Question: PLEASE ANSWER ALL!! WILL UPVOTE!! DYI Construction Co. is considering a new inventory system that will cost $850,000. The system is expected to generate cash

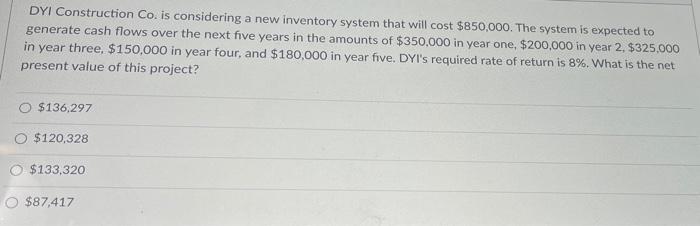

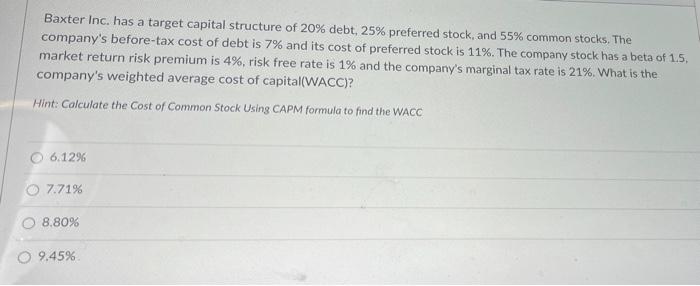

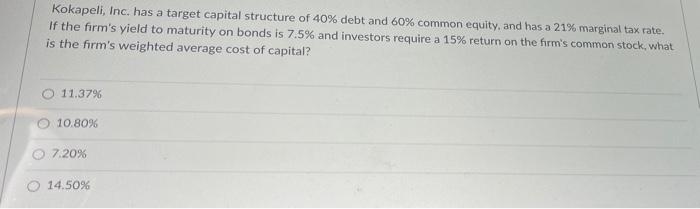

DYI Construction Co. is considering a new inventory system that will cost $850,000. The system is expected to generate cash flows over the next five years in the amounts of $350,000 in year one, $200,000 in year 2, $325,000 in year three, $150,000 in year four, and $180,000 in year five. DYI's required rate of return is 8%. What is the net present value of this project? $136,297 O $120,328 $133,320 $87,417 Baxter Inc. has a target capital structure of 20% debt, 25% preferred stock, and 55% common stocks, The company's before-tax cost of debt is 7% and its cost of preferred stock is 11%. The company stock has a beta of 1.5. market return risk premium is 4%, risk free rate is 1% and the company's marginal tax rate is 21%. What is the company's weighted average cost of capital(WACC)? Hint: Calculate the cost of Common Stock Using CAPM formula to find the WACC 6.1296 7.71% 8.80% 9.45% Kokapeli, Inc. has a target capital structure of 40% debt and 60% common equity, and has a 21% marginal tax rate. If the firm's yield to maturity on bonds is 7.5% and investors require a 15% return on the firm's common stock, what is the firm's weighted average cost of capital? 11.3796 10.8096 7.20% 14.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts