Question: PLEASE ANSWER ALLLLLLL 1. 2. 3. 4. 5. 6. 7. 8. A liquid asset can be converted to cash quickly without significantly impacting the asset's

PLEASE ANSWER ALLLLLLL

1.

2.

2.

3.

3.

4.

4.

5.

5.

6.

6.

7.

7.

8.

8.

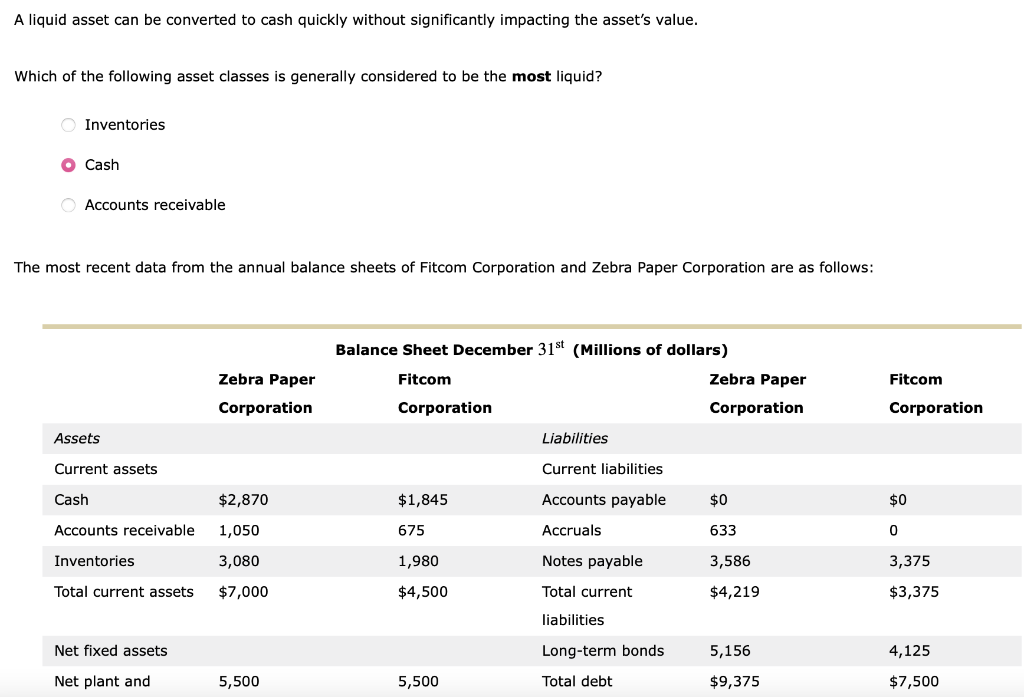

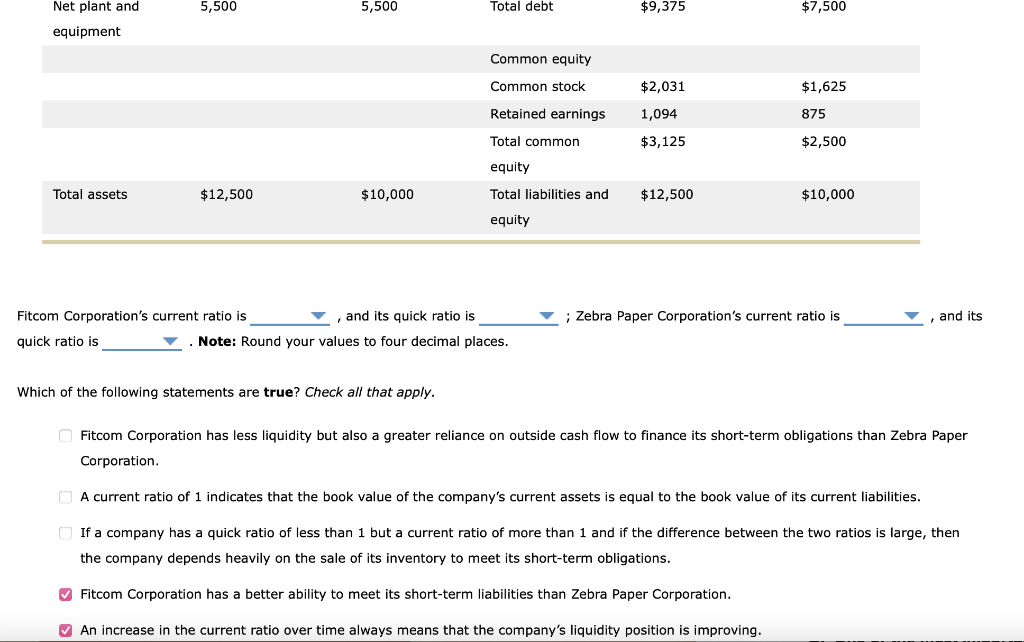

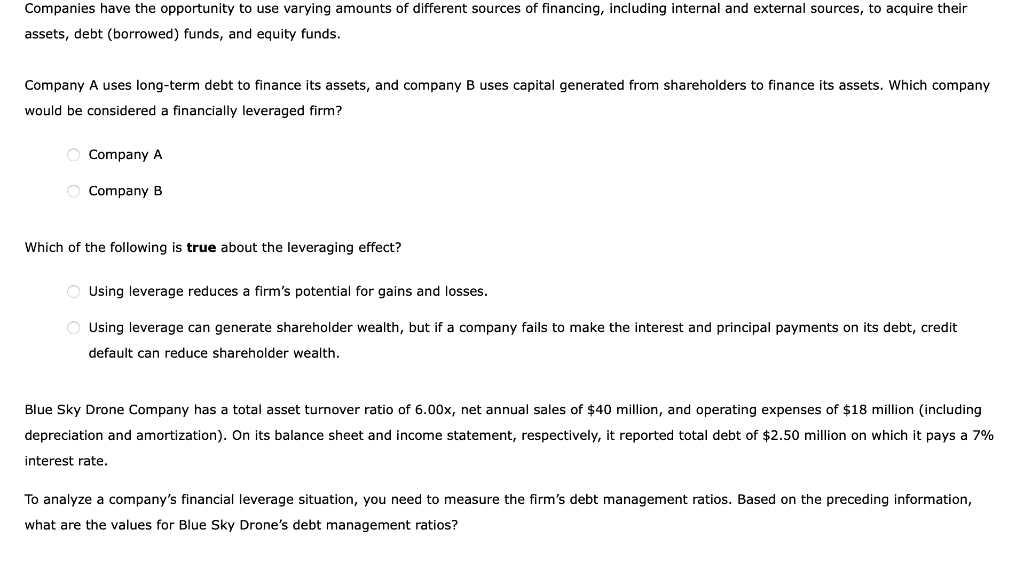

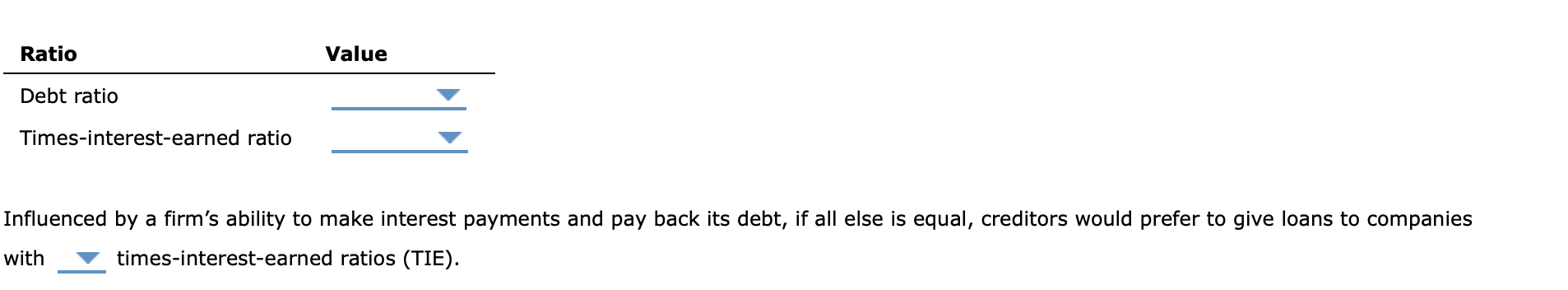

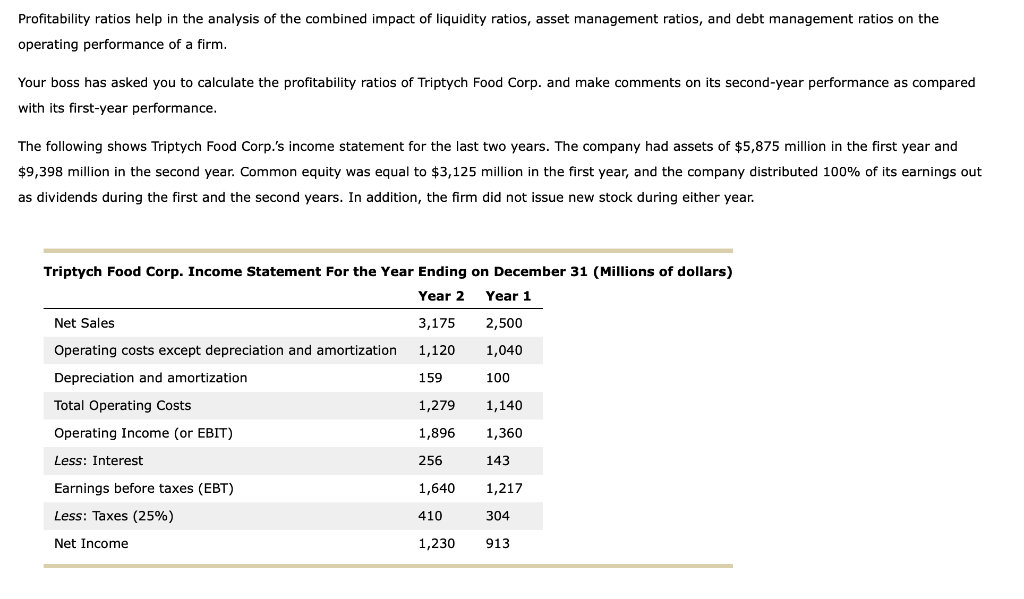

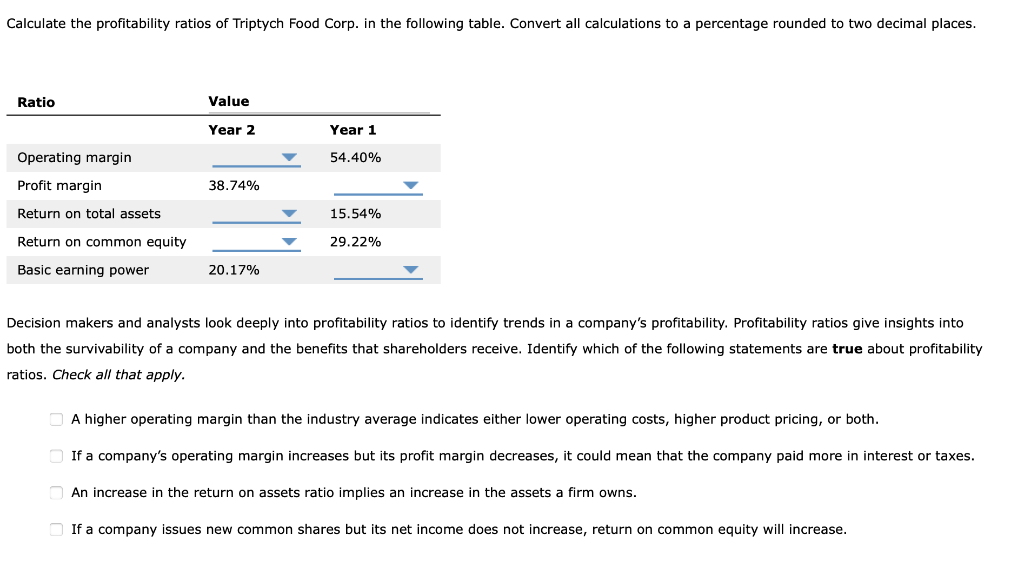

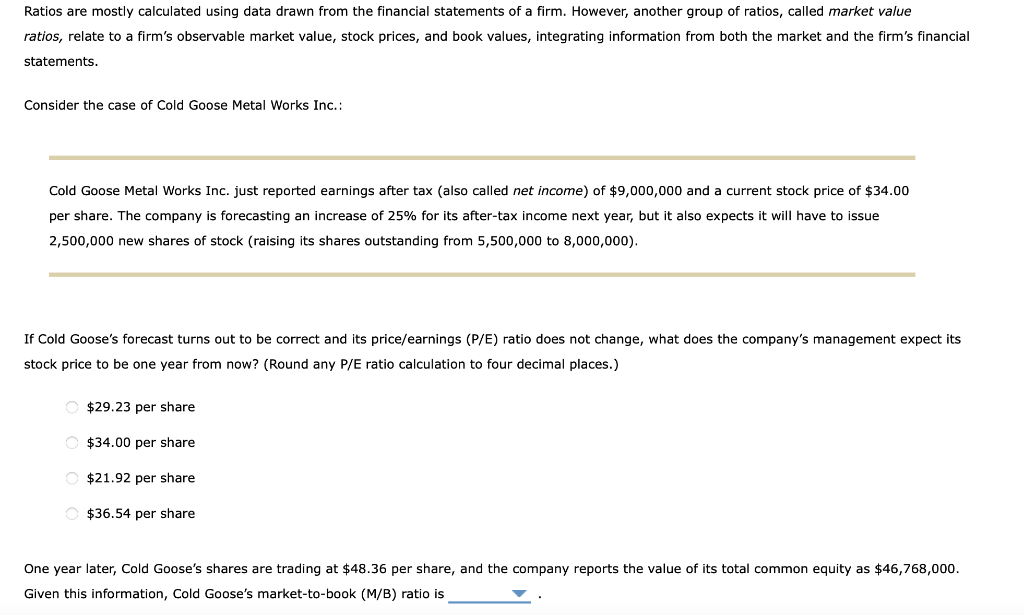

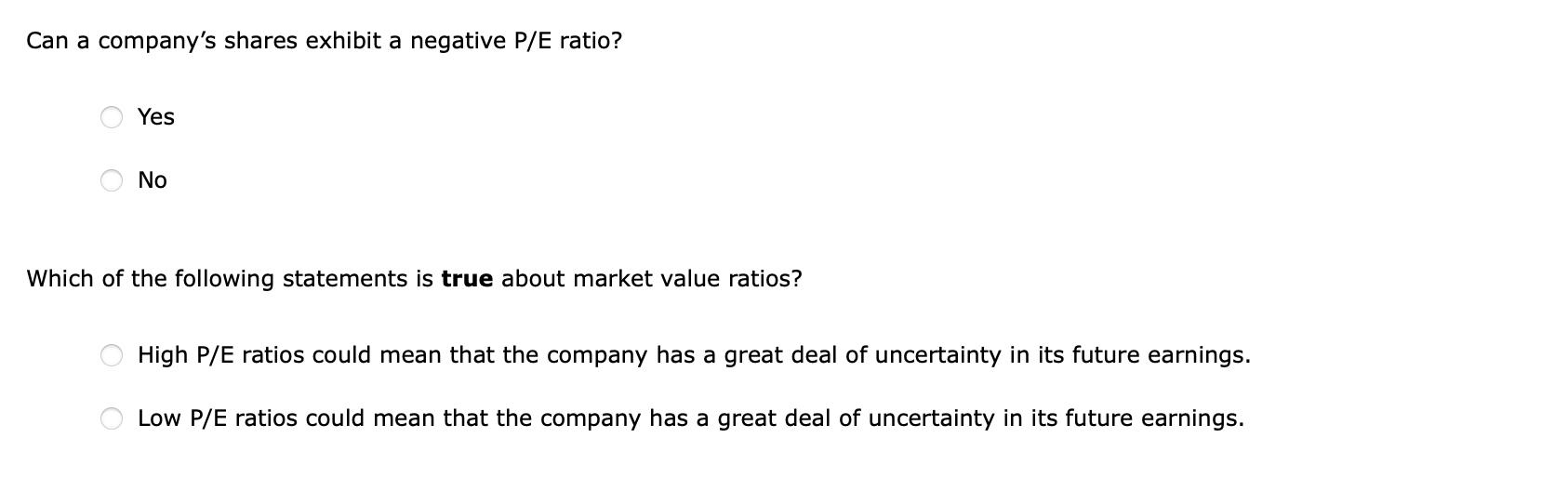

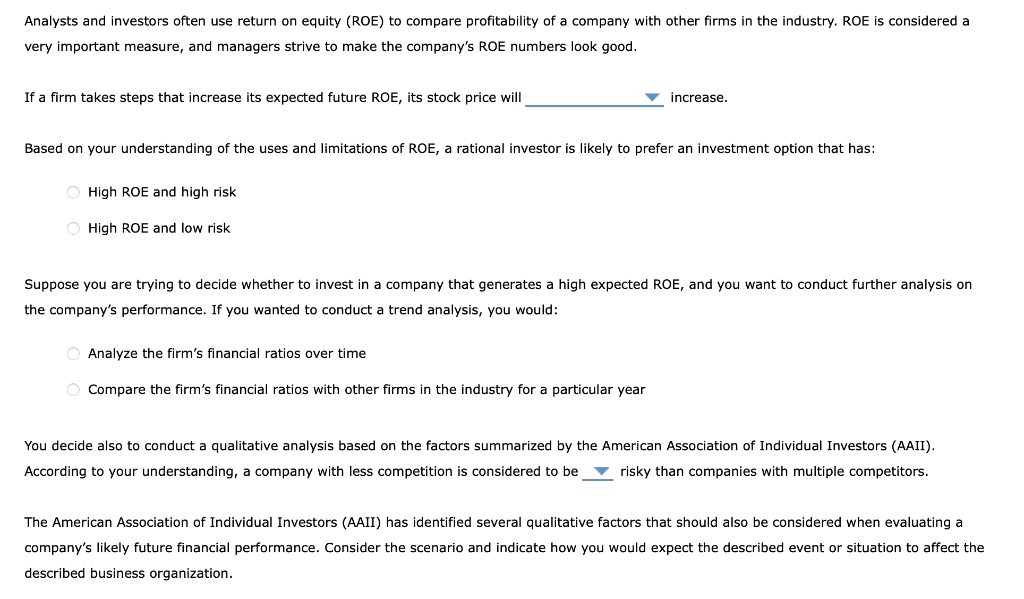

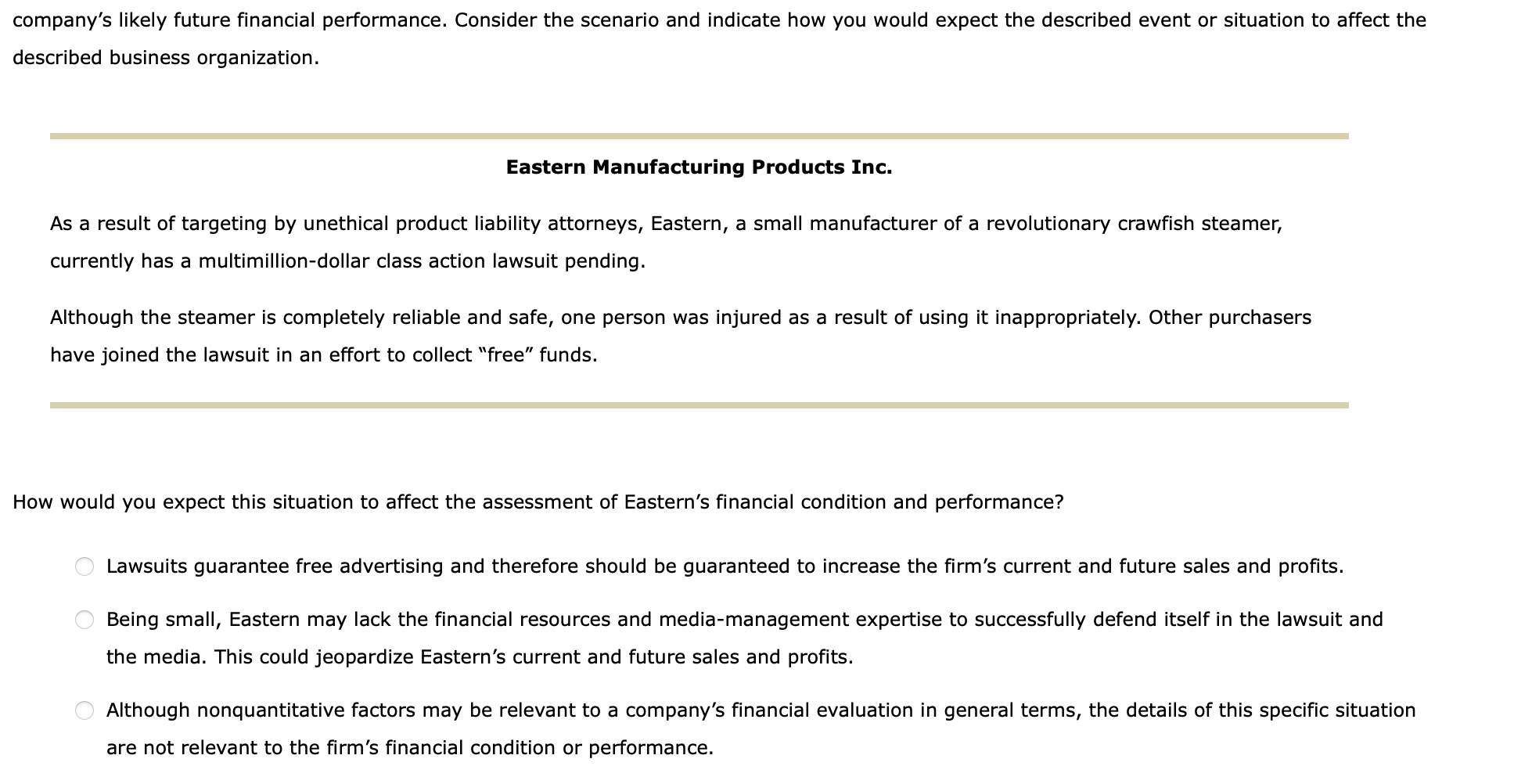

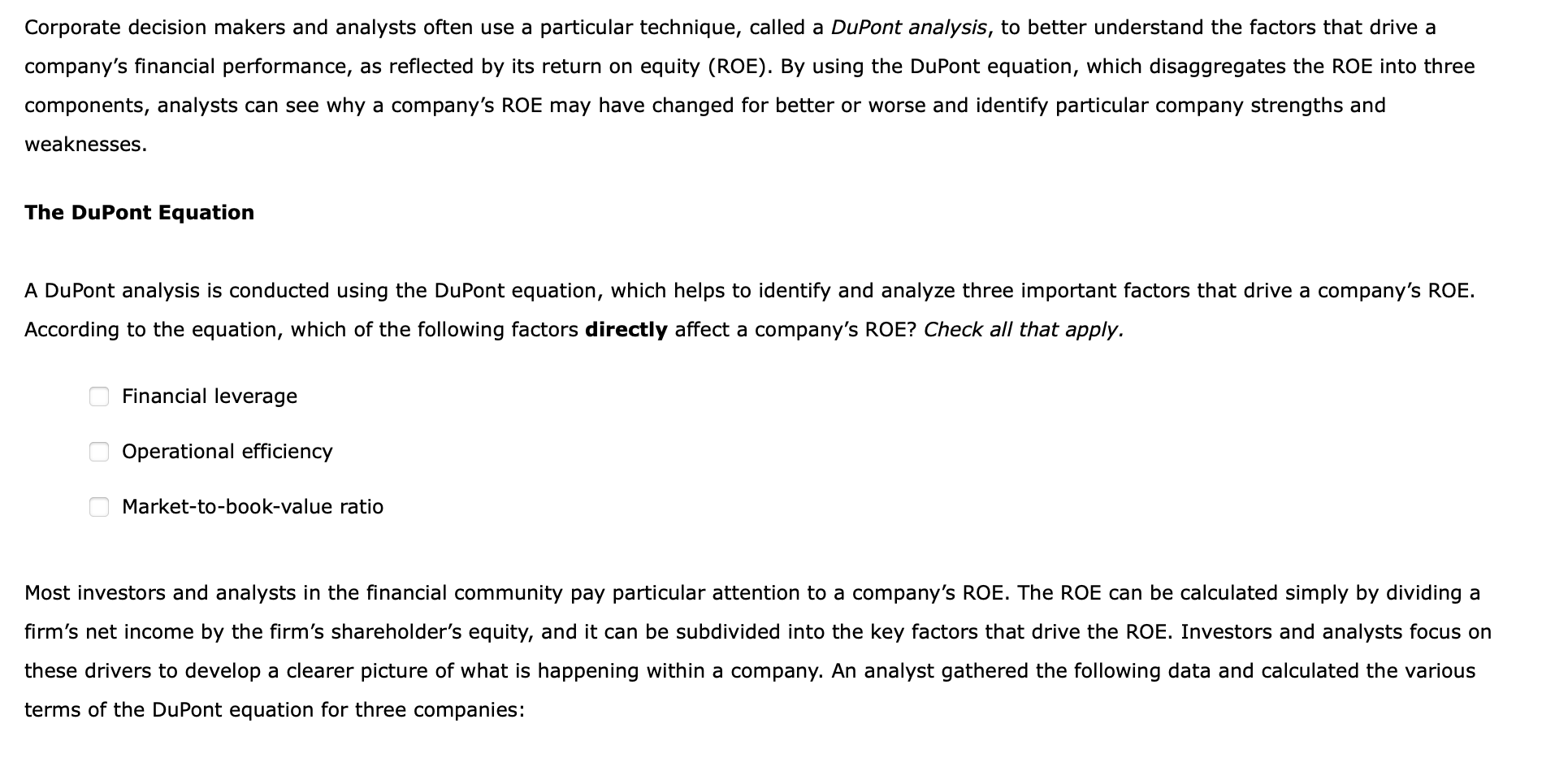

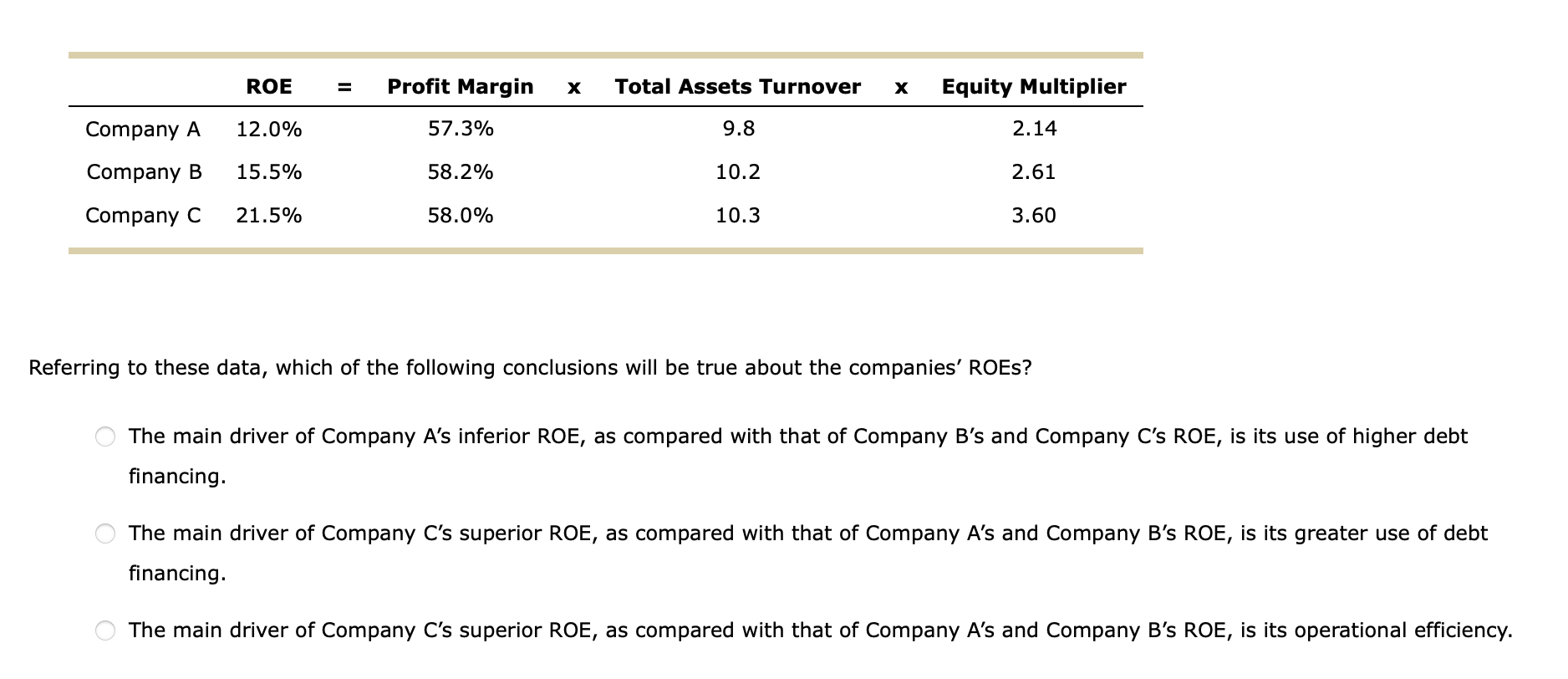

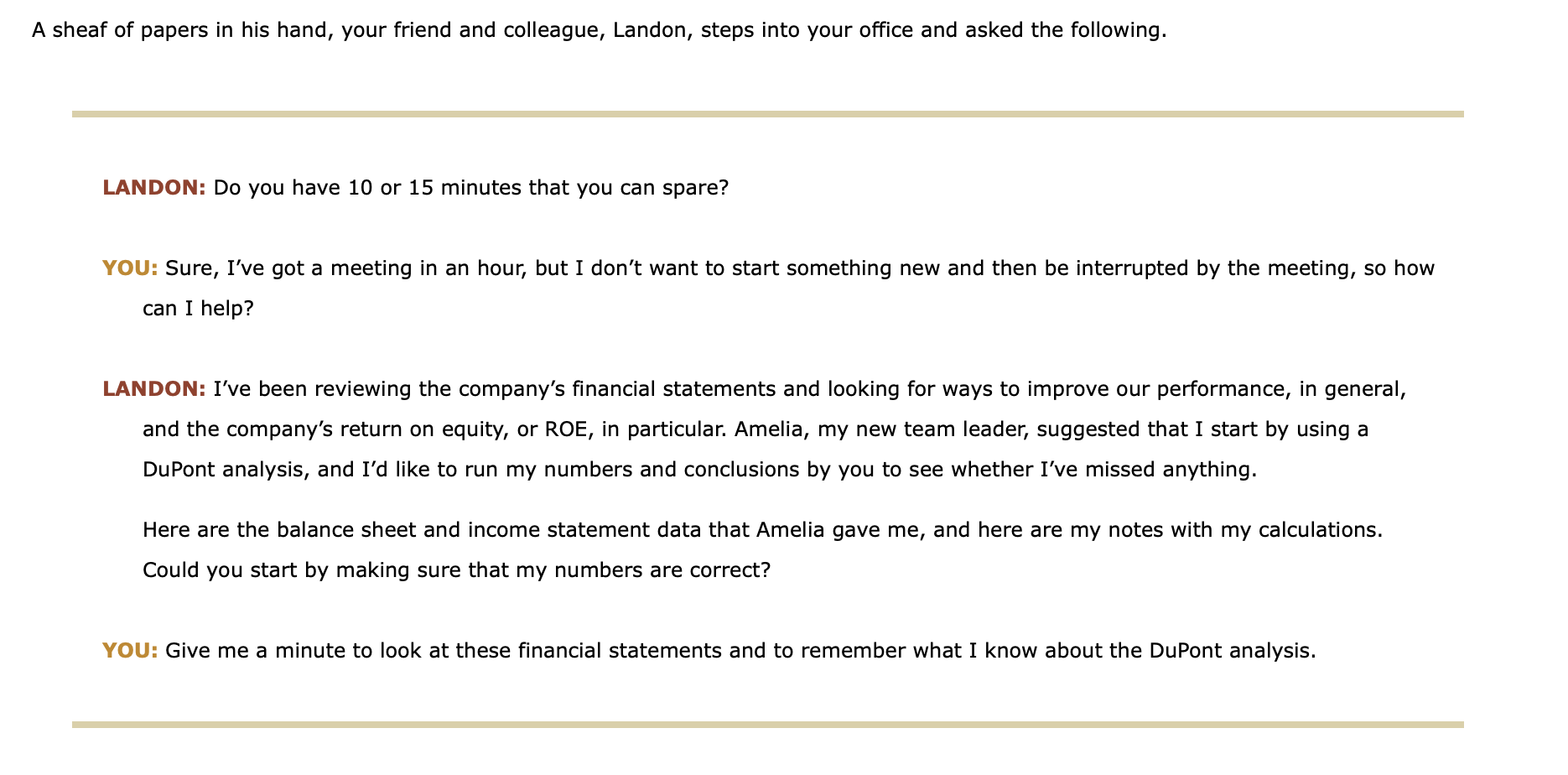

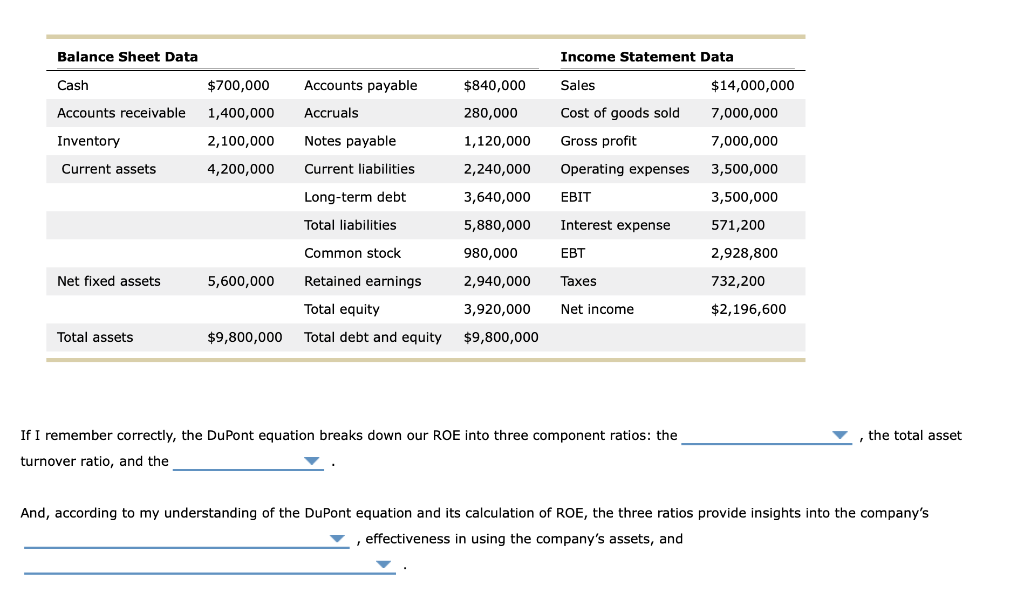

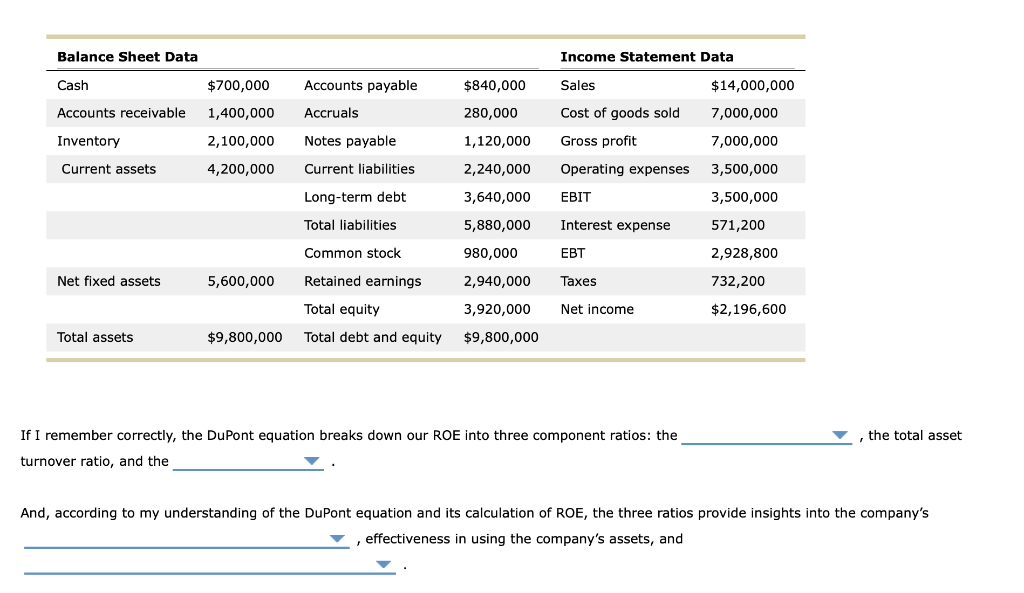

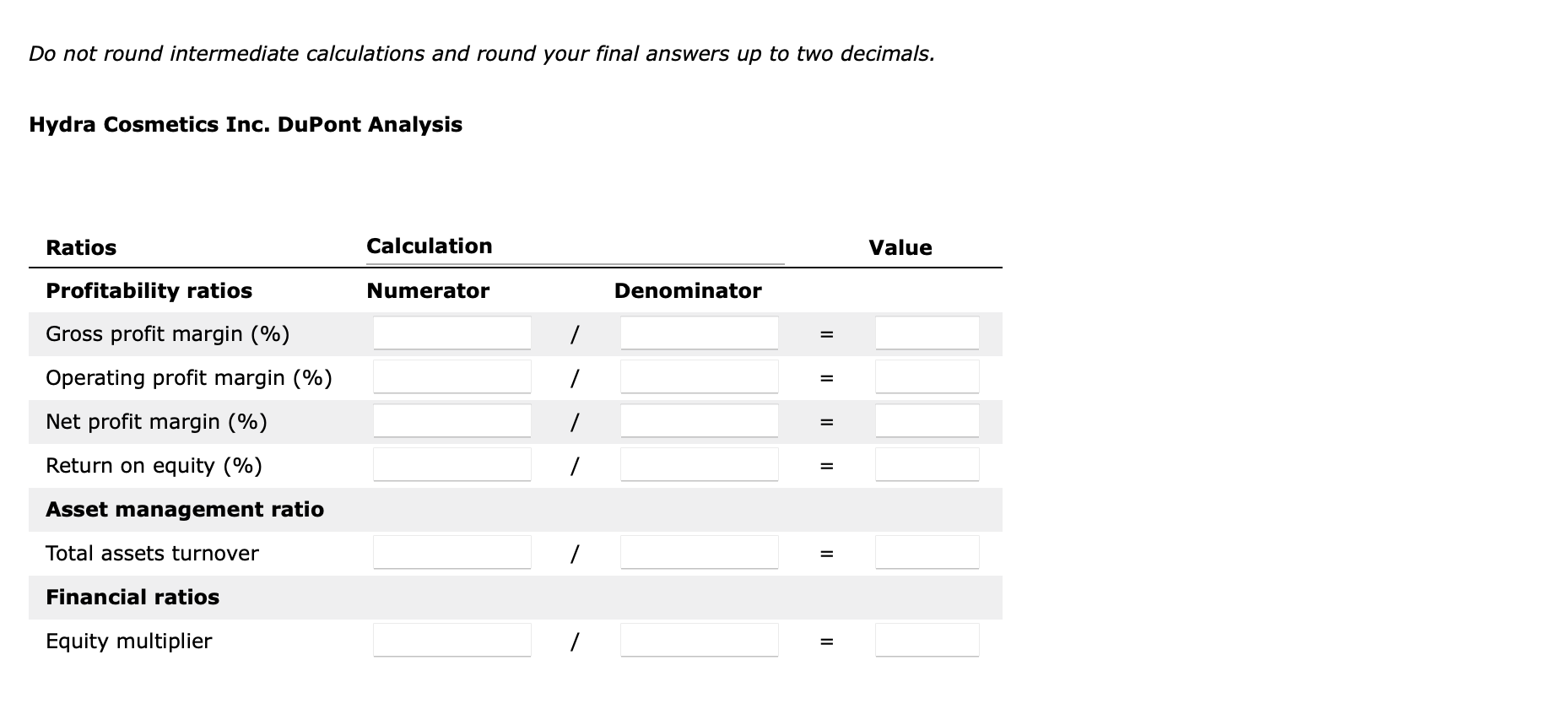

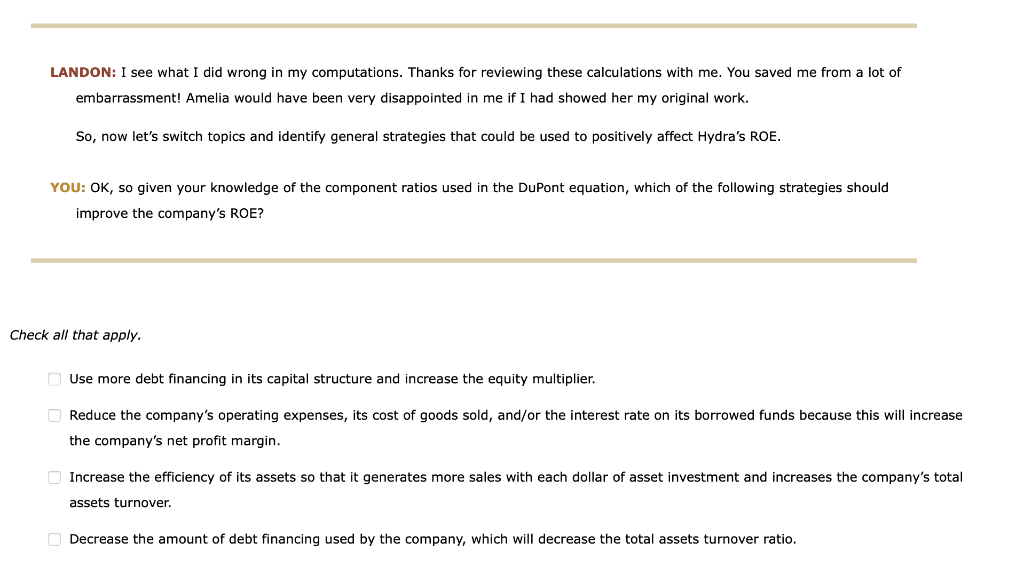

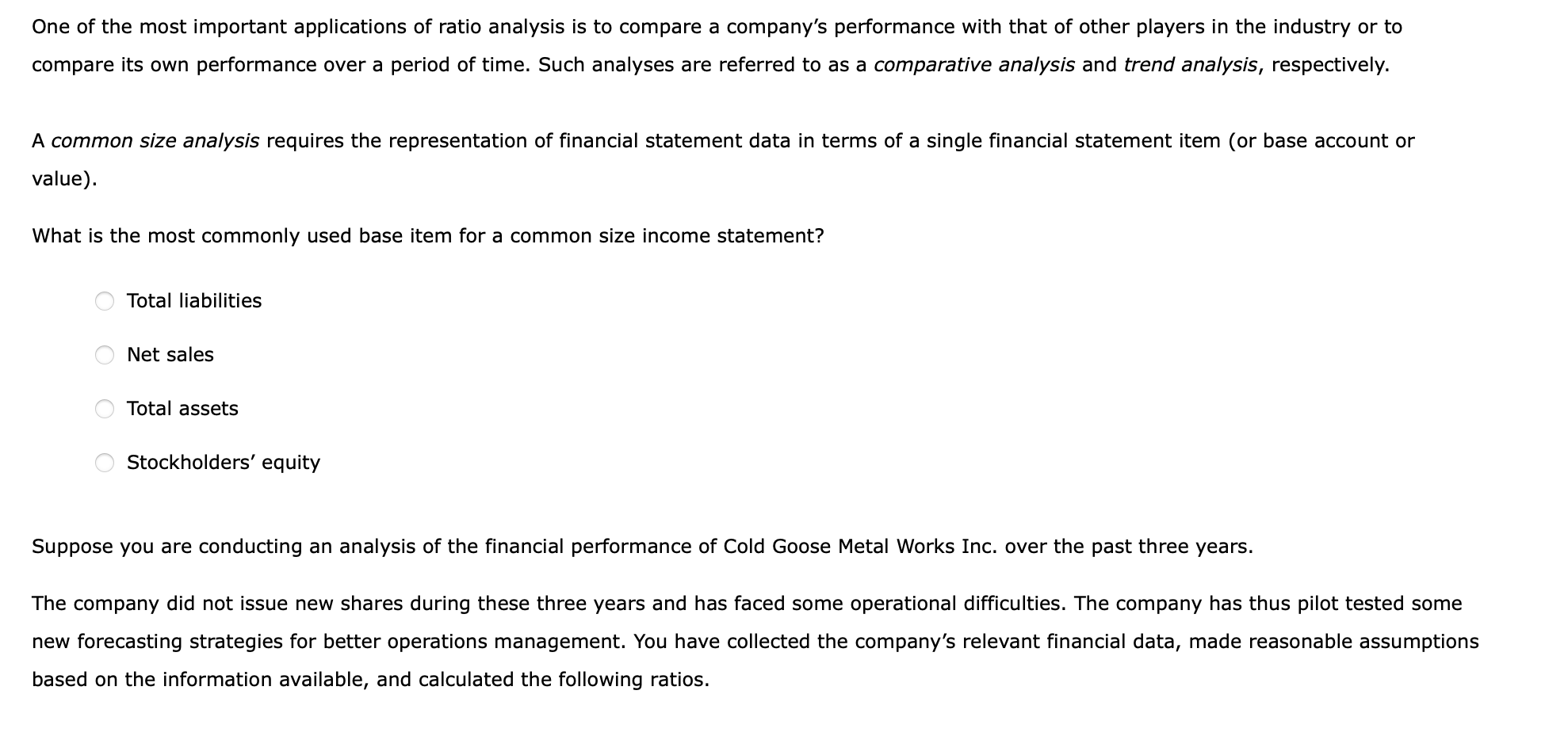

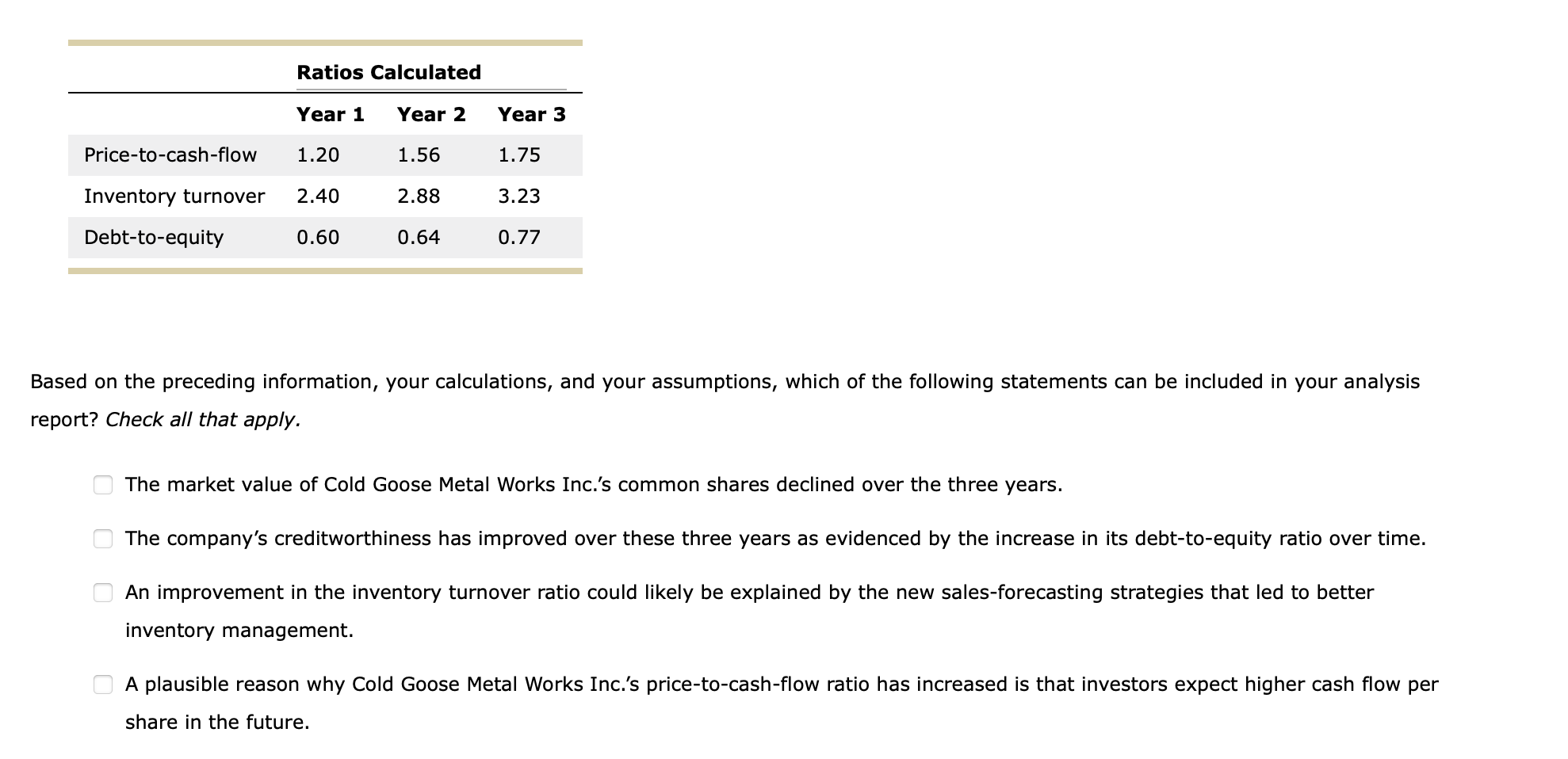

A liquid asset can be converted to cash quickly without significantly impacting the asset's value. Which of the following asset classes is generally considered to be the most liquid? Inventories O Cash Accounts receivable The most recent data from the annual balance sheets of Fitcom Corporation and Zebra Paper Corporation are as follows: Zebra Paper Balance Sheet December 31st (Millions of dollars) Fitcom Zebra Paper Corporation Corporation Fitcom Corporation Corporation Assets Liabilities Current assets Current liabilities Cash $2,870 $1,845 Accounts payable $0 $0 Accounts receivable 1,050 675 Accruals 633 0 Inventories 3,080 1,980 Notes payable 3,586 3,375 Total current assets $7,000 $4,500 Total current $4,219 $3,375 liabilities Net fixed assets Long-term bonds 5,156 4,125 Net plant and 5,500 5,500 Total debt $9,375 $7,500 5,500 5,500 Total debt $9,375 $7,500 Net plant and equipment Common equity Common stock $2,031 $1,625 Retained earnings 1,094 875 Total common $3,125 $2,500 equity Total assets $12,500 $10,000 Total liabilities and $12,500 $10,000 equity ; Zebra Paper Corporation's current ratio is , and its Fitcom Corporation's current ratio is , and its quick ratio is quick ratio is Note: Round your values to four decimal places. Which of the following statements are true? Check all that apply. Fitcom Corporation has less liquidity but also a greater reliance on outside cash flow to finance its short-term obligations than Zebra Paper Corporation. A current ratio of 1 indicates that the book value of the company's current assets is equal to the book value of its current liabilities. If a company has a quick ratio of less than 1 but a current ratio of more than 1 and if the difference between the two ratios is large, then the company depends heavily on the sale of its inventory to meet its short-term obligations. Fitcom Corporation has a better ability to meet its short-term liabilities than Zebra Paper Corporation. An increase in the current ratio over time always means that the company's liquidity position is improving. Companies have the opportunity to use varying amounts of different sources of financing, including internal and external sources, to acquire their assets, debt (borrowed) funds, and equity funds. Company A uses long-term debt to finance its assets, and company B uses capital generated from shareholders to finance its assets. Which company would be considered a financially leveraged firm? Company A Company B Which of the following is true about the leveraging effect? Using leverage reduces a firm's potential for gains and losses. Using leverage can generate shareholder wealth, but if a company fails to make the interest and principal payments on its debt, credit default can reduce shareholder wealth. Blue Sky Drone Company has a total asset turnover ratio of 6.00x, net annual sales of $40 million, and operating expenses of $18 million (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $2.50 million on which it pays a 7% interest rate. To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Blue Sky Drone's debt management ratios? Ratio Value Debt ratio Times-interest-earned ratio Influenced by a firm's ability to make interest payments and pay back its debt, if all else is equal, creditors would prefer to give loans to companies with times-interest-earned ratios (TIE). Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Triptych Food Corp. and make comments on its second-year performance as compared with its first-year performance. The following shows Triptych Food Corp.'s income statement for the last two years. The company had assets of $5,875 million in the first year and $9,398 million in the second year. Common equity was equal to $3,125 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Triptych Food Corp. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 Net Sales 3,175 2,500 Operating costs except depreciation and amortization 1,120 1,040 Depreciation and amortization 159 100 1,279 1,140 Total Operating Costs Operating Income (or EBIT) 1,896 1,360 Less: Interest 256 143 1,640 1,217 Earnings before taxes (EBT) Less: Taxes (25%) 410 304 Net Income 1,230 913 Calculate the profitability ratios of Triptych Food Corp. in the following table. Convert all calculations to a percentage rounded to two decimal places. Ratio Value Year 2 Year 1 Operating margin 54.40% Profit margin 38.74% Return on total assets 15.54% Return on common equity 29.22% Basic earning power 20.17% Decision makers and analysts look deeply into profitability ratios to identify trends in a company's profitability. Profitability ratios give insights into both the survivability of a company and the benefits that shareholders receive. Identify which of the following statements are true about profitability ratios. Check all that apply. A higher operating margin than the industry average indicates either lower operating costs, higher product pricing, or both. If a company's operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes. An increase in the return on assets ratio implies an increase in the assets a firm owns. If a company issues new common shares but its net income does not increase, return on common equity will increase. Ratios are mostly calculated using data drawn from the financial statements of a firm. However, another group of ratios, called market value ratios, relate to a firm's observable market value, stock prices, and book values, integrating information from both the market and the firm's financial statements. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. just reported earnings after tax (also called net income) of $9,000,000 and a current stock price of $34.00 per share. The company is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to issue 2,500,000 new shares of stock (raising its shares outstanding from 5,500,000 to 8,000,000). If Cold Goose's forecast turns out to be correct and its price/earnings (P/E) ratio does not change, what does the company's management expect its stock price to be one year from now? (Round any P/E ratio calculation to four decimal places.) $29.23 per share $34.00 per share $21.92 per share $36.54 per share One year later, Cold Goose's shares are trading at $48.36 per share, and the company reports the value of its total common equity as $46,768,000. Given this information, Cold Goose's market-to-book (M/B) ratio is Can a company's shares exhibit a negative P/E ratio? Yes No Which of the following statements is true about market value ratios? High P/E ratios could mean that the company has a great deal of uncertainty in its future earnings. Low P/E ratios could mean that the company has a great deal of uncertainty in its future earnings. Analysts and investors often use return on equity (ROE) to compare profitability of a company with other firms in the industry. ROE is considered a very important measure, and managers strive to make the company's ROE numbers look good. If a firm takes steps that increase its expected future ROE, its stock price will increase. Based on your understanding of the uses and limitations of ROE, a rational investor is likely to prefer an investment option that has: High ROE and high risk O High ROE and low risk Suppose you are trying to decide whether to invest in a company that generates a high expected ROE, and you want to conduct further analysis on the company's performance. If you wanted to conduct a trend analysis, you would: Analyze the firm's financial ratios over time Compare the firm's financial ratios with other firms in the industry for a particular year You decide also to conduct a qualitative analysis based on the factors summarized by the American Association of Individual Investors (AAII). According to your understanding, a company with less competition is considered to be risky than companies with multiple competitors. The American Association of Individual Investors (AAII) has identified several qualitative factors that should also be considered when evaluating a company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization. company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization. Eastern Manufacturing Products Inc. As a result of targeting by unethical product liability attorneys, Eastern, a small manufacturer of a revolutionary crawfish steamer, currently has a multimillion-dollar class action lawsuit pending. Although the steamer is completely reliable and safe, one person was injured as a result of using it inappropriately. Other purchasers have joined the lawsuit in an effort to collect "free" funds. How would you expect this situation to affect the assessment of Eastern's financial condition and performance? Lawsuits guarantee free advertising and therefore should be guaranteed to increase the firm's current and future sales and profits. Being small, Eastern may lack the financial resources and media-management expertise to successfully defend itself in the lawsuit and the media. This could jeopardize Eastern's current and future sales and profits. O Although nonquantitative factors may be relevant to a company's financial evaluation in general terms, the details of this specific situation are not relevant to the firm's financial condition or performance. Corporate decision makers and analysts often use a particular technique, called a DuPont analysis, to better understand the factors that drive a company's financial performance, as reflected by its return on equity (ROE). By using the DuPont equation, which disaggregates the ROE into three components, analysts can see why a company's ROE may have changed for better or worse and identify particular company strengths and weaknesses. The DuPont Equation A DuPont analysis is conducted using the DuPont equation, which helps to identify and analyze three important factors that drive a company's ROE. According to the equation, which of the following factors directly affect a company's ROE? Check all that apply. Financial leverage 0 0 0 Operational efficiency Market-to-book-value ratio Most investors and analysts in the financial community pay particular attention to a company's ROE. The ROE can be calculated simply by dividing a firm's net income by the firm's shareholder's equity, and it can be subdivided into the key factors that drive the ROE. Investors and analysts focus on these drivers to develop a clearer picture of what is happening within a company. An analyst gathered the following data and calculated the various terms of the DuPont equation for three companies: ROE Profit Margin x Total Assets Turnover Equity Multiplier Company A 12.0% 57.3% 9.8 2.14 Company B 15.5% 58.2% 10.2 2.61 Company C 21.5% 58.0% 10.3 3.60 Referring to these data, which of the following conclusions will be true about the companies' ROES? The main driver of Company A's inferior ROE, as compared with that of Company B's and Company C's ROE, is its use of higher debt financing. The main driver of Company C's superior ROE, as compared with that of Company A's and Company B's ROE, is its greater use of debt financing. The main driver of Company C's superior ROE, as compared with that of Company A's and Company B's ROE, is its operational efficiency. A sheaf of papers in his hand, your friend and colleague, Landon, steps into your office and asked the following. LANDON: Do you have 10 or 15 minutes that you can spare? YOU: Sure, I've got a meeting in an hour, but I don't want to start something new and then be interrupted by the meeting, so how can I help? LANDON: I've been reviewing the company's financial statements and looking for ways to improve our performance, in general, and the company's return on equity, or ROE, in particular. Amelia, my new team leader, suggested that I start by using a DuPont analysis, and I'd like to run my numbers and conclusions by you to see whether I've missed anything. Here are the balance sheet and income statement data that Amelia gave me, and here are my notes with my calculations. Could you start by making sure that my numbers are correct? YOU: Give me a minute to look at these financial statements and to remember what I know about the DuPont analysis. Balance Sheet Data Income Statement Data Cash $840,000 Sales $14,000,000 $700,000 1,400,000 Accounts payable Accruals Accounts receivable 280,000 7,000,000 Inventory 2,100,000 Notes payable 7,000,000 Cost of goods sold Gross profit Operating expenses EBIT Current assets 4,200,000 Current liabilities 1,120,000 2,240,000 3,640,000 5,880,000 3,500,000 Long-term debt 3,500,000 Total liabilities Interest expense 571,200 Common stock 980,000 EBT 2,928,800 Net fixed assets 5,600,000 Retained earnings Taxes 732,200 2,940,000 3,920,000 Total equity Net income $2,196,600 Total assets $9,800,000 Total debt and equity $9,800,000 , the total asset If I remember correctly, the DuPont equation breaks down our ROE into three component ratios: the turnover ratio, and the And, according to my understanding of the DuPont equation and its calculation of ROE, the three ratios provide insights into the company's effectiveness in using the company's assets, and Balance Sheet Data Income Statement Data Cash $840,000 Sales $14,000,000 $700,000 1,400,000 Accounts payable Accruals Accounts receivable 280,000 7,000,000 Inventory 2,100,000 Notes payable 7,000,000 Cost of goods sold Gross profit Operating expenses EBIT Current assets 4,200,000 Current liabilities 1,120,000 2,240,000 3,640,000 5,880,000 3,500,000 Long-term debt 3,500,000 Total liabilities Interest expense 571,200 Common stock 980,000 EBT 2,928,800 Net fixed assets 5,600,000 Retained earnings Taxes 732,200 2,940,000 3,920,000 Total equity Net income $2,196,600 Total assets $9,800,000 Total debt and equity $9,800,000 , the total asset If I remember correctly, the DuPont equation breaks down our ROE into three component ratios: the turnover ratio, and the And, according to my understanding of the DuPont equation and its calculation of ROE, the three ratios provide insights into the company's effectiveness in using the company's assets, and Now, let's see your notes with your ratios, and then we can talk about possible strategies that will improve the ratios. I'm going to check the box to the side of your calculated value if your calculation is correct and leave unchecked if your calculation is incorrect. Hydra Cosmetics Inc. DuPont Analysis Ratios Value Correct/Incorrect Ratios Value Correct/Incorrect Profitability ratios Asset management ratio Total assets turnover 50.00 1.43 20.92 Gross profit margin (%) Operating profit margin (%) Net profit margin (%) Return on equity (%) 22.41 Financial ratios 53.52 Equity multiplier 1.67 LANDON: OK, it looks like I've got a couple of incorrect values, so show me your calculations, and then we can talk strategies for improvement. YOU: I've just made rough calculations, so let me complete this table by inputting the components of each ratio and its value: Do not round intermediate calculations and round your final answers up to two decimals. Hydra Cosmetics Inc. DuPont Analysis Ratios Calculation Value Profitability ratios Numerator Denominator Gross profit margin (%) / / Operating profit margin (%) Net profit margin (%) 1 = Return on equity (%) / Asset management ratio Total assets turnover / = Financial ratios Equity multiplier / II LANDON: I see what I did wrong in my computations. Thanks for reviewing these calculations with me. You saved me from a lot of embarrassment! Amelia would have been very disappointed in me if I had showed her my original work. So, now let's switch topics and identify general strategies that could be used to positively affect Hydra's ROE. YOU: OK, so given your knowledge of the component ratios used in the DuPont equation, which of the following strategies should improve the company's ROE? Check all that apply. Use more debt financing in its capital structure and increase the equity multiplier. Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase the company's net profit margin. Increase the efficiency of its assets so that it generates more sales with each dollar of asset investment and increases the company's total assets turnover. Decrease the amount of debt financing used by the company, which will decrease the total assets turnover ratio. LANDON: I think I understand now. Thanks for taking the time to go over this with me, and let me know when I can return the favor. One of the most important applications of ratio analysis is to compare a company's performance with that of other players in the industry or to compare its own performance over a period of time. Such analyses are referred to as a comparative analysis and trend analysis, respectively. A common size analysis requires the representation of financial statement data in terms of a single financial statement item (or base account or value). What is the most commonly used base item for a common size income statement? 0 Total liabilities Net sales Total assets Stockholders' equity Suppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Ratios Calculated Year 1 Year 2 Year 3 Price-to-cash-flow 1.20 1.56 1.75 Inventory turnover 2.40 2.88 3.23 Debt-to-equity 0.60 0.64 0.77 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. The market value of Cold Goose Metal Works Inc.'s common shares declined over the three years. The company's creditworthiness has improved over these three years as evidenced by the increase in its debt-to-equity ratio over time. 0 0 An improvement in the inventory turnover ratio could likely be explained by the new sales-forecasting strategies that led to better inventory management. A plausible reason why Cold Goose Metal Works Inc.'s price-to-cash-flow ratio has increased is that investors expect higher cash flow per share in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts