Question: PLEASE ANSWER ALL WITH COMPUTATION Problem 8-22 (AICPA Adapted) On January 1, 2020, Jonathan Company borrowed P500,000 8% note due in four years. The present

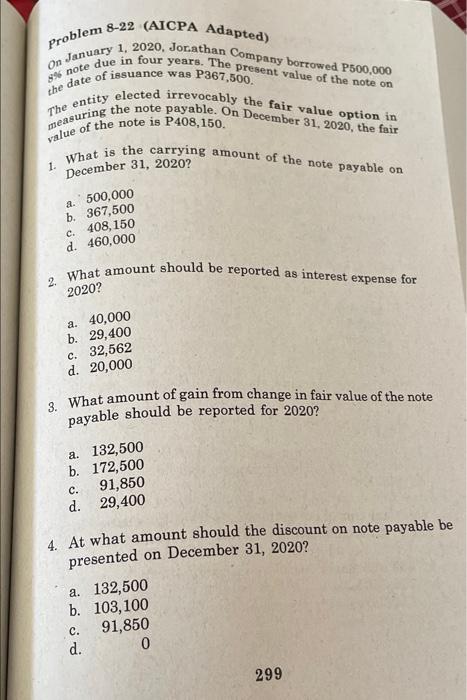

Problem 8-22 (AICPA Adapted) On January 1, 2020, Jonathan Company borrowed P500,000 8% note due in four years. The present value of the note on the date of issuance was P367,500. measuring the note payable. On December 31, 2020, the fair The entity elected irrevocably the fair value option in 1. What is the carrying amount of the note payable on value of the note is P408, 150. December 31, 2020? &. 500,000 b. 367,500 c. 408, 150 d. 460,000 2 What amount should be reported as interest expense for 2020? a. 40,000 b. 29,400 C. 32,562 d. 20,000 3. What amount of gain from change in fair value of the note payable should be reported for 2020? a. 132,500 b. 172,500 91,850 d. 29,400 c. 4. At what amount should the discount on note payable be presented on December 31, 2020? a. 132,500 b. 103, 100 91,850 d. 0 C. 299

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts