Question: please answer all with a general explaination please and thank you! On April 1, Tamarisk, Inc. began operations. The following transactions were completed during the

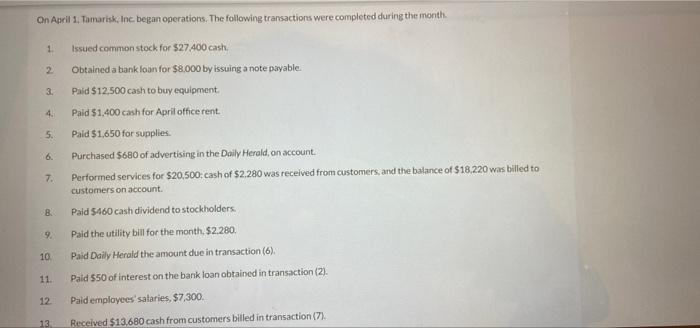

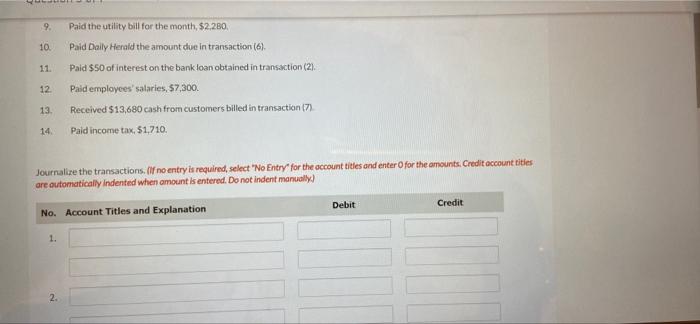

On April 1, Tamarisk, Inc. began operations. The following transactions were completed during the month. 1 Issued common stock for $27,400 cash, 2 Obtained a bank loan for $8.000 by issuing a note payable. 3. Paid $12.500 cash to buy equipment. 4. Paid $1,400 cash for April office rent. 5. Paid $1,650 for supplies. 6. Purchased $680 of advertising in the Daily Herald, on account. 7. Performed services for $20,500: cash of $2.280 was received from customers, and the balance of $18.220 was billed to customers on account. 8. Paid $460 cash dividend to stockholders. 9. Paid the utility bill for the month, $2.280. Paid Daily Herald the amount due in transaction (6). Paid $50 of interest on the bank loan obtained in transaction (2). Paid employees' salaries, $7,300. Received $13,680 cash from customers billed in transaction (7) 10 11. 12. 13. 9. Paid the utility bill for the month, $2,280. 10. Paid Daily Herald the amount due in transaction (6). 11. Paid $50 of interest on the bank loan obtained in transaction (2) 12. Paid employees' salaries, $7,300. 13. Received $13,680 cash from customers billed in transaction (7) 14. Paid income tax, $1,710. Journalize the transactions. (If no entry is required, select "No Entry for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) Debit Credit No. Account Titles and Explanation 1. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts