Question: Please answer all with work shown! 4. Packer Credit Union enters into a four-year interest rate collar with the one-year LIBOR as the interest rate

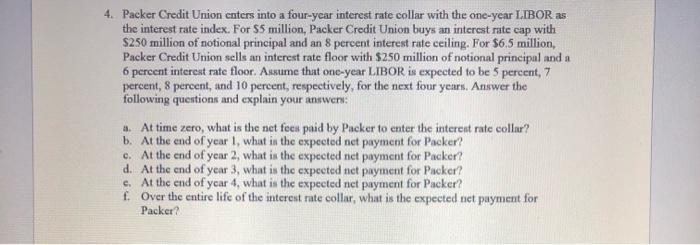

4. Packer Credit Union enters into a four-year interest rate collar with the one-year LIBOR as the interest rate index. For $5 million, Packer Credit Union buys an interest rate cap with $250 million of notional principal and an 8 percent interest rate ceiling. For $6.5 million, Packer Credit Union sells an interest rate floor with $250 million of notional principal and a 6 percent interest rate floor. Assume that one-year LIBOR is expected to be 5 percent, 7 percent, 8 percent, and 10 percent, respectively, for the next four years. Answer the following questions and explain your answers: a. At time zero, what is the net fees paid by Packer to enter the interest rate collar? b. At the end of year 1, what is the expected net payment for Packer? c. At the end of year 2, what is the expected net payment for Packer? d. At the end of year 3, what is the expected net payment for Packer? c. At the end of year 4, what is the expected net payment for Packer? f. Over the entire life of the interest rate collar, what is the expected tct payment for Packer? 4. Packer Credit Union enters into a four-year interest rate collar with the one-year LIBOR as the interest rate index. For $5 million, Packer Credit Union buys an interest rate cap with $250 million of notional principal and an 8 percent interest rate ceiling. For $6.5 million, Packer Credit Union sells an interest rate floor with $250 million of notional principal and a 6 percent interest rate floor. Assume that one-year LIBOR is expected to be 5 percent, 7 percent, 8 percent, and 10 percent, respectively, for the next four years. Answer the following questions and explain your answers: a. At time zero, what is the net fees paid by Packer to enter the interest rate collar? b. At the end of year 1, what is the expected net payment for Packer? c. At the end of year 2, what is the expected net payment for Packer? d. At the end of year 3, what is the expected net payment for Packer? c. At the end of year 4, what is the expected net payment for Packer? f. Over the entire life of the interest rate collar, what is the expected tct payment for Packer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts