Question: please answer all. will upvote. thank u. 3. At the beginning of the year, you purchased a share of Murray Manufacturing for $40. It was

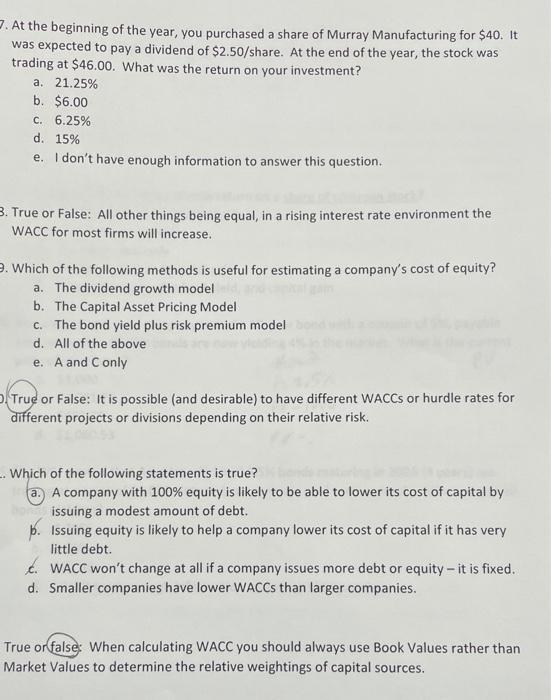

3. At the beginning of the year, you purchased a share of Murray Manufacturing for $40. It was expected to pay a dividend of $2.50/share. At the end of the year, the stock was trading at $46.00. What was the return on your investment? a. 21.25% b. $6.00 C. 6.25% d. 15% e. I don't have enough information to answer this question. 3. True or False: All other things being equal, in a rising interest rate environment the WACC for most firms will increase. 9. Which of the following methods is useful for estimating a company's cost of equity? a. The dividend growth model b. The Capital Asset Pricing Model c. The bond yield plus risk premium model d. All of the above e. A and C only True or False: It is possible and desirable) to have different WACCs or hurdle rates for different projects or divisions depending on their relative risk. . Which of the following statements is true? a. A company with 100% equity is likely to be able to lower its cost of capital by issuing a modest amount of debt. B. Issuing equity is likely to help a company lower its cost of capital if it has very little debt. 6. WACC won't change at all if a company issues more debt or equity - it is fixed. d. Smaller companies have lower WACCs than larger companies. True or false: When calculating WACC you should always use Book Values rather than Market Values to determine the relative weightings of capital sources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts