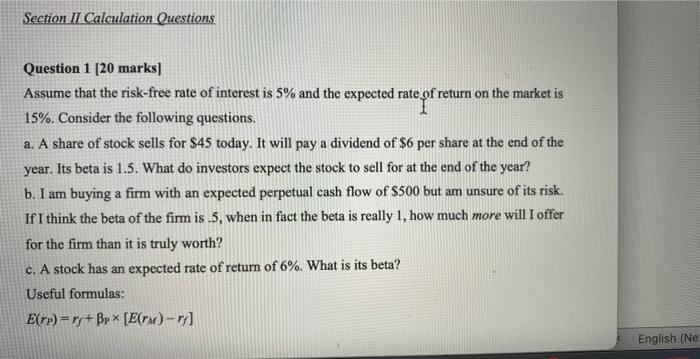

Section Il Calculation Questions Question 1 [20 marks] Assume that the risk-free rate of interest is 5% and the expected rate of return on the market is 15%. Consider the following questions. a. A share of stock sells for $45 today. It will pay a dividend of $6 per share at the end of the year. Its beta is 1.5. What do investors expect the stock to sell for at the end of the year? b. I am buying a firm with an expected perpetual cash flow of $500 but am unsure of its risk. If I think the beta of the firm is.5, when in fact the beta is really 1, how much more will I offer for the firm than it is truly worth? c. A stock has an expected rate of return of 6%. What is its beta? Useful formulas: E(rp) = ry+Bp* [E(mm)-r] English (Ne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts