Question: please answer all You are considering two loans. The terms of the two loans are equivalent with the exception of the interest rates. Loan A

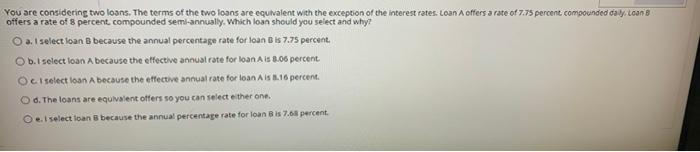

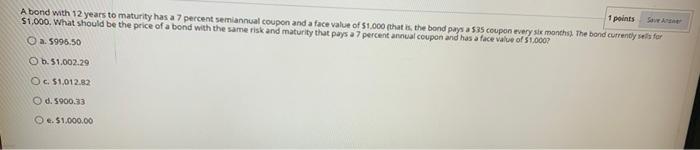

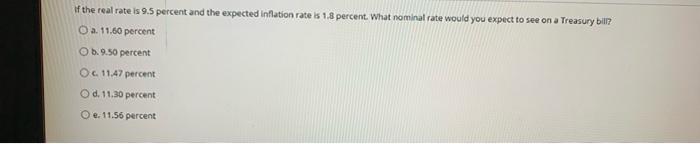

You are considering two loans. The terms of the two loans are equivalent with the exception of the interest rates. Loan A offers a rate of 7.75 percent compounded day Loans offers a rate of 8 percent compounded semi-annually. Which loan should you select and why? a. I select loan because the annual percentage rate for loan is 7.75 percent. Obi select loan A because the effective annual rate for loan A is 3.06 percent Oci select loan Abecause the effective annual rate for loan Als 8.16 percent. Od. The loans are equivalent offers so you can select either one e. i select loan because the annual percentage rate for loan Bis 7.68 percent 1 points Abond with 12 years to maturity has a 7 percent semiannual coupon and a face value of $1.000 (that is the bond pays a 535 coupon every six months. The bond currently sel for $1.000. What should be the price of a bond with the same risk and maturity that pays a 7 percent annual coupon and has a face value of $1.000? a. 5995.50 Ob. 51.002.29 O. 51,012.82 d. 5900.33 e. $1.000.00 if the real rate is 9.5 percent and the expected Inflation rate is 1.8 percent. What nominal rate would you expect to see on a Treasury bill? O a. 11.60 percent Ob. 9.50 percent O. 11.47 percent O d. 11.30 percent O . 11.56 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts