Question: please answer all, will leave an upvote :) We are evaluating two mutually exclusive projects Project A has an initial investment of $30,000 and produces

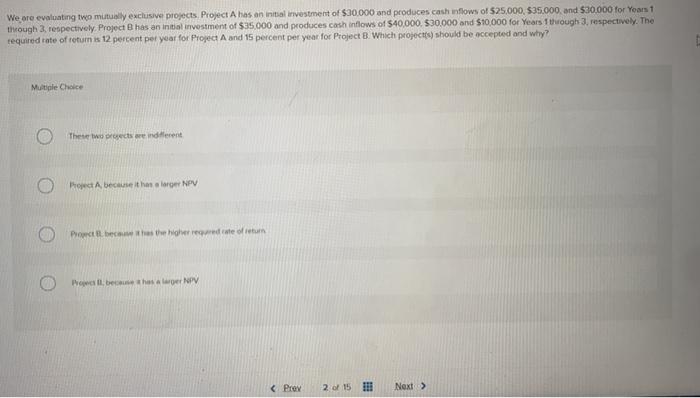

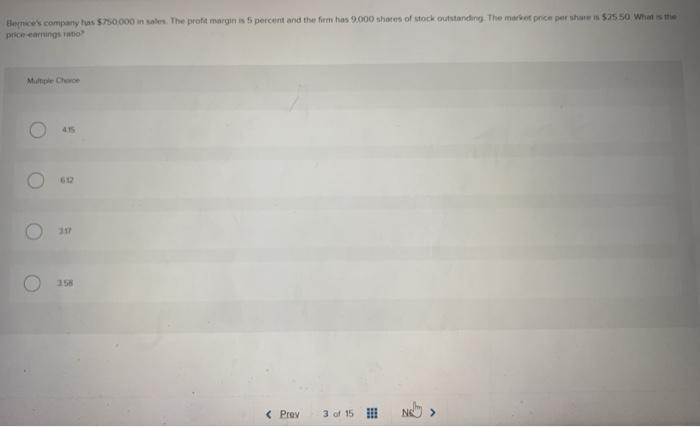

We are evaluating two mutually exclusive projects Project A has an initial investment of $30,000 and produces cash flows of $25,000, $35.000 and $30,000 for Years 1 through 3, respectively, Project has an initial investment of $35.000 and produces cash inflows of $40,000, 530,000 and $10,000 for years through 3, respectively. The required rate of return is 12 percent per year for Project A and 15 percent per year for Project 8. Which projects) should be accepted and why? Multiple Choice The two pects are indent Propect A because it has a larger NPV Protect the higher rate of return Powel, bechos ar PV Proy 2 of 15 II Next > Elices company los $750.000 in sales. The profit margin is 5 percent and the firm has 9.000 shares of stock outstanding the market price per show $25 50 What is the prio carrings to Multiple Chee 415 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts