Question: please answer and explain correctly. Sarah is single, 44 years old and earned $5,000 taxable compensation in 2022. She has only two traditional IRA accounts,

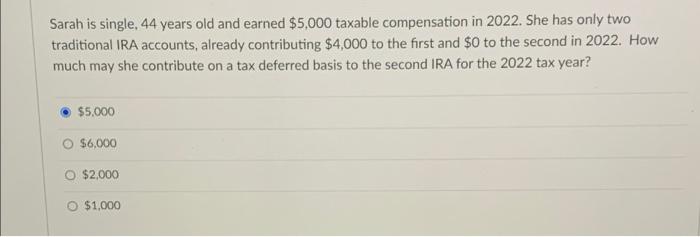

Sarah is single, 44 years old and earned $5,000 taxable compensation in 2022. She has only two traditional IRA accounts, already contributing $4,000 to the first and $0 to the second in 2022. How much may she contribute on a tax deferred basis to the second IRA for the 2022 tax year? $5,000 O $6,000 O $2,000 $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts