Question: please answer alll? Required: a. What is the maximum possible subscription price? What is the minimum? (Do not round intermediate calculations. Leave no cells blank

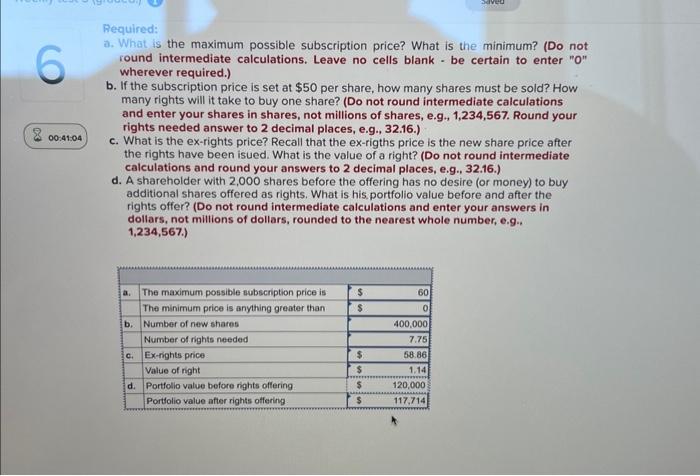

Required: a. What is the maximum possible subscription price? What is the minimum? (Do not round intermediate calculations. Leave no cells blank - be certain to enter " 0 " wherever required.) b. If the subscription price is set at $50 per share, how many shares must be sold? How many rights will it take to buy one share? (Do not round intermediate calculations and enter your shares in shares, not millions of shares, e.g., 1,234,567. Round your rights needed answer to 2 decimal places, e.g., 32.16.) c. What is the ex-rights price? Recall that the ex-rigths price is the new share price after the rights have been isued. What is the value of a right? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. A shareholder with 2,000 shares before the offering has no desire (or money) to buy additional shares offered as rights. What is his, portfolio value before and after the rights offer? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g.. 1,234,567. Required: a. What is the maximum possible subscription price? What is the minimum? (Do not round intermediate calculations. Leave no cells blank - be certain to enter " 0 " wherever required.) b. If the subscription price is set at $50 per share, how many shares must be sold? How many rights will it take to buy one share? (Do not round intermediate calculations and enter your shares in shares, not millions of shares, e.g., 1,234,567. Round your rights needed answer to 2 decimal places, e.g., 32.16.) c. What is the ex-rights price? Recall that the ex-rigths price is the new share price after the rights have been isued. What is the value of a right? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. A shareholder with 2,000 shares before the offering has no desire (or money) to buy additional shares offered as rights. What is his, portfolio value before and after the rights offer? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g.. 1,234,567

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts