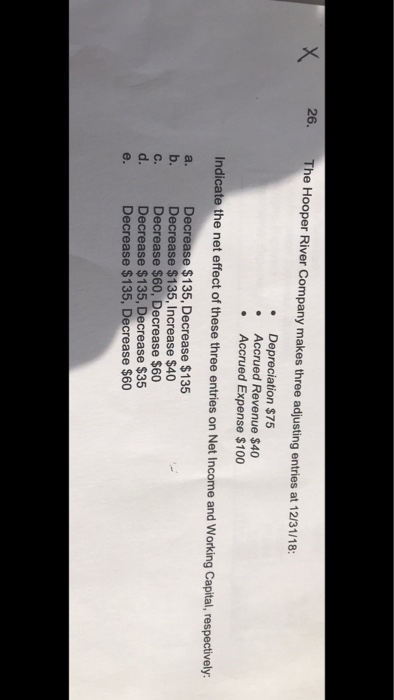

Question: PLEASE ANSWER ALL WITH STEP BY STEP EXPLANTION ON THE ANSWET CHOSEN x 20. The Hooper River Company makes three adjusting entries at 12/31/18: Depreciation

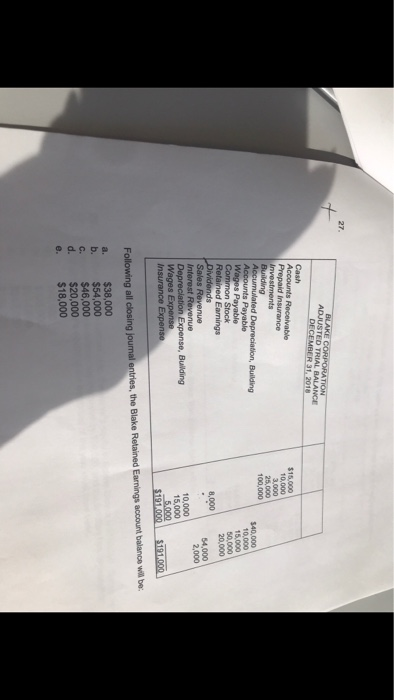

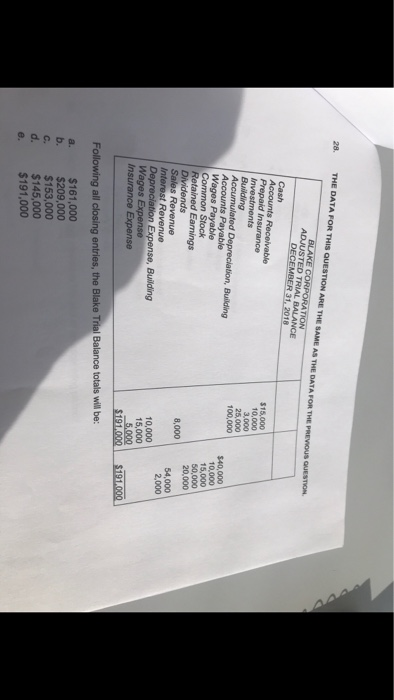

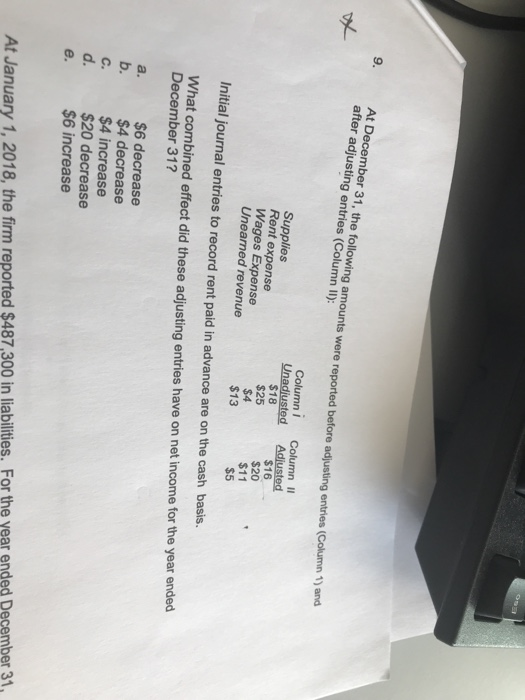

x 20. The Hooper River Company makes three adjusting entries at 12/31/18: Depreciation $75 Accrued Revenue $40 Accrued Expense $100 Indicate the net effect of these three entries on Net Income and Working Capital, respectively: ooo Decrease $135, Decrease $135 Decrease $135, Increase $40 Decrease $60, Decrease $60 Decrease $135, Decrease $35 Decrease $135, Decrease $60 28. THE DATA FOR THIS QUESTION ARE THE SAME AS THE DATA FOR THE PREVIOUS QUESTION BLAKE CORPORATION ADJUSTED TRIAL BALANCE DECEMBER 31, 2018 Cash Accounts Receivable $15,000 Prepaid Insurance 10,000 Investments 3.000 Building Accumulated Depreciation Building 100,000 $40,000 Accounts Payable 10,000 Wages Payable 15,000 Common Stock 50,000 Retained Earnings 20,000 Dividends 8,000 Sales Revenue 54,000 Interest Revenue 2,000 Depreciation Expense, Building Wages Expense Insurance Expense 10,000 15,000 5.000 $191.000 $191,000 Following all closing entries, the Blake Trial Balance totals will be: b. C. d. e $161,000 $209,000 $153,000 $145,000 $191,000 At December 31, the following amounts were reported before adjusing on after adjusting entries (Column ll): reported before adjusting entries (Column 1) and Column 1 Column II Unadjusted Adjusted Supplies $18 $16 Rent expense Wages Expense Unearned revenue $25 $4 $13 $20 $11 $5 Initial Journal entries to record rent paid in advance are on the cash basis. What combined effect did these adjusting entries have on net income for the year ended December 31? $6 decrease $4 decrease $4 increase $20 decrease $6 increase At January 1, 2018, the firm reported $487,300 in liabilities. For the year ended December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts